Technicians are eyeing the 1230ish S&P level as resistance going back to the highs of 2008. But that’s the bigger picture.

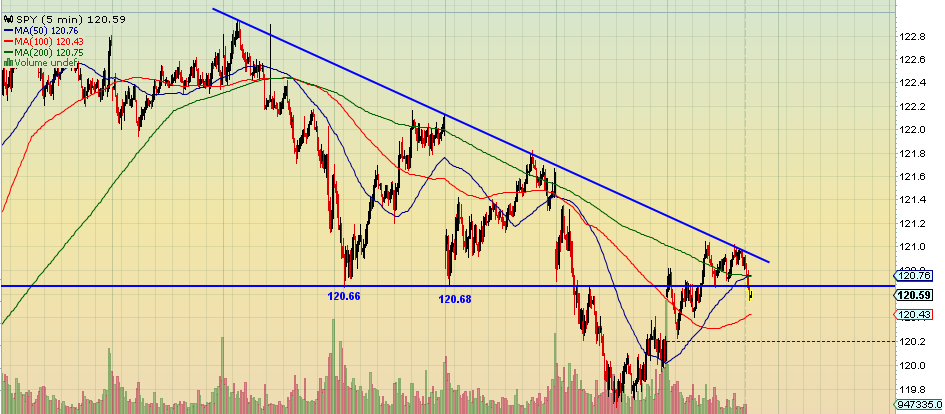

Let’s play a bit of small ball and have a look at a new downtrend for the Spyders as illustrated by Greg Harmon over at Chart.ly:

That downward sloping blue line has been hit 4 times as you can see from this 5 minute chart Greg posted yesterday. He notes that the more times we see contact against it, the more important the downtrend becomes.

The SPY has had quite a bit of trouble closing positively ever since coming within a hair of that 1230 level in the first week of November. Keep that level in mind along with the shorter-term action depicted above and I think you get a good feel for where we are.

I would add that just because the market has hit an obvious resistance level, it doesn’t mean we must sell off. Correcting through time, as opposed to price, is also an option.

But another technician I greatly respect, Jack Sparrow of the Mercenary Trader blog, sees nasty reversals everywhere – Gold, Silver, Munis (via $NUW), China (via the $FXI) etc. He points to every chart topping out except for one:

According to Jack and many other market watchers, the dollar-vs-risk assets inverse correlation is simply too ingrained at this point for a decoupling. Stocks can go up with the dollar up, but they haven’t lately – at least not for any appreciable stretch of time.

Here’s Jack on this relationship:

And finally, the $USD, which is supposed to be falling forever and ever amen in response to the Fed’s endless money printing. The problem with that view, as an old boss way back when used to say, is that “Conventional wisdom is not necessarily wisdom that will enrich you.”

The $USD is the one paper asset the bulls don’t want to see higher bids in. That’s because the buck functions as a sort of grand archimedes’ lever, giving counterweight strength to the entire risk-on complex. If speculators are supermen, the $USD is kryptonite.

So Welcome to the Resistance. You might want to make yourselves comfortable in case we’re here for a while.

***

For more of Greg’s charting and commentary, add Dragonfly Capital to your blogroll/reader.

Also, you must check out Jack’s panoramic macro update here:

The QE2 Inflation Trade is Collapsing Like a House of Cards (Mercenary Trader)

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Here you will find 93040 additional Info to that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] There you can find 82467 more Information to that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2010/11/16/welcome-to-the-resistance/ […]