I’ve been thinking about lithium a lot lately. You can’t make an electric car without it. Lithium is the lightest metal on the periodic table. In fact, it’s the lightest solid element period and the lightest element than can conduct electricity. I’m insanely bullish about electric cars and trucks. But I’m not terribly interested in buying Tesla stock, given the valuations and Elon’s spinning plate routine with the company’s finances, which makes me nervous.

Tesla’s kicked the door down for mass acceptance of EVs, and they were the first to spotlight the need for a massive battery-producing infrastructure. But first movers and innovators don’t always win. Even if Musk can thread the needle – delivering on his vehicle production promises while continuing to raise enough capital to get to some semblance of true profitability – it’s not a fait accompli that Tesla will ultimately win. Volkswagen, BMW, Benz, Toyota, Nissan, GM, Ford, Fiat Chrysler et al are all coming on strong, to say nothing of the nascent Chinese automakers. I think, in the case of EVs, I would prefer to invest in the arms dealers and not the combatants. In the world of automakers, even when things are good they still aren’t great.

Let’s think about the arms dealers…who are they? I’ve come around to believing that they are the companies who supply the lithium to make all the batteries. I’ve made an investment. I may make others. I think I want to be on the lithium side of the trade right now. While lithium is widely used currently in everything from airplane parts to cellphone batteries, it’s beginning to find the limelight because of the revolution that Tesla has kicked off.

Before you read any further, it’s important for me to remind you that nothing you read on this site is an endorsement of a particular security, a solicitation to buy or sell anything or advice of any kind. I write about what I’m interested in and never tell people I don’t know what they should do with their own money here. My full terms and conditions here. If you’re unable to think and act for yourself, you should probably read a different blog.

Okay, sorry about that. Now that it’s adults only, let’s talk…

The thing you need to know about lithium – and I’m far from a subject matter expert at this stage in the game – is that it’s rare (making up 0.00007 of the earth’s crust) but it’s not terribly rare. The earth contains a 365 year supply of lithium at the current rate of production (roughly 37,000 tons a year), according to the US Geological Survey. Which is a good thing – it’s why the industry should standardize on lithium ion batteries in the first place. There’s no reason to attempt a ramp-up to 20 million cars that require a material you can’t get.

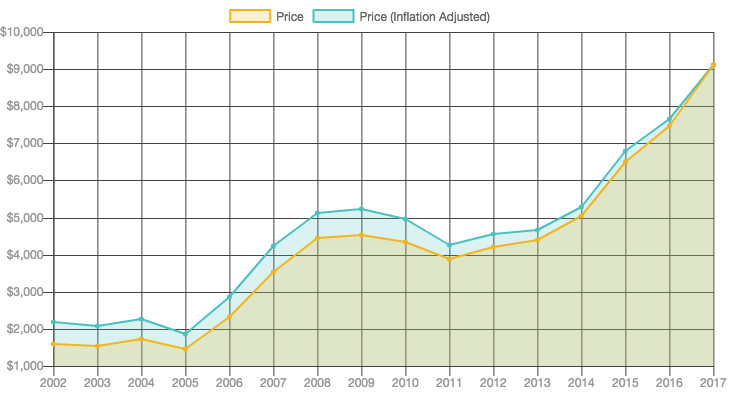

But just because there is enough, that doesn’t mean it’s free. The bottleneck in lithium is that the demand is sudden and explosive. There isn’t enough capacity to meet that demand absent continued price increases and investment. This is great for the small handful of producers who control a great deal of the supply and wherewithal to mine it, refine it and sell it.

Lithium is so light that in the places where you can find it, it floats atop the surface of the water. The more I read and ask about this metal, the more fascinated I become. Below, via Amusing Planet, is what Lithium Carbonate looks like in the refining process:

In the wastelands of Salar de Atacama, about 700 miles north of Santiago, is a huge lithium mine field operated by Sociedad Química y Minera de Chile (SQM), a Chilean chemical company, and the world’s third largest produced of lithium. The silver-white metal is found dissolved in brine, a mere 130 feet below the surface of the desert. The thick slushy brine is pumped from the ground and poured into shallow evaporation pools to dry under the hot desert sun. As the water slowly evaporates, it leaves behind a greasy yellowy material that yields one of the most precious metal of the 21st century.

