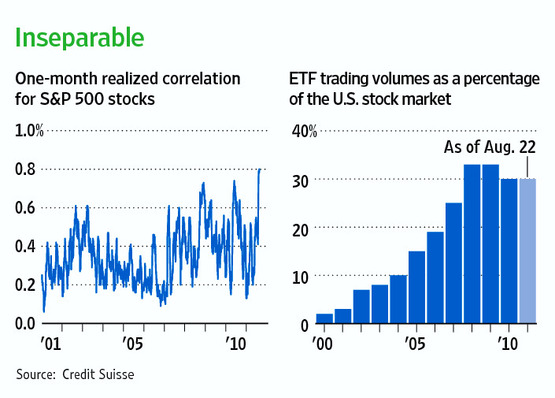

The WSJ is out with a story on this summer’s return to hyper-correlation of stocks. Credit Suisse calls it currently as an 80% correlation for S&P 500 names, higher than the 73% we saw during the panicky peak in 2008.

As has been discussed here exhaustively (as well as by Tadas at Abnormal Returns), there are two major reasons for the rise of equity correlations, one short-term and one longer-term.

The short-term spikes in correlation are almost always driven by fear and panicking markets. When players want to (or have to) get out of stocks quickly, they begin to be treated like bushels of wheat – commoditized so that one stock is indistinguishable from another without regard for the underlying business. In addition, large pools of stock assets can use index futures or ETFs to hedge their longs that they’d rather not part with even if they do see turbulence coming. And so between unorganized dumping of stocks and this mass-hedging with index instruments, we get these big spikes in stocks all acting as one.

However, the longer-term forces driving increased correlation have always been more interesting to me. And this definitely has something to do with the “ETFization of Everything” as Tadas puts it. But Heard on the Street‘s John Jannarone says that ETFs are a much smaller influence on individual stock action than we might think:

One potential reason is the popularity of exchange-traded funds. ETFs account for more than 30% of volume in U.S. stock markets, compared with just 2% in 2000, Credit Suisse says. It’s reasonable to expect ETF trading to drive correlation higher because many of the vehicles are tied to stock indexes.

Even so, ETFs were by no means the beginning of index-based trading. Mutual-fund managers have traded baskets of stocks tracking the S&P 500 for decades. Stock index futures began trading in 1982 and they remain far larger than ETFs. According to CME Group, the value of CME E-mini S&P 500 futures traded each day is more than four times the combined volume of SPDR S&P 500 ETF and iShares S&P 500 Index ETF.

John also talks about the growing influence of structured derivative products on share price movement in his piece. The debate about whether or not ETFs are “ruining” the stock market will continue unabated, I think the takeaway here is that there are additional factors adding to the phenomenon as well.

Correlations in stocks are important to understand if only because of how much money is spent and marketing is done based on the concept of stock-picking and individual company research. Investors are well-served to be reminded of the fact that sometimes they are simply overemphasizing a discipline that is beginning to matter less and less in a world of cheaper and better sector exposure.

Source:

Traders Seek Salvation From Correlation (WSJ)

Tags: $SPY

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] There you can find 24549 more Information on that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/08/29/etfs-and-stock-correlation-part-458/ […]