The President took an opportunity today to return to one of his key themes from the 2016 campaign, which is something he does whenever the news cycle turns to Russia and quitting staffers, and shocked the markets with a regressive, counter-productive and possibly destructive tariff plan for aluminum and steel.

Anyone who’s read, say, half a book about trade and tariffs knows what I’m going to post below, but it’s an important quote from the New Yorker’s Adam Davidson introducing the lunacy of Trump’s economic guru, Peter Navarro, from a couple of years ago…

It is hard to find a major American exporter who doesn’t see China as its most promising area of growth. A trade war would shatter General Motors, all of Hollywood, the music industry, Boeing, and the entire state of Washington, which exports more goods to China than any other.

Navarro and Trump also assume a manufacturing universe that no longer exists. American manufacturers have shifted away from making lower-cost commodity goods and focus, instead, on more expensive, complex products, like medical devices, automobiles, and airplanes. All of those goods require a steady input of smaller, commodity components like screws and circuit boards that are made in China and other countries. Some companies might react by beginning to manufacture those lower-cost commodity products domestically, but it seems unlikely that many manufacturers would do so. A huge tariff on China wouldn’t suddenly force Vietnam or Mexico or, for that matter, Germany or Japan to reduce their global competitiveness. Indeed, they would see it as an opportunity. Multinational corporations considering leaving China would face an easy choice: they could reinvest in the U.S., in the midst of a unilaterally created trade war, or they could invest in any other country on earth and have access to the U.S. and global markets.

Now, of course, none of these are considerations for the current moment. The goal of the President is to win today’s headlines and “shore up the base” with more promises about returning to a world that no longer exists. People in the GOP will be even more shocked that he was serious about this than the Democrats, with whom protectionism is more traditionally associated.

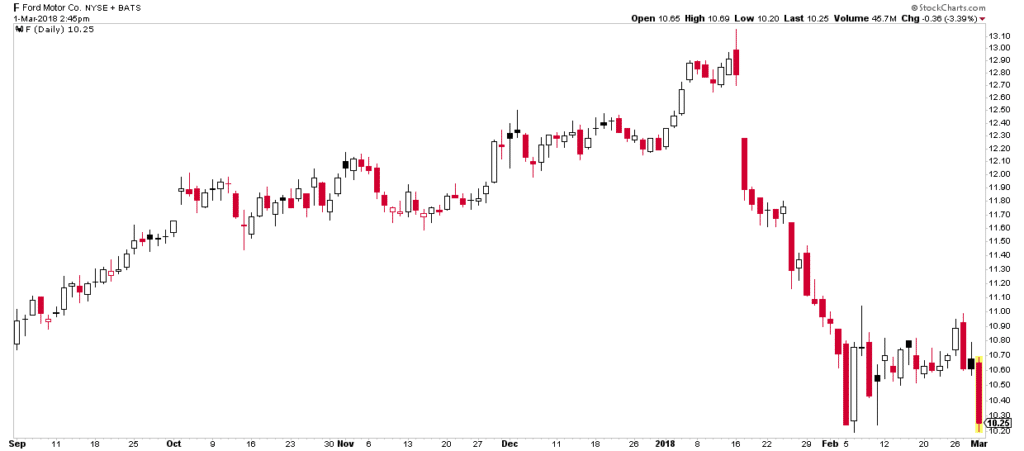

Needless to say, markets hate this idea, because it’s dumb, and the Dow Jones immediately vomited up 500 points as the impromptu declaration was made in front of an audience of steel CEOs.

For many segments of the economy, a 25% tariff on metals means an increased cost of doing business (think construction, auto manufacturing, etc) and the end result is actually a tax on the consumer. Whether or not it leads to sustainable jobs in 2018 and beyond for steelworkers remains to be seen. Even that isn’t a slam dunk.

And this is before we even know what the retaliatory actions from Asia and Latin America might be.

I’ll leave you with Linette Lopez’s lede, she’s been warning about what trade protection could mean for a year now…

If President Trump puts in place steel and aluminum tariffs recommended by the Commerce Department, his administration will be crossing an unspoken line in the sand no country has crossed since World War II…once the US starts invoking national security to protect industries, everyone can do it. That’s why no one has done it. The international trade system is built on trust, and no one has violated that trust to this degree.

Aside from Navarro and Wilbur Ross, no one else in the administration seems to think this is a great idea right now.

And you can see the stock market’s reaction writ large in shares of Ford Motors:

Read Also:

Trump’s Muse on U.S. Trade with China (New Yorker)

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2018/03/01/1234-lets-have-a-trade-war/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2018/03/01/1234-lets-have-a-trade-war/ […]