I said a little while back that the “I” word was going to make a comeback this year and could represent the biggest theme in the markets for 2018. I say “could” because if I thought I knew for sure, I’d be one of these 2-and-20 guys, and I am decidedly not.

But I have a nose for these things because I watch price action on the charts, listen to the concerns of our clients and read tons of market commentary every day. And for the first time in forever, the cost of living / rise in commodities / rise in interest rates are making themselves felt in the daily discourse.

Before I continue, I ask that you keep in mind that a blog post does not constitute an investment recommendation, personalized advice or a recommendation of any security or strategy. See my terms and conditions for a full 100,000 word disclaimer.

Okay, let’s continue.

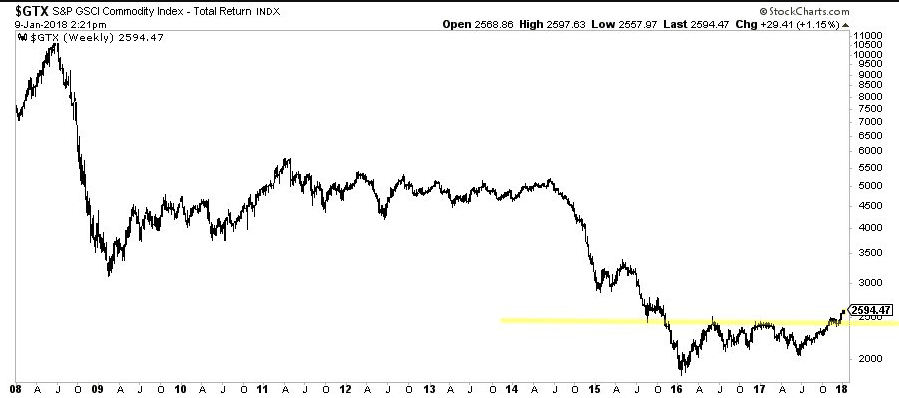

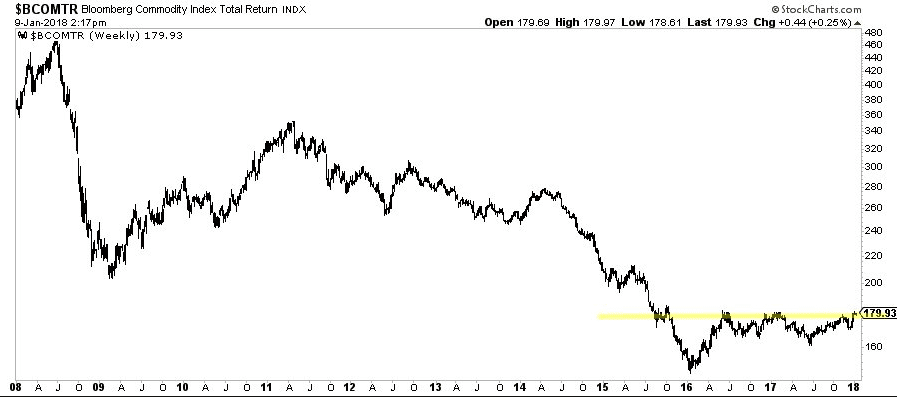

I shared these two charts yesterday with the subs in my premium Twitter feed. The first one is a breakout and the second one is a potential breakout in progress…

Here’s the S&P GSCI index, which features a heavy amount of oil in its calculation and has already climbed out of this two-year base.

The next one is the Bloomberg Commodities index, which looks like it wants to go. It has oil in it but downplays that exposure somewhat in favor of a larger weighting toward precious metals and agricultural commodities (the “softs”).

These are nascent breakouts, not longstanding uptrends, and so they should be watched closely with an understanding that anything can happen. Commodities have been in an incredible downtrend for years and years now. And relative to stocks, they’ve been a horrendous asset class. One dollar invested in commodities in 2012 is worth about 55 cents. In comparison, a dollar invested in the S&P 500 over the same time frame is now worth about $2.50.

It’s too early to call a reversal of this, but it’s not too early to contemplate the possibility, and what it might mean for a diversified portfolio.