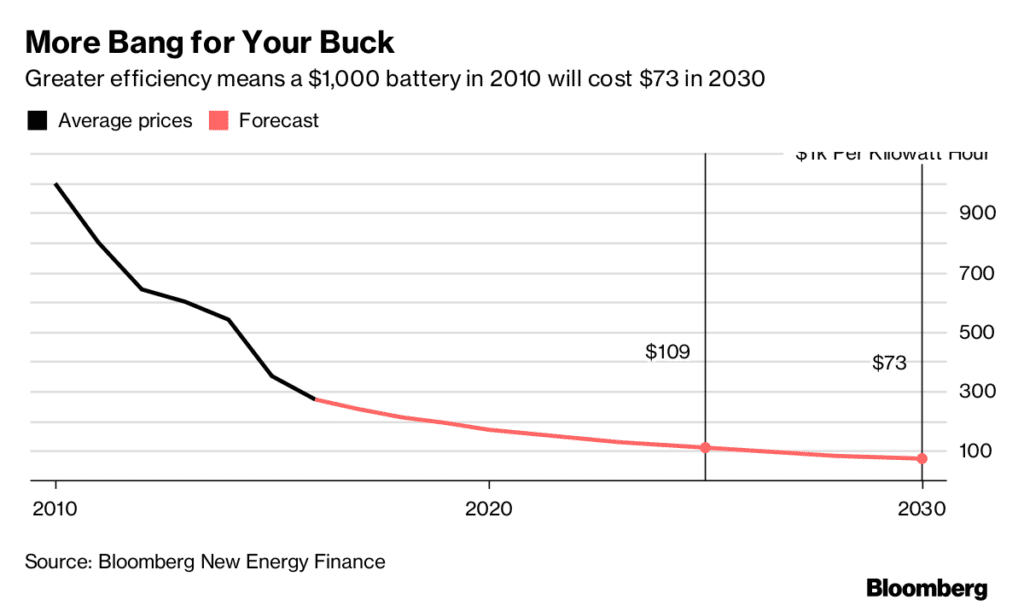

There are a number of small companies coming up with new and innovative ways to bring even more lithium on to the market with experimental techniques. I am way out of my depth on which of those will be commercially successful. But innovation will be necessary – according to one expert, the world will need 800,000 tons for battery production alone by 2040! As battery prices come down, usage and adoption of lithium ion technology will explode. The below chart comes from a Bloomberg story today about EV adoption trends in Europe, where war has been declared against the combustion engine:

The thing is, almost all of the world’s supply is coming from just a handful of places. Chile is the Saudi Arabia of lithium. Australia is second. In the US, there is literally just one site of production worth speaking of – 200 miles outside Las Vegas, where else? Asia takes a lot of the production right off the market for all of the electronics they make. Prices have nearly tripled over the last ten years and have doubled since 2012 as the electric car market began to blow up.

Let’s talk about investment options. I obviously don’t know which company will do the best, or even whether or not pricing will hold up. But if in fact lithium turns out to be “the most strategically important metal” of our time, I want to be involved.

