In the early 00’s, Russia had just gone through a devaluation of its currency, China was still nominally a Communist country, Brazil was locked in its endless battle against inflation and India was fairly hostile toward outside investment in its companies.

And then the favorable demographics and commodity-production capacity of these nations took the wheel and the rest is history. As I’ve said before, BRIC was the biggest market call of the last decade.

In this frame of mind, I’ve spent the last few months delving deeper into a passion project of mine that I don’t talk a lot about here on TRB – researching the investment possibilities of the Frontier Markets.

The trouble with the Frontier Markets as an investment thesis is a simple one: Nobody agrees on which countries are the Frontier Markets!

There is no standard, widely accepted definition yet of which countries make up this investment concept, nor is there any officially recognized standard for classification. I view this confusion as a positive, it is a testament to how new the concept is to most investors, even the pros. This is despite the fact that the term “Frontier Markets” was coined back in 1992.

So which countries are frontier markets? Here are two fairly well-assembled lists, one from FTSE and the other from MSCI:

FTSE Frontier Markets List

Albania

Albania

Bahrain

Bahrain

Bangladesh

Bangladesh

Bosnia and Herzegovina

Bosnia and Herzegovina

Botswana

Botswana

Bulgaria

Bulgaria

Croatia

Croatia

Cyprus

Cyprus

Estonia

Estonia

Côte d’Ivoire

Côte d’Ivoire

Jordan

Jordan

Kenya

Kenya

Lithuania

Lithuania

Macedonia

Macedonia

Mauritius

Mauritius

Nigeria

Nigeria

Oman

Oman

Qatar

Qatar

Romania

Romania

Serbia

Serbia

Slovakia

Slovakia

Slovenia

Slovenia

Sri Lanka

Sri Lanka

Tunisia

Tunisia

Vietnam

Vietnam

Argentina

Argentina

Malta

Malta

MSCI Barra Frontier Indices

***

You’ll notice that these lists are not at all identical. This is because they are made up based on different criteria for inclusion. I will include links for you to better understand their standards at the bottom of this post.

FTSE, for example, has a checklist that ranks some of the nations on MSCI’s list as a grade above Frontier, which they refer to as Secondary Emerging Markets. The United Arab Emirates is an example of this, as they will be moved to this higher status this year.

Further complicating the classification are other index creators who have used still other criteria and standards to select the countries that they consider to be frontier markets.

The Bank of New York Mellon launched their own proprietary index of frontier markets (The New Frontier DR Index). It is composed of Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, United Arab Emirates, Egypt, Ghana, Kenya, Malawi, Mauritius, Morocco, Nigeria, Tunisia, Zimbabwe, Bulgaria, Croatia, Czech Republic, Estonia, Georgia, Kazakhstan, Latvia, Lithuania, Poland, Romania, Slovak Republic, Slovenia, Ukraine, Bangladesh, Pakistan, Papua New Guinea, Sri Lanka, Vietnam, Peru, Chile, Colombia, Ecuador, Jamaica, Panama and Trinidad & Tobago.

You will notice that the BNY Mellon index includes Poland, Peru and Egypt, none of which appear in either FTSE’s or MSCI’s indices.

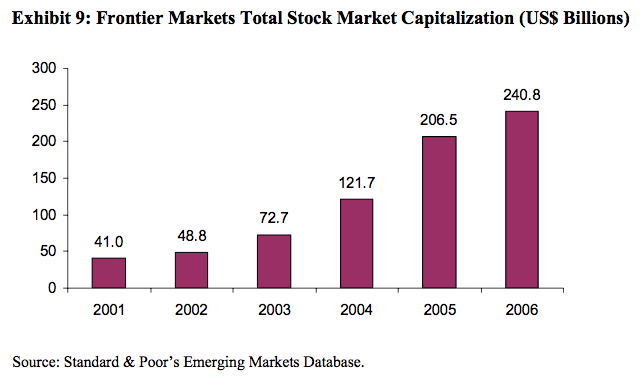

Standard & Poors has its own universe of frontier markets, and this one is perhaps the most comprehensive – it is an extended group of 150 nations. In a blockbuster presentation from 2007, S&P gave us some great stats about the growth of trading and market caps (below) in these markets.

Their index, The S&P New Frontiers Index, is somewhat more narrow, with stocks from only 11 countries making the cut. These include (based on 2007 makeup) Bahrain, Bulgaria, Colombia, Croatia, Jordan, Oman, Pakistan, Romania, Sri Lanka, the U.A.E. and Vietnam.

As new products are rolled out by fund families to allow investors to play the potential growth of the frontier, I am seeing several trends:

– ETFs are being rolled out by geography (Africa Fund, Middle East Fund etc.)

– ETFs are named after and modeled on the broader indexes (Claymore markets a BNY Mellon frontier index fund for example)

– Mutual Fund managers are using London or NY traded shares (ADRs, GDRs) rather than local shares for liquidity and governance precautions.

– Managers are being more selective than the indexes themselves (Templeton’s Mark Mobius is looking for PE ratios under 10 and scrutinizing cash flows, Accessor’s Paul Herber is focused on leverage levels and finding companies without much debt.)

The final point I will make here is that although the potential growth rates are high, the risks involved with frontier markets are greater than those of even emerging markets investments. Political intervention, military and civil strife, the possibility for corruption and differing ideas about shareholder protections are just some of these risk factors. I offer no advice in this post whatsoever, rather I hope you will use it as a jumping off point for your own homework.

Follow the links below to learn more:

MSCI_Frontier_Markets_FactSheet

FTSE_Country_Classification_Sept_09_update

[…] What constitutes a frontier market these days? (The Reformed Broker) […]

[…] What constitutes a frontier market these days? (The Reformed Broker) […]

[…] If you invest with an active asset allocation strategy, I would highly recommend putting a portion of your high beta equity capital in the Vietnam ETF (The Reformed Broker) […]

[…] If you invest with an active asset allocation strategy, I would highly recommend putting a portion of your high beta equity capital in the Vietnam ETF (The Reformed Broker) […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] There you can find 77765 more Information to that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2010/01/18/what-are-the-frontier-markets/ […]