Yeah, this album is dedicated

To all the teachers that told me I’d never amount to nothin’

To all the people that lived above the buildings that I was hustlin’ in front of

Called the police on me when I was just tryin’ to make some money to feed my daughter

Today the Dow Jones Industrial Average crossed 25,000 for the first time in history. This new high was set in close proximity to the breaking of 24,000, which makes perfect sense when you consider the fact that as the numbers go up, the distance between each 1,000 point increment gets shorter percentage-wise.

Lots of people are going to trot out the usual tropes about why it doesn’t matter. They’ll say “it’s just a round number, it doesn’t signify anything,” and “the Dow is price-weighted, a flawed index, and only captures the movement of 30 stocks.”

They’re right technically but wrong spiritually and, frankly, wasting your time with pedantry where none is necessary. It’s like a friend who corrects your spelling in a text message.

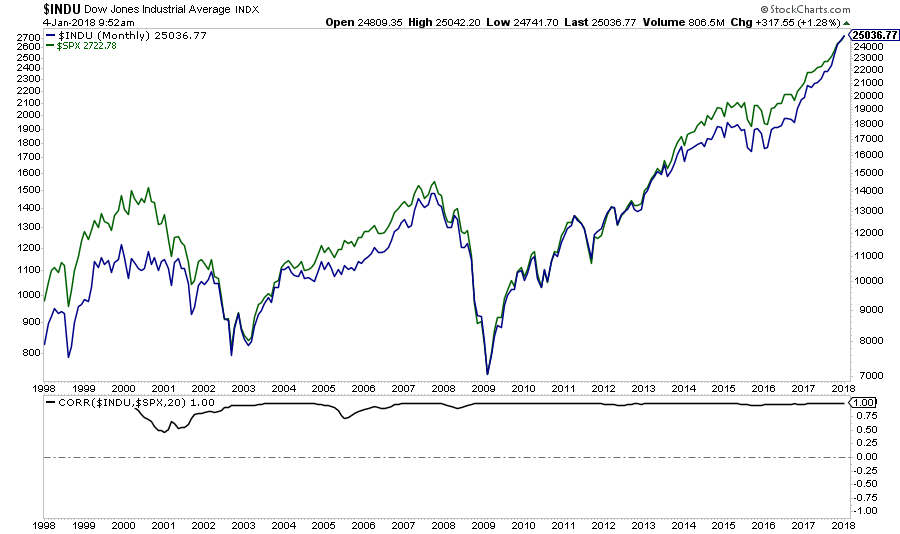

Let’s start with the fact that, yes, price-weighted isn’t quite ideal, but the S&P 500, which is market-cap weighted and broader, ends up in the same place as the Dow over longer (more meaningful) timeframes, so who cares?

Here’s Dow Jones vs S&P 500 over 20 years with 20-period correlation in the lower pane. What’s the difference?

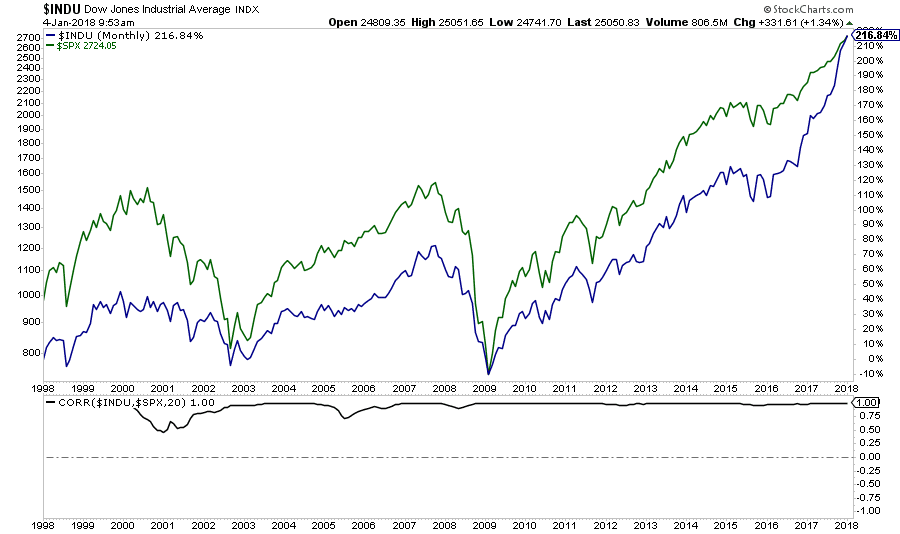

See how pointless the weighting debate becomes? Here’s percentage terms:

Yes, I am aware that the Dow’s 30 stocks can be considered to be somewhat arbitrary and that they are selected (and de-selected) by a human committee, but so is the S&P 500. It’s actually the same committee. Dow Jones Standard & Poors Indices is the company managing both.

And as far as the “round numbers” thing, whatever. The S&P 500 might be a better representation of the stock market but the Dow was first, by about 60 years (late 1890’s versus late 1950’s) and it’s the People’s Index. When the man or woman on the street asks you “How’s the market doing?” they’re expecting an answer denominated in Dow points. You can give them the Russell 3000 if you want to, but you’ll be met with a blank stare. As my date on prom night once said, “It is what it is.”

Don’t overthink it. We’re in one of the most obvious bull markets in history by any measure, and there are no asterisks next to the milestones as we hit them. And the milestones are meaningful insofar as sentiment plays a very important role in the recipe for how these things start, proceed and, yes, eventually end.

Take in the scenery.

Last thing – I’d also like to point out that this is still a global phenomenon. This morning, European stocks gapped up almost 1% to take out a four-year high. A glance at Japan ex-yen (DXJ ETF, for instance) shows you a index that’s up 65% since the summer of 2016. Together, that’s like 75% of the global total, give or take. It’s all happening and it’s all worth remarking upon.

[…] Yeah, this album is dedicated To all the teachers that told me I’d never amount to nothin’ To all the people that lived above the buildings that I was hustlin’ in front of Called the police on me when I was just tryin’ to make some money to feed my daughter Today the Dow Jones Industrial Average crossed 25,000 for the first time in history. This new high was set in close proximity to the breaking o… Source: http://thereformedbroker.com/2018/01/04/dow-25000/ […]

[…] Dow 25,000 (The Reformed Broker) […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Here you can find 87289 additional Info on that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Here you will find 80708 more Information to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2018/01/04/dow-25000/ […]