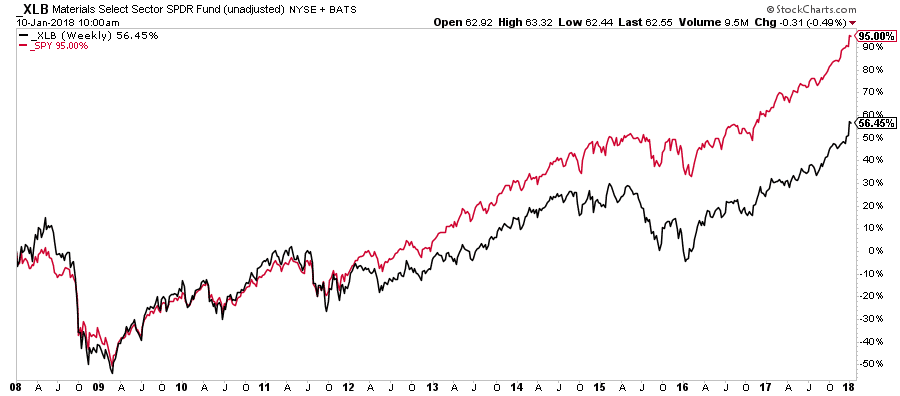

You’re going to see a lot of renewed interest in commodity plays this year should present trends continue in the economic data and the futures market. Take a look at the relatively tiny S&P 500 Materials Sector SPDR over the last ten years and you see substantial underperformance (I’ve taken dividends out to focus on price).

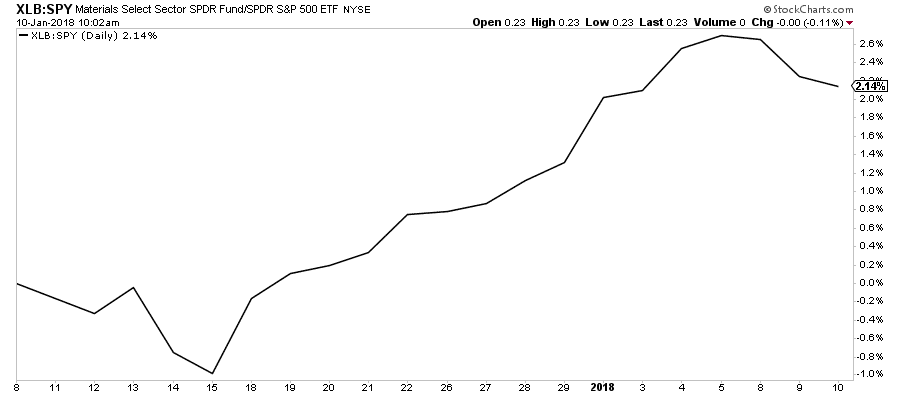

Now look at the last month, with a ratio chart of XLB / SPY – 200 basis points of outperformance and counting since early December.

The commodity-related equities are confirming the new breakouts for the commodities themselves, which is what a technician would want to see – confirmation.

Jeff Gundlach was talking about commodities on his DoubleLine call last night. Via Bloomberg:

I think commodities will outperform in 2018,” Gundlach said during his annual ‘Just Markets’ webcast on Tuesday, in which he gives his outlook for the coming year. “Commodities always rally sharply — much more sharply than they have so far — late in the business cycle as we lead into a recession.”

Bloomberg points out that Goldman is saying something similar:

His thoughts on commodities echo Goldman Sachs Group Inc., which last month said raw materials will bring better returns than other assets in the long run on strong global demand, and reiterated its 12-month overweight recommendation. The Bloomberg Commodity Index of 22 raw materials has climbed about 11 percent since the second half of June.

Crude oil is trading at the highest in more than three years…

Over on the fixed income side, the bond bears are growling and talking about inflation.

The 10-year yield just hit 2.6% this morning, said to be a key level of resistance which may now represent a breakout in yields. The Wall Street Journal led their markets coverage this morning with a story titled “Investors Prepare For Inflation“…

The recent shift in investors’ inflation expectations will face a test Friday, when the Labor Department releases CPI data for December. The CPI increased 2.2% in November from a year earlier. However, the Fed’s preferred inflation gauge, the price index for personal-consumption expenditures, rose just 1.8% on a headline basis and 1.5% when excluding volatile food and energy costs. That is below the central bank’s 2% annual target.

“If we get a strong CPI number on Friday, then I think certainly the market will be justified in moving past the 2.5% mark,” said Gennadiy Goldberg, senior U.S. rates strategist at TD Securities. Yet if the data disappoints, “I think this will all come back very quickly,” he added.

Sorry, Gennadiy, it happened today instead.

Now that I’ve set the table, let me say what I want you to take away from this, and I’m going to put this in bold:

Inflation bets are only a trade, they should never, ever, ever be an investment.

Commodity booms always, always, always end in busts.

