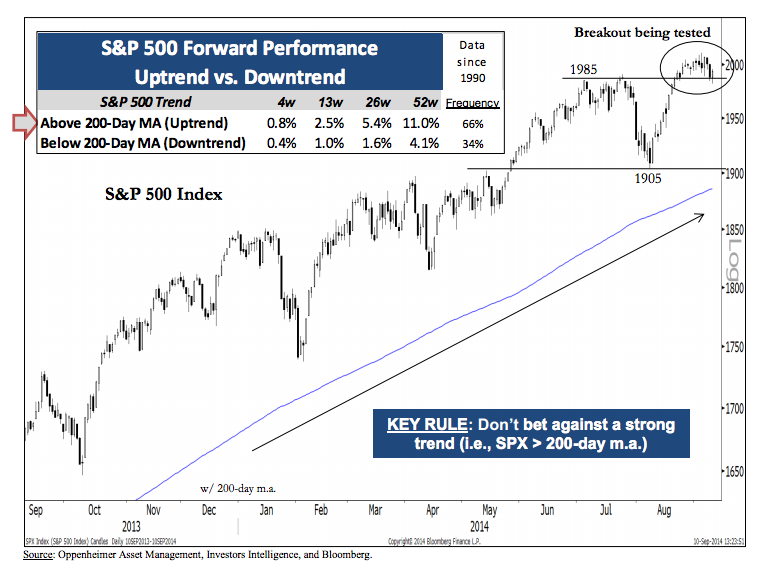

Ari Wald, technical analyst at Oppenheimer Asset Management, is telling clients to remain constructive on the bull market given the intact-ness of the long-term trend. He sees the weakness last week as a retest of the breakout level, although he does advocate a more selective positioning in case the trend fails to hold. In other words, keep only your core positions on if your horizon is short-term. If it’s long-term, nothing to see here just yet.

Overall, Wald prefers large caps to mid- and small- given how they’re acting in relative terms.

Here’s his chart and commentary:

Overall, our near-term view has become cautious, but we believe bouts of volatility are opportunities to buy an intact bull cycle. We recommend maintaining core positions and investing selectively until near-term conditions strengthen.

Longer term, we advise against a bearish posture and favor the continuation of the bull market cycle over the start of a devastating decline because historically it has been rewarding to stick with the S&P 500’s uptrend, specifically when the index is above its 200-day m.a.

STUDY: Since 1990, the S&P 500 has averaged a 5.4% gain in the forward six months when the index is above its 200-day m.a. vs. a 1.6% gain when the index is below this smoothed trend.

Source:

Inflection Points

Oppenheimer – September 15th 2014

@ReformedBroker the trend is your friend – until it isn’t. Right now the market and I are BFF http://t.co/bB5oY6FIyy

Raise Your Charts: After last weeks “weakness”, the markets are sitting a retest… @ReformedBroker http://t.co/29dgyk0HwV

RT @asibiza1: Raise Your Charts: After last weeks “weakness”, the markets are sitting a retest… @ReformedBroker http://t.co/29dgyk0HwV

.

tnx for info!

.

thanks for information!

.

ñïàñèáî çà èíôó.

.

hello.

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Here you will find 50582 more Information to that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Here you will find 2811 additional Information to that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/09/15/chart-o-the-day-this-is-the-retest/ […]