We’ve removed competition from just about every facet of American life for our children:

No dodgeball or football in elementary school for fear of the more aggressive kids dominating the meeker kids

Everyone who shows up to a spelling bee or a sporting event gets a ‘participant” award, just for having a pulse

There is now something called social promotion, where teachers let students move on to the next grade for social reasons even if they fail all the tests their peers are passing…this is why there are 8th graders in major city school districts who cannot read.

Now we’re going to do the same with our public companies?

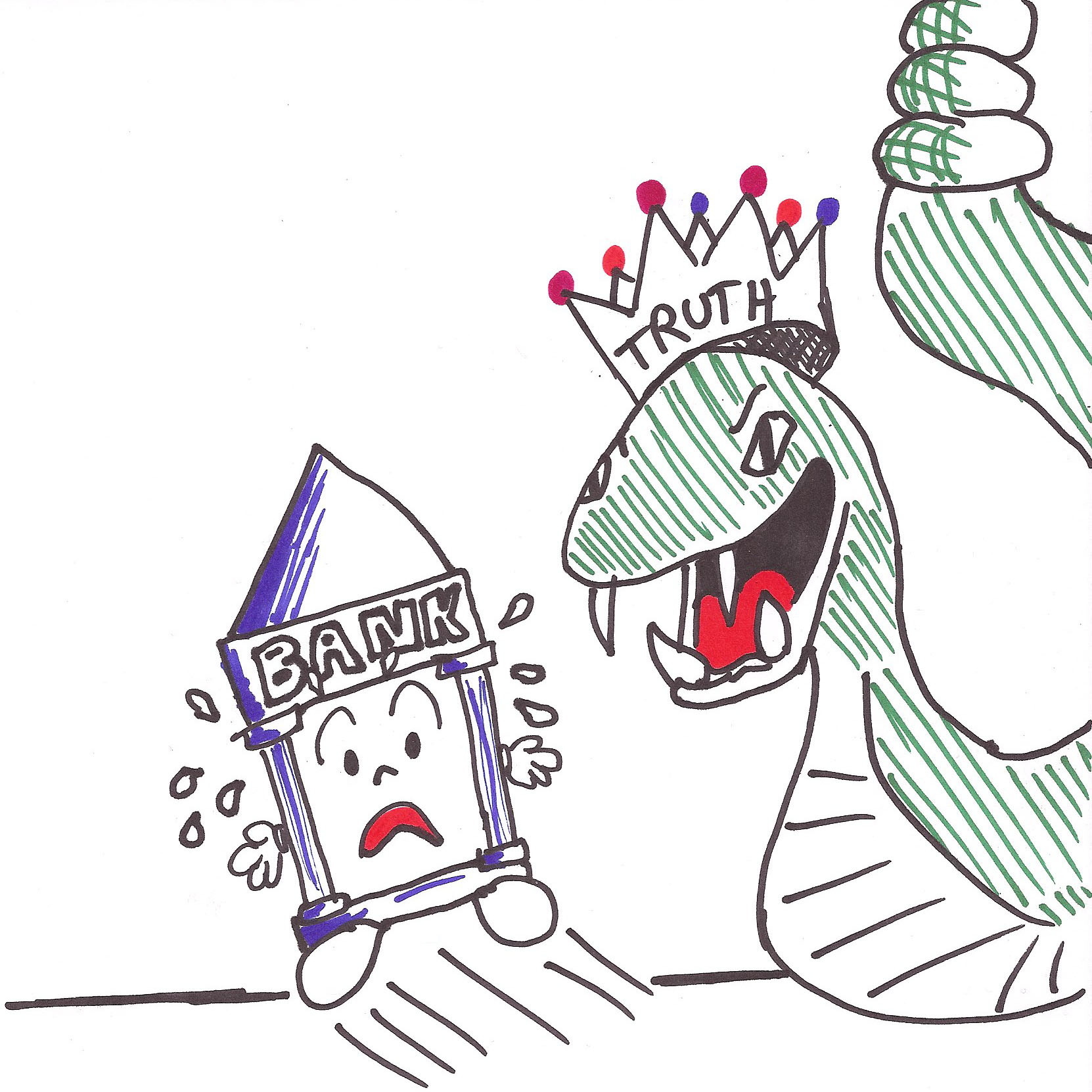

In the new capitalist system we’ve created, known as the Coddle State, we must be careful with how we disseminate truthful economic information, lest we offend anyone or allow any major company to go under.

19 US Banks have been given Stress Tests, hypothetical academic exercises to determine the future health of the companies as economic conditions worsen. The results of these stress tests have been kept secret during earnings season and most analysts don’t even fully understand the criteria that was included in the tests themselves (we’ll find out how they did the tests on April 24th).

The deadline for the release of the stress test results is May 4th, but the Coddle State’s leadership is now pondering the details of how to go about handling the release.

Now, the big debate is over how the results of the stress tests should be divulged and most importantly for the bureaucrats, who should be the person or entity to communicate this information.

From Bloomberg:

With a May 4 deadline approaching, there is no set plan for how much information to release, how to categorize the results or who should make the announcements

And how much should the American public actually be told?

