Dynamic Hedge blogs about correlation, relative value and quantitative analysis at http://www.dynamichedge.com

The $VIX is a very misunderstood index. One could go into all sorts of detail about how the $VIX is calculated and the relative problems associated with trading volatility products. Instead, here’s a dead simple calculation traders can use everyday. Take the current $VIX index calculation and divide it by the square root of 252 (number of trading days in a year). Divide the result by 100 to give you the expected percentage change. Then take previous closing price of the $SPX and multiply it by the expected percentage daily change and you will have an approximation of how many handles worth of volatility you should expect from the $SPX.

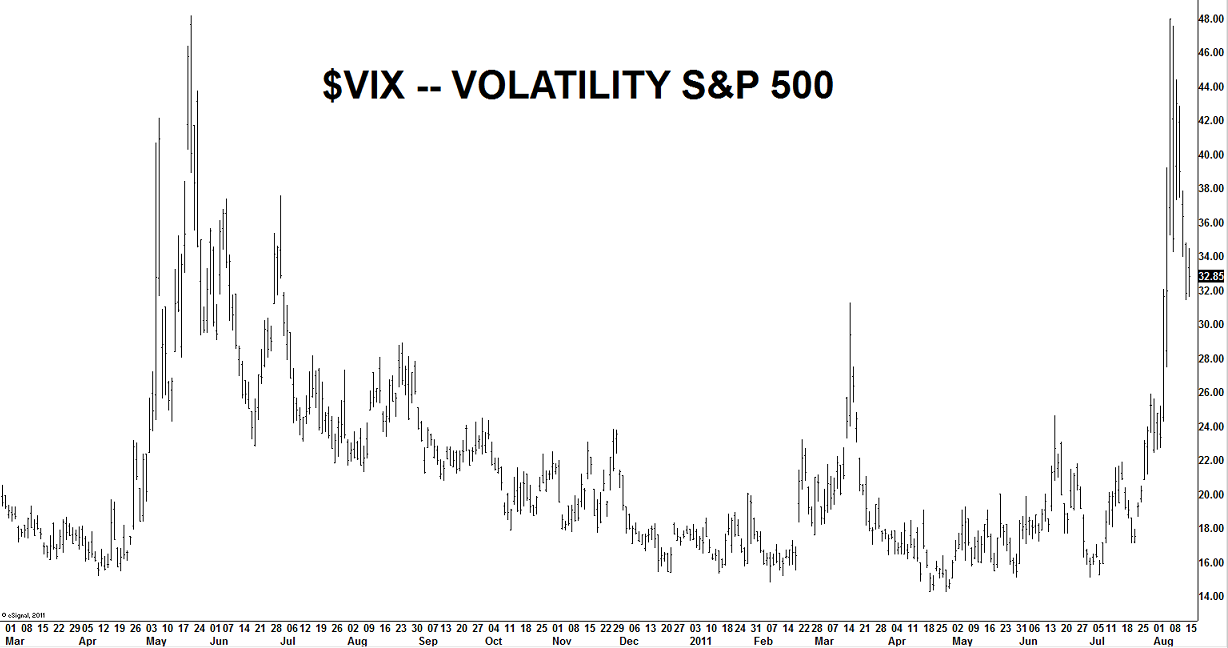

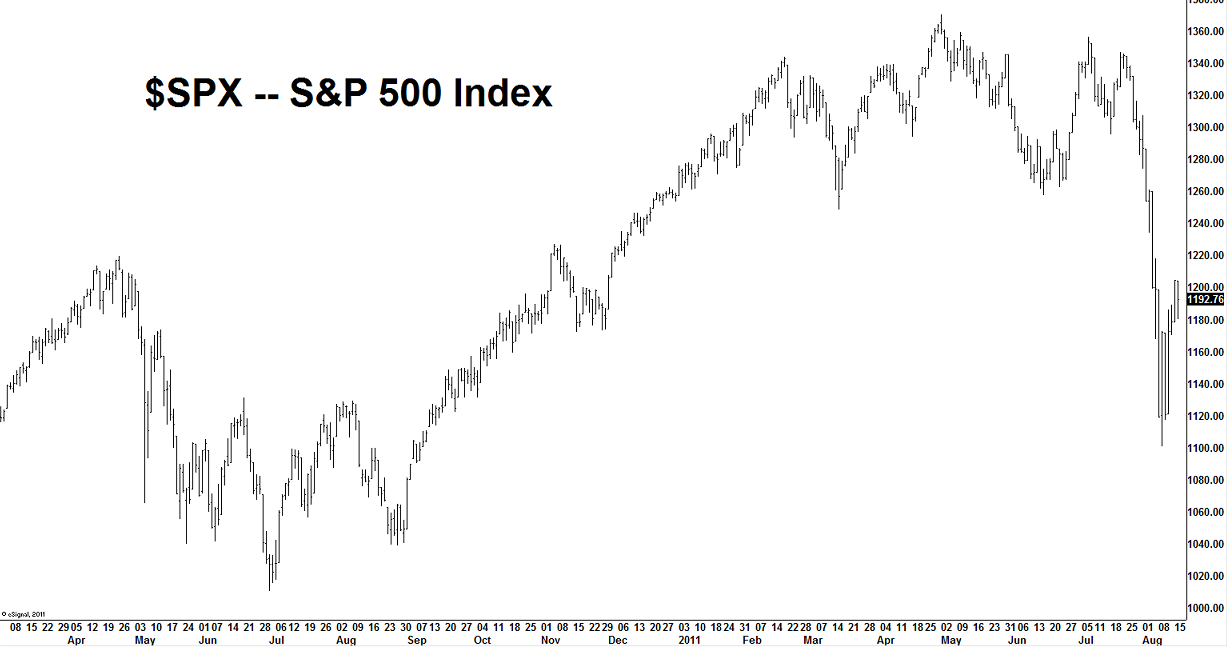

Based on the charts above, the calculation for today is:

32.85 / √252 = 2.07%

1192.76 * 0.0207 = 24.69

Tomorrow I’m expecting the $SPX and $ES_F to be bounded by approximately 24.5 handles 68% of the time. As the day progresses you can adjust based on whether the $VIX is expanding or contracting.

Remember, the $VIX is not predictive. The numbers are just estimates of expected volatility.

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] There you can find 64560 additional Information to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Here you will find 46895 more Info to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] There you can find 97512 additional Information on that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] There you will find 91920 additional Info on that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/08/17/vix-trix/ […]