this post originally appeared on August 30th 2009

Go try to find an interview with virtually any sell-side analyst or money manager either in print or on financial television from this past February.

Most told you to be completely out of stocks, understandably.

The ones who did have the courage lack of choice and had to be recommending stocks in the media were coming on with their gravest expressions and talking about dollar stores, food companies, discount retailers and in general, companies that catered to the low end or benefited from consumers trading down.

We were told to invest in staples, defensives and bargain basements; to avoid anything discretionary or high-end at all costs for at least the intermediate term.

But a funny thing happened on the way to the new frugality…this advice was the exact opposite of what actually worked for the ensuing 6 month period!

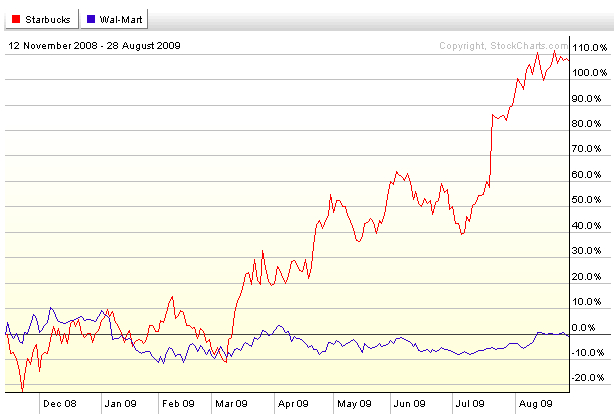

The chart above is a comparison of Wal-Mart (in blue) versus Starbucks (in red) over the last 200 days. Granted, Starbucks had been hammered while Wal-Mart had been flattish going into the rally, but still – you would’ve pulled your hair out of your head watching the quintessential money-waster stock doubling this year while the ultimate money-saver stock went up less than 1%.

This Through The Looking Glass scenario unfolded as the unemployment rate climbed every month, hitting 14.5 million as of this writing.

And lest you think Starbucks vs Wal-Mart are just two extreme outlying examples, believe me, you can do the same with Family Dollar (13%) versus Saks (52%) or Costco (7%) versus Coach (91%) and the results are equally mind-boggling based on what the pundits told us.

The trade-down trade killed you – KILLED YOU – as you would’ve have been puking up high-end brands or discretionary names this winter at a 10 year trough, only to load up the “defensive” stuff, which really only ended up defending you from making back some money! Owning stock in Wal-Mart defended you from profits so far this year, that’s about it.

I think the performance itself of the waster stocks versus the saver stocks was probably based more on mechanics than any kind of significant business improvement. Any time you have the concoction of too many shorts, too much cash on the sidelines and stocks selling for below their replacement values, the mechanics of the market can easily trump the fundamentals of a particular company.

I’m certainly not postulating that urban professionals are in better shape than their discount chain-shopping contemporaries, I am merely saying that, at least in the short term, economic trends do not always translate into an investable thesis.

The advice we got last winter en masse was quite possibly some of the worst imaginable given where the performance has been.

Now we’ll have to see if the Yuppie Bounce for Starbucks and it’s ilk has gone as far as it can on mechanics alone, and whether or not the trade-down thesis will ever be a money maker.

Full Disclosure: Nothing on this site should ever be construed as research, advice or an invitation to buy or sell any securities. Do not trade or invest based on anything you read here, see my Terms & Conditions page for a full disclaimer.

… [Trackback]

[…] There you can find 83965 additional Information to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] There you will find 13328 additional Information to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Here you will find 86937 more Information to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Here you will find 66050 additional Information on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Here you will find 50790 additional Info to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] There you will find 94552 more Info to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2009/12/25/the-yuppie-bounce-reprise/ […]