Production always arrives eventually to meet demand and bring prices back in line. Or, innovation brings a new commodity or solution online to deal with the pain point caused by high prices for the old commodity. You will watch this happen with electric vehicles over the next decade, by the way. Your ancestors saw it happen with natural gas replacing coal and coal replacing whale oil and on and one back to the beginning of time.

So you trade inflation spikes, you don’t invest in them as though they are permanent. Now, this could be a multi-year trade of course, but it’s a trade nonetheless.

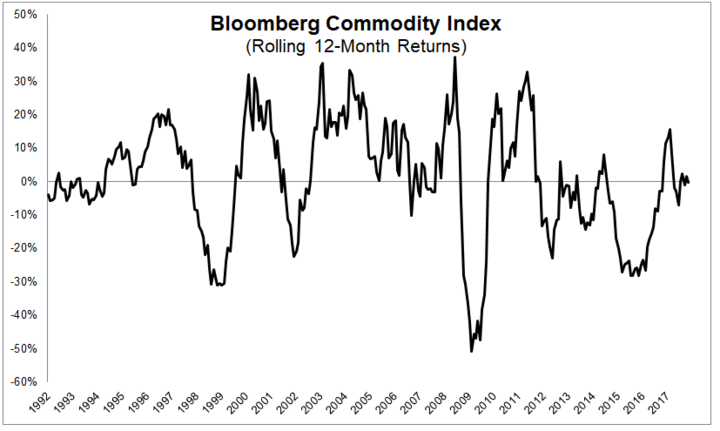

Here’s a chart I asked my director of research, Michael Batnick, to put together, it shows rolling one-year returns for the Bloomberg Commodity Index. It’s a dead end for long-term investors. Mean reversion will destroy your gains in commodities over time, you can take it to the bank. These things are meant to be produced and then sold and consumed – they do not generate income or throw off profits in and of themselves.

And as far as the comparison to owning stocks – even commodity-related equities – well, there is no comparison.

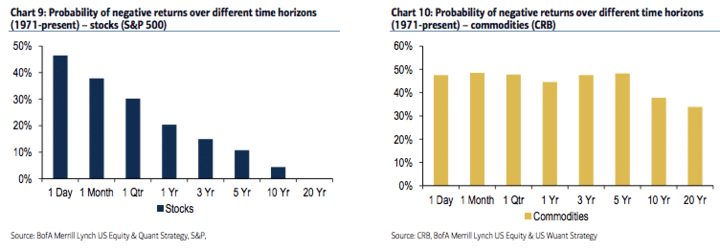

Bank of America Merrill Lynch shows the probability of having a drawdown in both asset classes. For stocks, the chances of seeing losses over a long term holding period have been pretty much nil. For commodities, the chances of losing money long-term are substantially higher. Over 20 years, BofA calculates a 4 in 10 chance that you’ve got negative returns in the CRB over any 20-year holding period, historically.

(You can click to embiggen)

Now, of course, this reality is why commodities have always been thought of as a two-way market, a place for buying and selling, or buying and shorting. This is why there is a lot more money in futures contracts and in managed futures funds than there is in commodity ETFs (aside from GLD, which is whole ‘nother story).

There’s been some innovation in the commodity ETF space recently, which I’ll tell you about briefly. I had the pleasure of meeting Will Rhind of Granite Shares at my firm’s Evidence-Based Investing conference this past fall. Will’s a veteran of the ETF space in both the US and Europe and has come up with what he believes is the ultimate way for ETF investors to gain exposure to the mainstream commodities indexes.

I had him in my office walking me through how they work – essentially he’s been able to create index trackers for both the GSCI and the Bloomberg indexes, with no K-1’s for tax purposes (the bane of all alternatives shareholders). He owns treasury exposure, which is used as collateral for the futures contracts that mimic the index on a front-month basis. So he’s seeking to provide investors the returns of the commodities market, with minimal tracking error and no annoying tax bullshit at the end of the year.

