“All told, investors’ losses on these Chinese ventures have stretched into the billions.”

The New York Times is out with the definitive look at the Chinese reverse merger game (see: Red Collar Crime archives) and what its gradual dissolution has meant for markets and investors. RINO International, the poster child for Chinese corporate crookery, gets the spotlight in the piece…

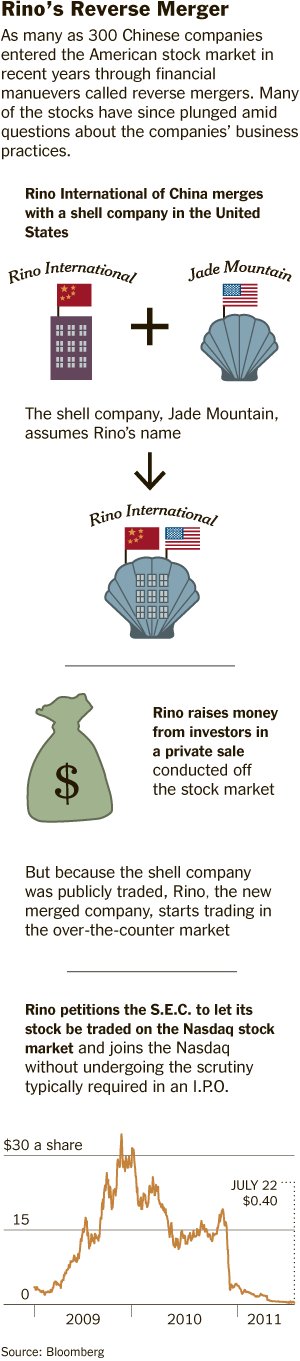

How companies like Rino wormed their way into the temples of American capitalism is a story for these financial times. Even amid the wreckage of the 2007-8 financial collapse, an ecosystem of Wall Street enablers — bankers, lawyers, entrepreneurs, auditors — spirited Chinese companies to the United States. With some deft financial maneuvers, these businesses essentially went public while sidestepping the usual rules. Before long, many were trading on the Nasdaq stock market, alongside the likes of Google.

It was all perfectly legal. With bankers’ help, the Chinese companies executed what are known as reverse mergers. They bought American companies that were merely shells and assumed those companies’ stock tickers — sort of the Wall Street equivalent of “Invasion of the Body Snatchers.” The strategy let them avoid reviews with state and federal regulators that are normally required for initial public stock offerings.

The article spends some time on both who’s to blame as well as the mechanics of a reverse merger IPO. Here’s a diagram for the uninitiated:

Head over the whole story, it is this weekend’s must-read.

Source:

China to Wall Street: The Side-Door Shuffle (WSJ)

Read Also:

The Red Collar Crime Wave archives (TRB)

hat tip Barry

… [Trackback]

[…] Here you can find 16615 additional Info to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] There you can find 33802 additional Information on that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] There you will find 81351 more Info to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Here you can find 46653 additional Information on that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Here you can find 35650 additional Info to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/07/24/anatomy-of-a-chinese-reverse-merger-scam/ […]