While the Office of the Comptroller of the Currency and other regulators want few details about the assessments to be publicized, the Treasury is pushing for broader disclosure.

And Tim Geithner may be screwed either way…

If all the banks pass, the tests’ credibility will be questioned, and if some banks get failing grades and are forced to accept more government capital and oversight, they may be punished by investors and customers.

The deal is this, someone has to lose, even though the timing maybe sucks and some people will lose their jobs.

So now, we have weak banks and strong banks and just as some of the major banks are looking healthier, government officials are afraid to throw cold water on all that by reminding us that if and when unemployment breaks the 10% mark, some of the banks in the US will need even more taxpayer money.

Too bad, give us that information and let The Street sort it out. The sooner we have winners who take advantage of the failures of the losers, the better off the markets will be. That’s actually the definition of what a market is, btw.

No one pines for the days of Washington Mutual or misses the sh@t out of Wachovia. These institutions, while they are the sponsors of many golf tournaments, simply mean nothing in the scheme of things. As long as their deposits and customer assets can be transferred to a healthier bank (a la Bear, WaMu, IndyMac), then lets get on with it.

Stop stressin’, give us the results. We’re grown ups, we played dodgeball and competitive sports as kids, we can handle it.

Full Story: Officials Clash Over Stress Tests

Read Also: Slightly Used Ticker Symbols For Sale

Your zerohedge blog crush linked Hal Turner today… that’s not good!

-DT

Your zerohedge blog crush linked Hal Turner today… that’s not good!

-DT

Your zerohedge blog crush linked Hal Turner today… that’s not good!

-DT

Here is a nut to chew on. There is no accurate way to predict the actual delinquency or credits defaults if unemployment reaches 10% this year (or next year). Why? Because delinquency and credit loss depend on other items which have changed in totally unprecedented ways.

For example: banks recently reduced credit limits on cards by over 1 Trillion dollars. That has never been done before in the history of lending. So… this could and should mitigate losses. But by how much?

It’s not as simple to answer as the author of this article makes us believe.

Another important factor are social policies that have or will be put in place. For example if special or extended unemployment benefits are in place (versus periods where they were not in place) will also change default rates. Again, by how much?

The point is the government is actually working to put real support in place that directly reduces the chance of default. Meanwhile the author is rushing for them to publish something in mid process…

Please please please stop over-simplifying the situation. It is a lot like screaming at the driver to stop the car while they are trying to correct a skid.

Here is a nut to chew on. There is no accurate way to predict the actual delinquency or credits defaults if unemployment reaches 10% this year (or next year). Why? Because delinquency and credit loss depend on other items which have changed in totally unprecedented ways.

For example: banks recently reduced credit limits on cards by over 1 Trillion dollars. That has never been done before in the history of lending. So… this could and should mitigate losses. But by how much?

It’s not as simple to answer as the author of this article makes us believe.

Another important factor are social policies that have or will be put in place. For example if special or extended unemployment benefits are in place (versus periods where they were not in place) will also change default rates. Again, by how much?

The point is the government is actually working to put real support in place that directly reduces the chance of default. Meanwhile the author is rushing for them to publish something in mid process…

Please please please stop over-simplifying the situation. It is a lot like screaming at the driver to stop the car while they are trying to correct a skid.

Here is a nut to chew on. There is no accurate way to predict the actual delinquency or credits defaults if unemployment reaches 10% this year (or next year). Why? Because delinquency and credit loss depend on other items which have changed in totally unprecedented ways.

For example: banks recently reduced credit limits on cards by over 1 Trillion dollars. That has never been done before in the history of lending. So… this could and should mitigate losses. But by how much?

It’s not as simple to answer as the author of this article makes us believe.

Another important factor are social policies that have or will be put in place. For example if special or extended unemployment benefits are in place (versus periods where they were not in place) will also change default rates. Again, by how much?

The point is the government is actually working to put real support in place that directly reduces the chance of default. Meanwhile the author is rushing for them to publish something in mid process…

Please please please stop over-simplifying the situation. It is a lot like screaming at the driver to stop the car while they are trying to correct a skid.

Hey Tom, thanks for reading. I don’t look at this stuff like its the JFK evidence being supressed by the Warren Commission.

the longer they hold this info back, the more suspicion and skepticism will be tacked on to it.

I guess we’ll hear something coming May 4th regardless.

Hey Tom, thanks for reading. I don’t look at this stuff like its the JFK evidence being supressed by the Warren Commission.

the longer they hold this info back, the more suspicion and skepticism will be tacked on to it.

I guess we’ll hear something coming May 4th regardless.

Hey Tom, thanks for reading. I don’t look at this stuff like its the JFK evidence being supressed by the Warren Commission.

the longer they hold this info back, the more suspicion and skepticism will be tacked on to it.

I guess we’ll hear something coming May 4th regardless.

[…] Read Also: Stress Tests – Capitalism Without Competition […]

[…] Read Also: Stress Tests – Capitalism Without Competition […]

[…] Read Also: Stress Tests – Capitalism Without Competition […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2009/04/19/stress-test-capitalism-without-competition/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2009/04/19/stress-test-capitalism-without-competition/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2009/04/19/stress-test-capitalism-without-competition/ […]