The Herd Humiliates Itself Yet Again

Misery loves company and anyone who makes their living in the investment, Wall Street, real estate or banking world has just gone through the most miserable set of 12 months since the Great Depression. So for this reason, those of us in need of commiseration have found each other and our favorite source of guilty pleasure on Dealbreaker.com.

Here’s how it works, for the uninitiated: On any given day, the two main bloggers, Bess Levin and Equity Private, will dangle several raw meat steaks in the form of blog posts for the lions to chew on. These posts will range from updates on a particular investment bank’s layoff plans to reprints of the latest “Dear Investor, We Really Blew It But It Wasn’t Our Fault” hedge fund letter. The lurking lions will then tear into the subjects of these posts, often anonymously, and with a ferocity spawned by the stifling culture we’ve all been bound by for far too long.

The recipe is equal parts Gallows Humor, Schadenfreude, Gossip and Player-Hating with a dash of the most virulent Sarcasm to ever come out of New York City.

Equity Private is one of the best writers of any blog out there and she mixes her industry experience, biting wit and erudite observation into almost every piece she posts (see her guide that explains how to escape capture after perpetrating a major financial fraud for a great example of this).

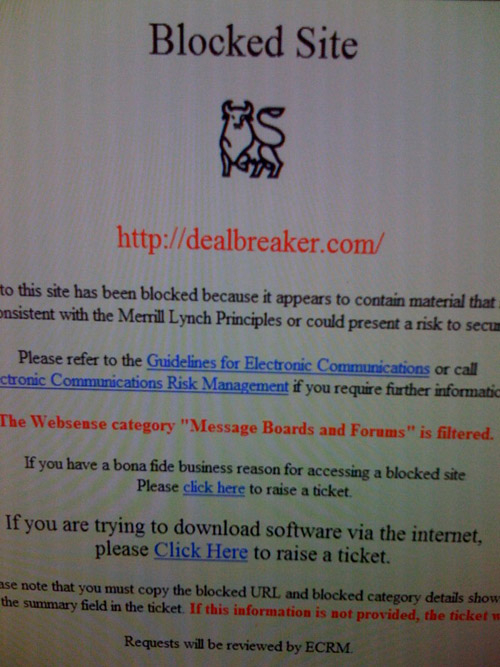

The other mouthpiece, Bess Levin, may be the most acid-tonged, satirical and sarcastic talent since Dorothy Parker. The ease with which she calls BS on the Gatsby’s of our time is nothing short of liberating. Her scoops and drive-by shootings have literally gotten the site banned on corporate internet servers from Connecticut to Manhattan (Merrill Lynch being the latest to throw up a Putin-like curtain between their employees and Freedom of Speech.)

And if you think the bloggers are poisonous, just try and post something disingenuous or uninformed on the message board (snake pit) below each post. You better post as a guest your first few times if you can’t deal with the vitriol from the regulars.

There isn’t a high profile regulator, hedgie, bank executive or otherwise notable Wall Streeter who hasn’t had their veneer or reputation dissected and dismantled on the site, and that’s part of the fun. During 2008, we witnessed the crumbling of just about every facade out there, in terms of management savvy, trading prowess and investment expertise. Thankfully, Dealbreaker was there to catch it all for posterity. As I’ve said here before, when it really counted, it turned out that none of the emperors had any clothes. With everyone taken down a few notches, we have a more even playing field than at any time in the last few decades here in the investment business.

Everything I’ve described thus far only explains why Dealbreaker is a satisfying diversion, but over the last few months, the site has actually become must-read for those of us trying to keep up with the Wall Street death spiral.

Having a site that acts as a running record of the denials, smoke-blowing and subterfuge not only keeps you amused to get through a vicious market, it can also protect you from believing, for example, a bank CEO asserting that “the dividend is safe” or a brokerage firm head declaring that “the worst is over/ we’ve seen the bottom”. Having access to this record gives you the perspective needed to avoid value traps and head fakes in the stock and bond markets.

Lately, staying at the forefront of the Wall Street madness has made all the difference, if you’ve wanted to keep your own sanity. Dealbreaker is a site that helps you do so while delivering laughs at the same time.

And I’ll be honored to hear a denizen of that site sarcastically comment that this post is “Too long, didn’t read” or “Too Reformed, didn’t Broker“, etc.

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2009/02/10/too-bess-didnt-levin-why-dealbreaker-is-a-must-read-site/ […]