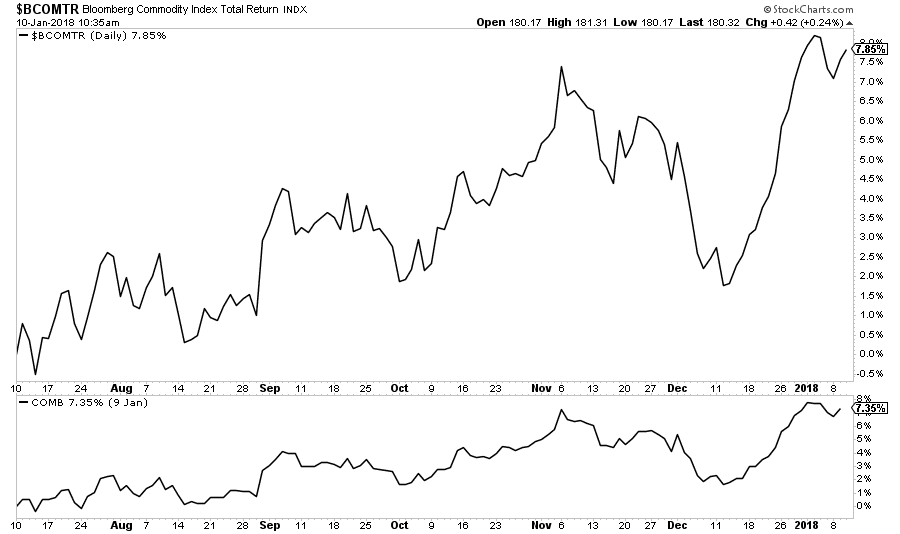

And the best part is that he’s priced them to take big market share. They’ve been trading for less than a year so no one knows about them yet. The GSCI tracker ETF’s ticker symbol is COMG, it’s stated expense ratio is a reasonable 35 basis points. The Bloomberg index tracker is COMB, with an even lower expense ratio of just 25 basis points. In comparison, most managed futures funds are asking for something like 300 basis points in management fees and then 30%(!) of the profits. If Will’s products are able to put together a track record showing they can do what they’re trying to do, he should be able to get a lot bigger.

Here’s how the COMB ETF looks compared to the index over the last six months – I wanted to see massive tracking error so I could be a skeptic, but I was pleasantly surprised:

I have no position in either security and no involvement in Granite Shares, just FYI. You should read all of the relevant risks before acting at their site.

One other thing I want to add in to this discussion is the “short bonds” trade. My personal opinion is that it’s not a good idea for a majority of investors, no matter how concerned they are about inflation. This is a trade best left to professionals or disregarded entirely.

I spoke with ProShares this morning about their inverse bond ETFs just to clarify something important – they’re both expensive investments and they have costs that do not show up as part of the stated expense ratio. That makes them more suitable for trading vehicles and less so for longer term investment.

The ProShares Short 7-10 Year Treasury ETF (ticker TBX) seeks to provide holders with the the returns of the ICE index that is the inverse of the treasury bond market. Unfortunately, this means that the trade has what’s called “negative carry”, meaning that by borrowing bonds to short them, holders are responsible for the payment of the bonds’ interest payments to the real owner. This is vastly oversimplified but the point is that this cost shows up in the ETF’s NAV (as a drag on returns) alongside the annualized .95% management expense which is also coming out.

From an investor’s perspective, the ProShares UltraShort 20+ Year Treasury (ticker TBT) is even more problematic. It’s seeking to provide double the inverse of the treasury market – this time, the long-term (20-year plus) treasury bond. The 2X inverse is definitely for traders only, as the negative compounding effect eats away at returns over longer time horizons and the tracking error increases as well, plus the negative carry from making interest payments. If you’re trading it over days or weeks, you won’t have an issue with the .93 management expense. Beyond that, all of these costs add up to more than they’re worth.

Fixed income investors with inflation concerns are better off talking to their financial advisors about it than experimenting with leveraged or inverse trades. A simple ladder that reinvests principle from maturing bonds into higher-yielding, longer-dated bonds in a systematic fashion is the safer way to go.

So remember – inflation is becoming the talk of the town and maybe this time, the hawks will be right. But that doesn’t mean their conclusions about what you should do about it make any sense. If you’re not sure about your portfolio’s preparedness, you’d be better off talking to us or your local trusted advisor than simply reacting or getting yourself into trouble with misguided stuff you hear in the media.

[…] ‘If You Remember Only One Thing About Inflation, Remember This’ – Josh Brown ̵… […]

[…] I said a little while back that the “I” word was going to make a comeback this year and could represent the biggest theme in the markets for 2018. I say “could” because if I thought I knew for sure, I’d be one of these 2-and-20 guys, and I am decidedly not. But I have a nose for these things because I watch price action on the charts, listen to the concerns of our clients and read tons of mar… Source: http://thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this… […]

[…] By Josh Brown […]

[…] If you remember only one thing about inflation, remember this – And relative to stocks. (You can click to embiggen) Now, of course, this reality. […]

[…] http://thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this… […]

[…] thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Here you can find 47535 additional Info on that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] There you can find 64971 more Info to that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2018/01/10/if-you-remember-only-one-thing-about-inflation-remember-this/ […]