I see a few mainstream options for investors to do some research on…

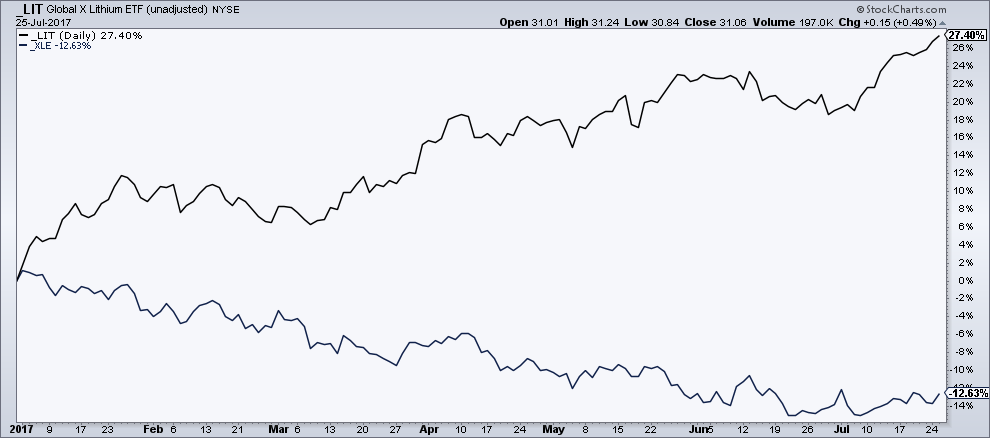

The best starting place would be the Lithium ETF from Global X. The ticker symbol – LIT – will be a hit with millennials. It’s not a commodity ETF holding the metal outright or buying futures. Rather it’s a fund holding companies involved in the production and use of it. Here’s how hot the space has been year-to-date, contrasted with oil stocks, which are ice cold:

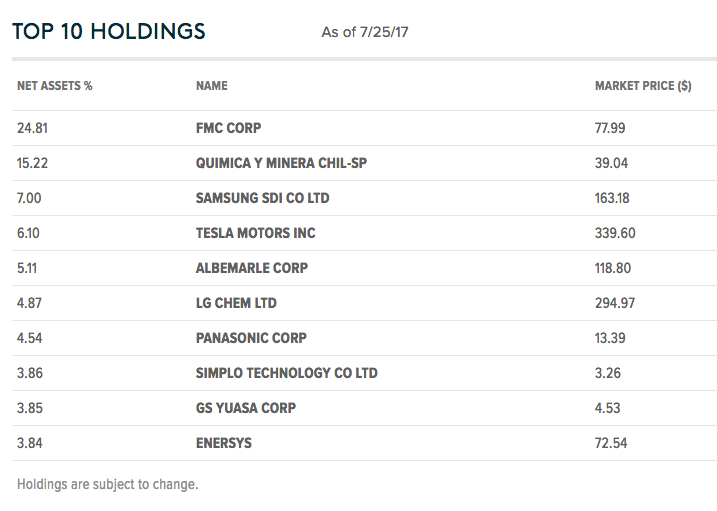

Anyway, in its top ten holdings, you’ll find producers side by side with consumers (Tesla) and battery manufacturers (what’s up, Panasonic!)…

I’m really only interested in the producers, for the reasons outlined above so I’m not in the LIT ETF.

FMC is the largest weighting in the index this fund is based on. It’s a massive chemicals conglomerate, but lithium is not very important to its overall business. In other words, it is very far from a “pure play”.

The biggest pure play in here is Sociedad Quimica y Minera de Chile, an ADR that trades on the NYSE under the ticker SQM. The thing is, it looks an awful lot like the overall Chilean stock market. Below, I compare the Dow Jones Chile index with SQM and see not much daylight between the performance of the two:

As an emerging market stock, I would expect there would be additional risks in SQM that could ruin a bet on lithium that could otherwise have been successful.

The name that caught my interest in then group was Albermarle, so I bought some a few weeks back – ticker is ALB. It’s in a pretty solid uptrend and seems to be under institutional accumulation. The company has been around in permutation or another since the 1870’s. It’s based in Charlotte, NC but has operations around the world. I would start with the company’s site to begin your own due diligence.

ALB’s got a $13 billion market cap on $2.7 billion in annual revenue and $466 million in net income (TTM). Revenue growth is over 9% a year. The next earnings report is on August 8th.

This is not a name that retail investors know but the growth fund crowd has absolutely begun to discover it. Stephen Mandel’s famed Lone Pine hedge fund began a new position in the stock of almost 2 million shares last quarter, or roughly $200 million of the fund’s assets, for example.

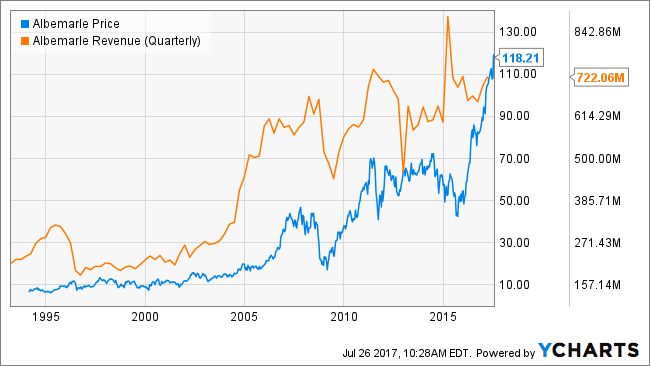

Here’s revenue growth vs stock price over the last 20 years, you can see why ALB’s becoming a favorite of the GARP crowd.

