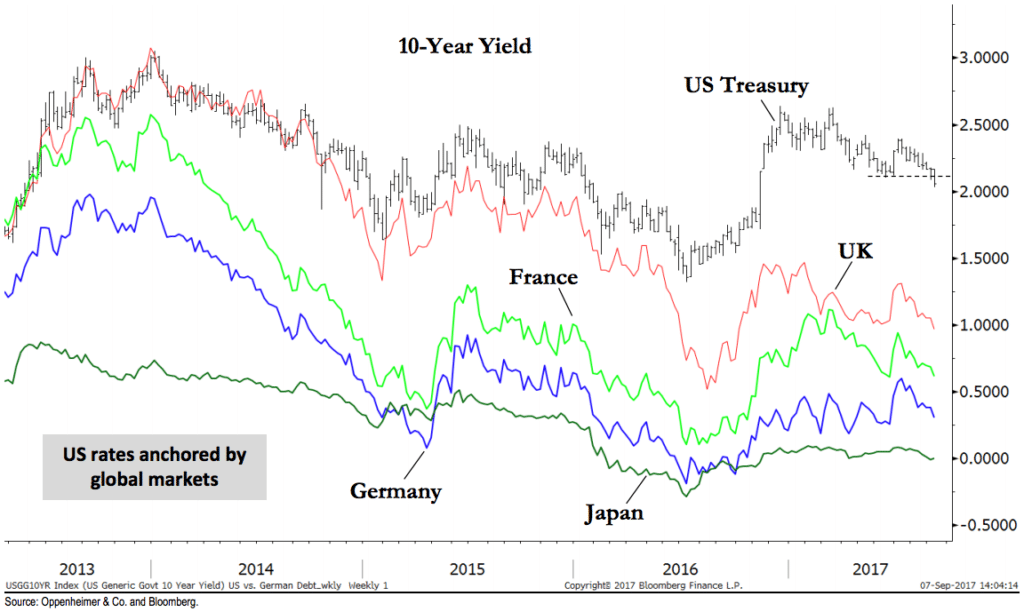

Pointing at the Treasury market and declaring this or that thing is a big econ newsletter trope but the truth is that sovereign bond yields are really one big market in the current era and it may be that way forever for all we know. Yes, different central banks are having different types of inflation or deflation fights all the time and are varying states of the stimulate-normalize-hike cycle at any given time. But this is swamped by the ability of global portfolio managers to allocate capital all over the world and this shows up in the synchronization of bond prices (yields) over time.

Ari Wald did this chart for Oppenheimer over the weekend and I think it’s a really good illustration of this phenomenon for those who don’t follow this sort of thing all day long.

US Rates Anchored Overseas

One risk to our bullish outlook is if US yields play “catch-down” to considerably lower rates in Europe and Asia, and a replay to the 2014 to 2016 market environment develops characterized by narrow internal breadth and wide credit spreads. Conversely, we think rising interest rates would be a tailwind towards a synchronized equity market recovery, and we think rates outside of the US need to move higher if rates in the US are going to move higher.

Josh here – yes there are, of course, differences in the absolute levels of yields and certainly we can see different tightenings and widenings between the pairs now and then. But directionally speaking, Ari’s anchoring concept is the real thing worth understanding. It’s a global marketplace for money, more so than ever. We need to think bigger than just whatever might be influencing Treasury yields domestically.

Source:

Technical Analysis: Inflection Points

Oppenheimer & Co – September 9th 2017

… [Trackback]

[…] There you can find 23979 more Info on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] There you can find 60334 additional Information on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] There you can find 6848 more Information to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]

… [Trackback]

[…] Here you will find 81314 more Information to that Topic: thereformedbroker.com/2017/09/11/chart-o-the-day-one-big-bond-market/ […]