Everyone is now wishing they were 100% invested in stocks. I’m not 100% long. You probably aren’t either. Sure, we’re long – but is anyone “long enough” for this?

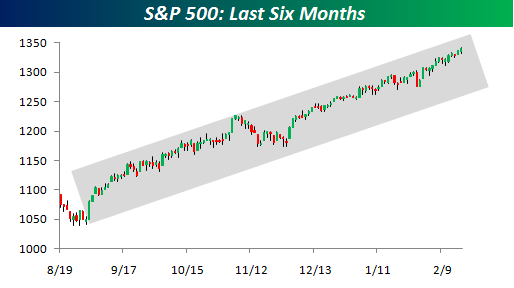

Bespoke is calling it the Zero Gravity Market:

As I survey my long positions, I find myself very much in the middle of the herd right now…tech and energy are by far the most well-represented sectors. This is the stuff that is and has been working so perfectly, so why go out on a limb?

On the other side of the ledger, I’m still running with a decent-sized short-term bond allocation (through funds/ETFs) that can be adjusted on a dime. I’m also holding what feels like way too much cash. Since January 18th, most of the profits I’ve taken have not been redeployed as several signs pointed toward a time for caution. Alas, caution has been the enemy over the first 6 weeks of 2011.

This week I spoke with three different prospective client households – three extremely smart people, well-educated and wealthy enough to have a good understanding of how the world works. They are fully in cash and fixed income. They thought it was the right the thing to do.

They are miserable.

They do not understand how this could be happening and they are cursing themselves for having listened to people on television or talk radio. Worse, they are tempted to throw big money at the S&P locomotive just to make that feeling go away – just to make it stop. I regard my responsibility with these potential clients as being to stop that from happening right away. There needs to be some discussion about longer-term cycles and where we may be in them.

Meanwhile, the Russell 2000 (small caps) is inching to within 2% of all-time highs and large cap stocks are 15% away.

And the interest rate thing is still a freak show that will begin to be resolved shortly, it’s all unprecedented as we’ve been told 9 million times. Just because we’re sick of hearing it doesn’t make it any less true.

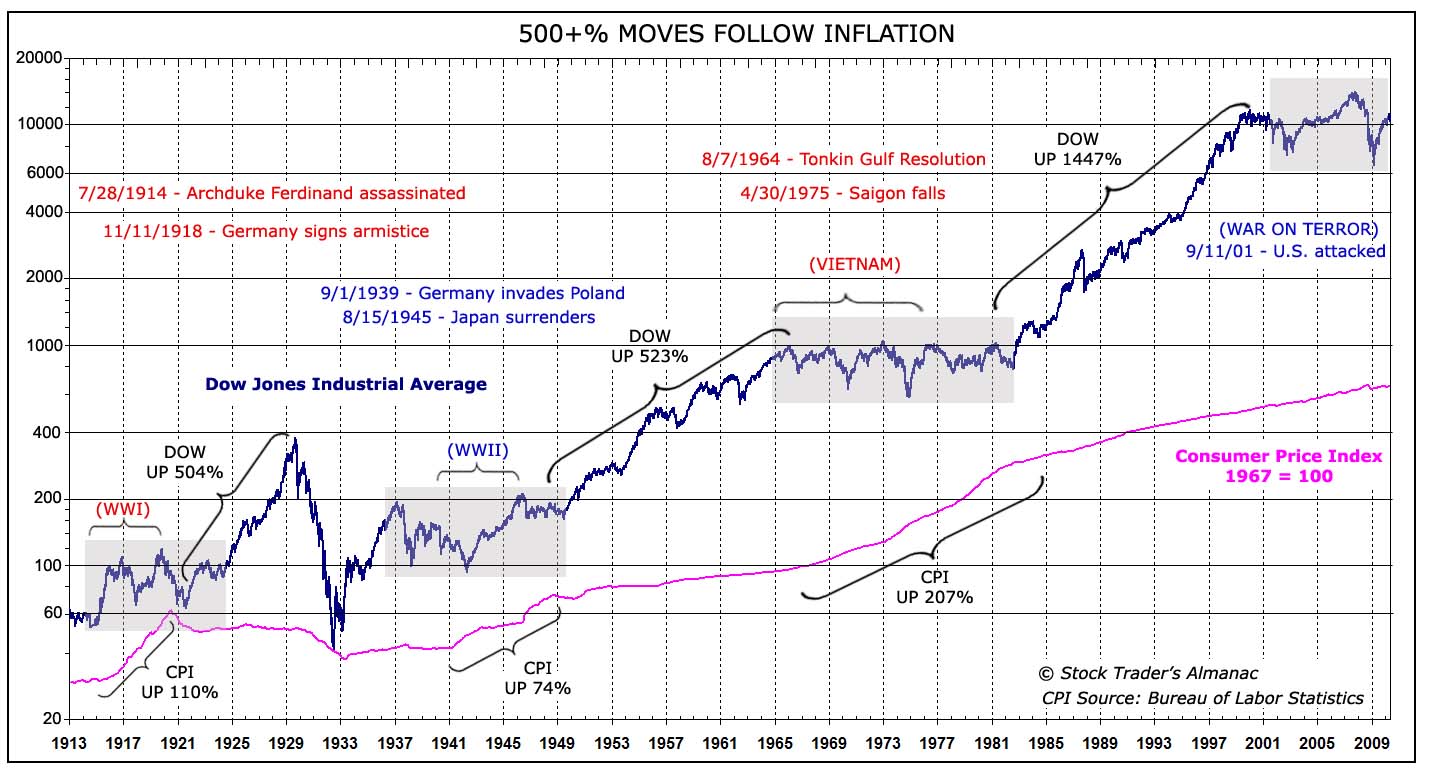

So my approach to soothe the underinvested soul is to pass on “My Favorite Chart on Earth”. It comes from The Stock Traders Almanac and I keep a copy at my desk. You may have seen it on this site before, it’s the one that keeps me focused on the practice I’m building whenever I get bogged down in the fact that the market has essentially round-tripped since my career began in the late 90’s…

This chart may be helpful for your own head right now, it tells us a few things:

1. There is always time to invest and get more heavily involved

2. This secular bear cycle could still have a few years left in it after all (if 16 years is the average length of secular bears then 5 more years of range-bound activity would be the norm)

3. The real rally, the one that breaks us away from this range, will be so powerful that missing the first 10% of it won’t mean a hill of beans.

The message here is to relax and catch your breath. No panic and no melancholia, they won’t solve anything.

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] There you will find 87868 additional Info on that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/02/19/chicken-soup-for-the-underinvested-soul/ […]