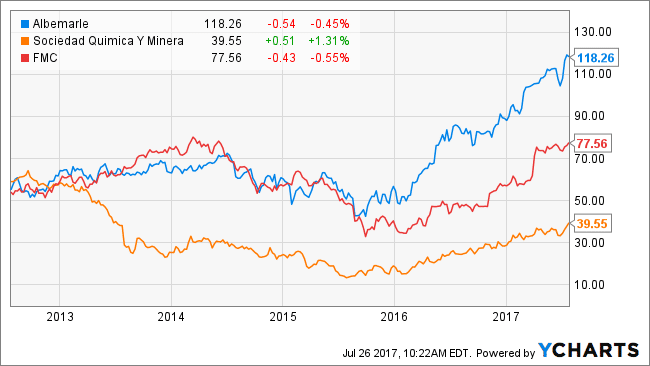

Albemarle might be the ideal pure play on lithium because it derives 25% of its revenues from the metal and almost 40% of its cash flow. That makes lithium sales more meaningful to the company than they are to FMC (which only derived 8% of its revenues last year from lithium). And, indeed, ALB seems to be running away from the other two as the lithium battery explosion continues – here’s a five year performance chart:

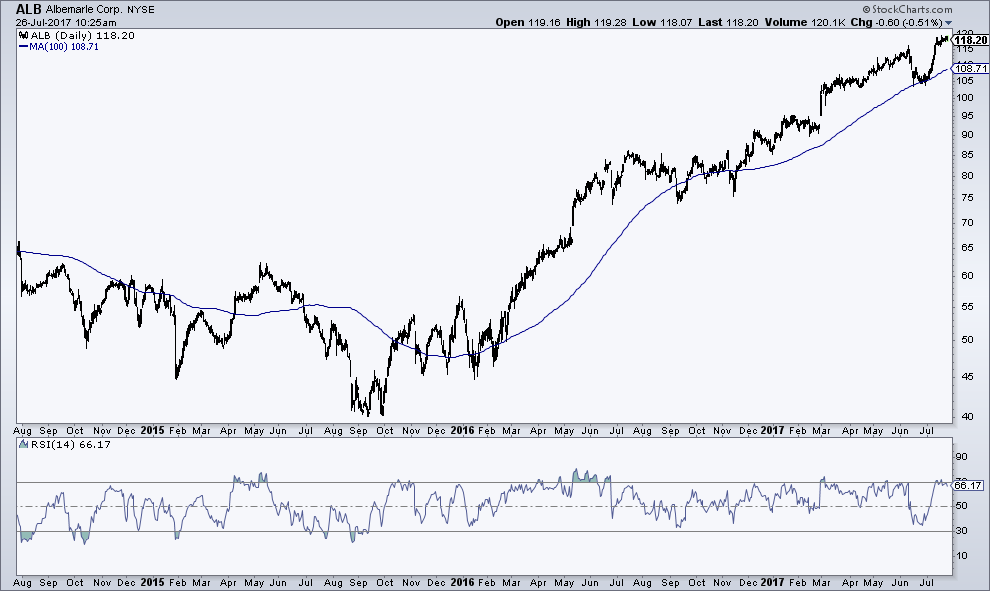

You can see that the 100-day simple moving average was recently tested – successfully and the bulls came in exactly where they were supposed to on the dip. Trailing a stop just below that 100-day and using a weekly closing basis as the decision point each Friday could be a good way to stay on the right side of the current uptrend.

Finally, I would say that what we’ve discussed above should merely be the starting point of your own research if you’re interested in the trend. I don’t know for sure that my chips are on the right square, but ALB seemed to be the most accessible stock to begin with. I will be learning more about lithium ion battery technology and electric vehicles right alongside with you. Feel free to hit me with any information I may have missed or might be worth considering at AllAccessTRB, my new premium Twitter feed if you want to chat.

Okay, Kurt. I didn’t forget you. Take it away…

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/07/26/lithium/ […]