I asked Ritholtz Wealth Management’s in-house tax expert, Bill Sweet, for some quick and dirty thoughts about what Trump’s one-page tax plan might mean for investors, business owners and other people to whom we give advice. What follows is apolitical, just the facts, and not a fully-formed policy paper – just some quick observations from Bill.

It may have taken him the same amount of time to jot down these notes as it took the team that released the actual plan for the White House, but we won’t hold that against them.

I hope this helps you, and if you need more help then you can talk to us directly about your portfolio and financial plan here.

Here’s Bill:

***

1. It’s not a plan, this is a memorandum. A snowflake (Rumsfeld term for a letter). There are zero details, zero analysis, zero thought behind the broad impact. Tax Policy Center, Tax Institute both said that there isn’t enough detail to understand the broader impact.

For example, there are no guideposts on how wide the tax brackets are going to be. Where does the 15% bracket start or end? 25%?

It’s less specific than the fall of 2016 Tax Plan even though they’ve had months to think about it.

So most intelligent tax folks are speculating on impact but are just guessing based on prior proposals

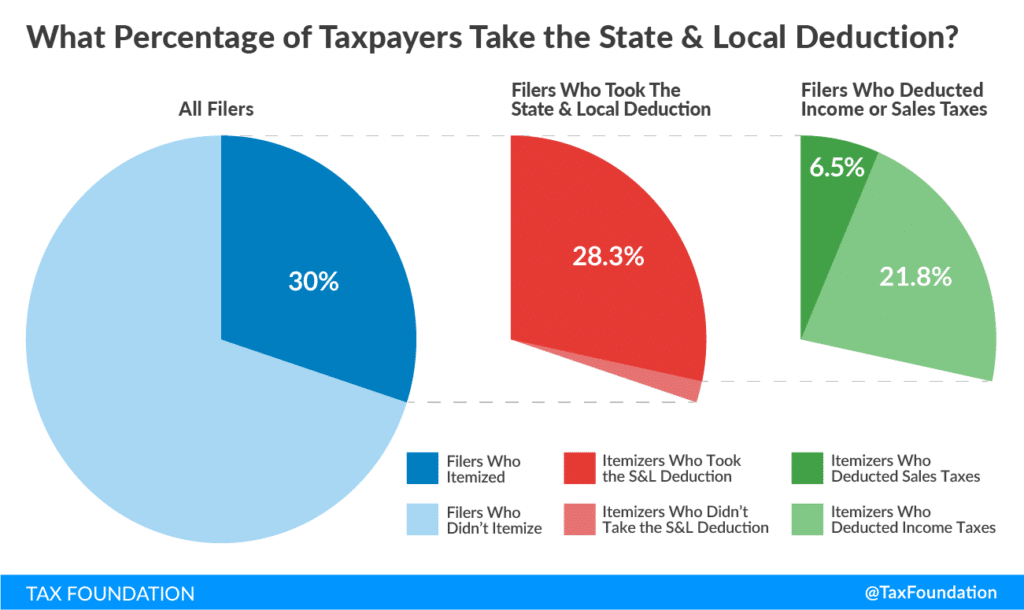

2. Proposal does remove state local tax deduction (you and I can deduct tax paid to NY state today, won’t under this plan) which massively hurts taxpayers in high tax states NY, NJ, CT, OR, CA)

On average its about a 7.1% increase on those who make $500,000 plus: “Taxpayers with incomes above $500,000 claim deductions worth nearly 7.1 percent of AGI The elimination of deductibility would reduce the cash income of the top decile of income earners by 1.3 percent, but the reduction would be less than 0.1 percent for each of the bottom five deciles.”

Granted, this is likely offset by reduction at the higher bracket.

Really key question is whether the 15% corporate tax would apply to pass through entities like LLCs and S-corporations.

Team was asked this question directly and refused to answer.

If yes, there would be a a huge incentive for employees to form corporate entities or LLCs and then bill for services as a contractor.

Would subject that income to a lower tax rate, 15% vs potentially 35% or 39.6% today.

Could potentially accelerate the gig economy effect since there would be a huge incentive to avoid employment income for better or worse.

That could impact social security and Medicare funding since these are generally funded by employment taxes.

Another lack of specific detail – tax relief promised for child care expenses, but no details. A deduction? A credit? Nothing specific.

3. Budget hawks are going to hate it – from WSJ “The Committee for a Responsible Federal Budget said Wednesday that the plan would cost about $5.5 trillion in lost revenue over a decade. Those limitations could lead Republicans to make some or all of the tax cuts temporary to limit the long-run fiscal effect.”

Summary:

1) Not a plan, this is a wish list, a tax hater’s dream.

2) No details on where the brackets start end, no details on credits or what tax relief means, makes it impossible to analyze outside of rabid speculation.

3) Removes state and local tax deduction, which is important for high earners in high tax states, favors low tax states Sun belt Texas, Florida without a state tax.

4) Theoretically, does simplify the tax code, which generally benefits anyone who isn’t a CPA or HR Block.

5) Could seriously impact labor structure creating a huge incentive for people to set up LLCs and corporations for contractor revenue in favor of employment, but this is unanswered at this time.

6) Like the AHCA, deficit Hawks will likely hate it because it will probably blow up the federal deficit.

7) Like the AHCA, little thought went into this, outside of broad strokes, and therefore its not likely to gain any bipartisan support, and I’m guessing like the AHCA will be DOA in adult Congress.

***

Thanks Bill! I know there wasn’t much here to work with, but that makes it easier to get people to believe in it I guess?

Talk to us about your investments today, we’d love to help you.

[…] Josh Brown: What We’re Telling Investors About Trump’s Tax Plan […]

[…] Josh Brown: What We’re Telling Investors About Trump’s Tax Plan […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2017/04/30/what-were-telling-investors-about-trumps-tax-plan/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2017/04/30/what-were-telling-investors-about-trumps-tax-plan/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/04/30/what-were-telling-investors-about-trumps-tax-plan/ […]

… [Trackback]

[…] Here you will find 22833 additional Information to that Topic: thereformedbroker.com/2017/04/30/what-were-telling-investors-about-trumps-tax-plan/ […]