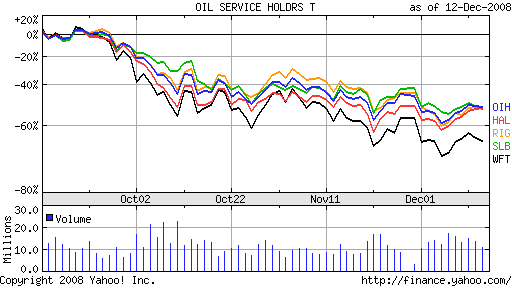

The Oil Equipment Services Index (OIH) Vs. Some of its Components

During times of great upheaval like these, if you live and breathe the market, you can sense something happening to whole groups of stocks even before anyone has surfaced with a statistical study to prove it. Sometime in mid-2008, many of us who actually pay attention to individual stocks began to realize that keeping up with company news had become a waste of energy and time.

Throughout the past year, the one consistent trend has been the lockstep trading of entire sectors of stocks. On a sell-off of crude oil, for example, you could punch up the symbol of almost any stock levered to the energy complex and see a down quote. This in and of itself is not strange. What is out of the ordinary, however, is that all of these stocks would often be down within fractions of the same percentage at any given moment of the day.

Moreover, like stocks also began turning up and down at almost the same exact moment with the precision of a flock of Canadian geese, keeping formation regardless of individual fundamentals or valuation. Should a large natural gas producer, for example Ultra Petroleum (UPL), be down 5.8% in a given session while a contract driller, say Pride International (PDE), is also down 5.9%? Yes, they are both energy names, but with very different business models, and at opposite ends of the energy food chain. On a down day for crude or natural gas, should they both be discounted by almost exactly the same degree? Now these are just two stocks, but what if we are talking about 100 or more energy related stocks all selling off, or rebounding in synchronistic moves that are almost perfectly correlated on a percentage basis?

Merrill Lynch recently took a look at this phenomenon and assigned actual empirical data to my observations on this type of “commoditization” within sectors.

Merrill’s research shows that stocks within industry groups (like retailing, pharmaceuticals, consumer durables, media and banks) have been moving in lockstep much more so than they have at any other point in at least 13 years. Through the end of October, the correlation of weekly returns for stocks in the same industry was 59%, compared to 42% last year and 46% in 2001, the previous high during the time period studied.

from “How Stock Picking has Changed”, Time Magazine 11/08

In other words, when news hits with either positive or negative ramifications for an industry, the big money either rewards or beats up that whole sector, with less regard for the actual component companies than ever before.

I’ve got some of my own inklings as to the cause of this, including the ETF effect, which probably grows each day, as well as the recent redemption-fueled liquidations by many hedge funds (they must all own the same names…great hedging).

The author of this report, Savita Subramanian, believes that people no longer care about individual prospects or projections for companies because of how important the macro and global impact is on business these days. “A stock’s fundamentals just aren’t as important as things like currency appreciation and global growth expectations right now,” the author explains.

Globalization isn’t going away anytime soon, so its time to come up with a plan for this macro-driven climate.

So if we have identified the pattern, how then do we use this information to our own advantage? Well, for starters, let’s agree to stop burning hours of our lives sitting through quarterly conference calls for each company’s earnings report. As passive minority investors, it becomes much more important to get representation in a sector we like than to be a company shareholder in this environment. Sector funds or ETF’s may be a better bet to get that exposure through a basket approach, if the stocks are all going to move together directionally anyway.

The drawback is not owning the name that outperforms it’s group, but as the evidence tells us, it becomes less and less likely that you are missing much anyway. On the flip side, can you imagine the disappointment of watching a group work it’s way higher and being stuck in the one stock that isn’t participating due to it’s own company-specific issues?

I see this on my screens all day, Merrill Lynch’s study or not, and so until this period passes (if it passes), I am more interested in absorbing the macro data or mood and discerning the groups or indices that could benefit or suffer, as opposed to worrying about the earnings for such-and-such company within the group. If I tear apart balance sheets and income statements and come up with a company that is undervalued, will anyone notice? Even if my information is right, it doesn’t seem like anyone else will care. However, If my group or sector is in favor, why not run with the herd? If it becomes out of favor, why not blow out the position, regardless of whether or not it’s a good company…everyone else will beat you to the punch if you do not, thus leading to better opportunities, apres le deluge.

These are the days when you either need to have a 20 year time frame or a 20 minute timeframe, and either can be extremely profitable. In either case, owning the sector is going to give you all you need in terms of volatility, so leave the stock picking to the masochists.

Disclosure: I do not currently own any of the stocks mentioned in this article.

[…] and losers” once again. This is in direct opposition to my recent Manifesto missive “Pick Sectors, Not Stocks” but it could be fun to be wrong next […]

[…] and losers” once again. This is in direct opposition to my recent Manifesto missive “Pick Sectors, Not Stocks” but it could be fun to be wrong next […]

[…] and losers” once again. This is in direct opposition to my recent Manifesto missive “Pick Sectors, Not Stocks” but it could be fun to be wrong next […]

The Silent Shard

This tends to probably be rather beneficial for many within your employment I want to do not only with my weblog but

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] There you will find 44802 more Info on that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] There you will find 22598 more Info to that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] There you can find 81615 more Info to that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] There you will find 48867 additional Information on that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2008/12/16/pick-sectors-not-stocks/ […]