silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver silver.

OK, I think I hit my quota for today.

Everyone has Silver on the Brain. Kid Dynamite is watching the obsession from afar. He has seen this stuff before.

The truth is that it’s a shallow, relatively small market that has long been notorious for how easily it can be manipulated – from the Hunt Brothers 30 years ago to JPMorgan in 2010 (allegedly). But despite this, it has captured the attention of market participants across the board.

People are inventing reasons to like it. They are acting as though it’s this great industrial metal (biotech! circuit boards! photography! solar panels! navajo jewelry on the side of the highway!) but the reality is that it is working for speculative reasons, not industrial ones.

Silver is the crack to gold’s cocaine: Cheaper, wilder and faster.

The retail investor is in silver. Big time. They are petting their silver mining stocks and calling them “My Precious”.

Does this obsession make you nervous? Makes me nervous. The only time I’ve been yelled at, actually yelled at, by a client this year was when I took a profit for him in Silver Wheaton. He was right in hindsight as we sold at 36, but still, it was a already a double.

Everyone is saying $50, the nominal high from the early 80’s, will be like a magnet for silver prices to eventually gravitate towards. We are 20% below that level now after a double in silver this year. The inflation-adjusted high is more like $130 if you want to understand the rationale of the real lunatic fringe in this trade.

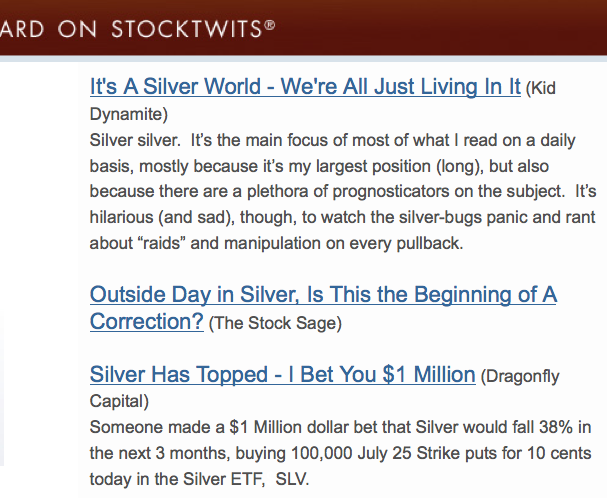

The bloggers are equally obsessed with talking about it, myself included. Here’s a snapshot from this morning’s daily Overheard on StockTwits email:

This morning it was announced that Silver Wheaton’s CEO is stepping down. If you don’t know Silver Wheaton ($SLW), on the stream we call it The Beast. I wrote the first ever blog post about SLW in 2009 when it was at 8 bucks, considered it “my baby” the whole way up. Now it is everyone’s favorite momentum name, the Dwyane Wade of the Miners.

I don’t know if he is cashing out or not but this bears watching. As does the silver mania in general.

… [Trackback]

[…] Here you will find 66947 additional Info to that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Here you can find 2667 additional Information on that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/04/12/silver-tells/ […]