Farmer Brown here…

Jack Hough has a piece in SmartMoney about pantry price increases versus a sampling of several asset classes. So far, the cost jump in the supermarket is somewhere in the middle of the pack…

Home pantries and freezers have outperformed bank deposits this year. The average six-month certificate of deposit bought in January and rolled over in July has so far paid about 0.3% in interest, failing to keep up with a 0.7% rise in consumer prices through October. Groceries have gotten 1.3% more expensive during that stretch.

Plenty of investments have done better, of course. U.S. shares have returned more than 7% this year, and emerging markets stocks, about double that in dollar terms. Gold’s price has shot 24% higher. It’s not realistic to expect ordinary foodstuffs to produce those kinds of returns.

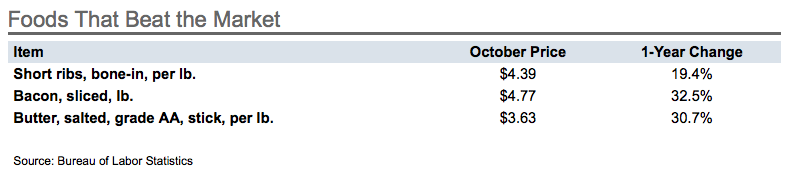

Or is it? Retail cheese prices are up 5% this year. Steaks and ground beef are up 7%. Butter is up almost 25%. Even hot dogs are up more than 4%.

A mixed bag, mostly dollar-related with a touch of international demand creeping in. You guys know I’m watching this story for you like a hawk. Like a fat hawk perched atop the dumpsters behind a grocery store as a blood red sun sets over the deserted parking lot. OK then.

And I just adored this chart showing a bit of Pigflation (yes, that’s mine but you can use it):

Good stuff.

Source:

… [Trackback]

[…] Here you can find 1165 additional Information on that Topic: thereformedbroker.com/2010/11/19/pigflation/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2010/11/19/pigflation/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2010/11/19/pigflation/ […]