“You need to judge us over a full cycle.”

It’s a reasonable argument made by both great active managers and mediocre ones. The subtext is that “any idiot can ride a bull market up, fully invested, and generate performance” but that it takes a skilled manager to know when to move toward less risky allocations or husband cash or take profits or rotate into defensive / high quality, etc. I am sympathetic to the argument and agree with it in theory.

Actually, when you examine every great value manager’s track record, they all broke away from their benchmark and began to outperform at the same moment – when they avoided the Nasdaq bubble and burst at the turn of the century. I could show you a hundred charts of this. In theory, they should be able to do this regularly and continue to outperform.

The trouble is, what works in theory doesn’t always become manifest in real life.

The SPIVA Scorecard that came out yesterday from S&P Dow Jones Indices is an absolutely devastating blow to this “full cycle” argument. For the first time ever, the study looked at 15-year track records for active managers vs their benchmarks, which would more than accommodate the request for a full cycle look (boom, bust, boom). The results are very not good.

Here’s Daisy Maxey and Chris Dieterich at WSJ:

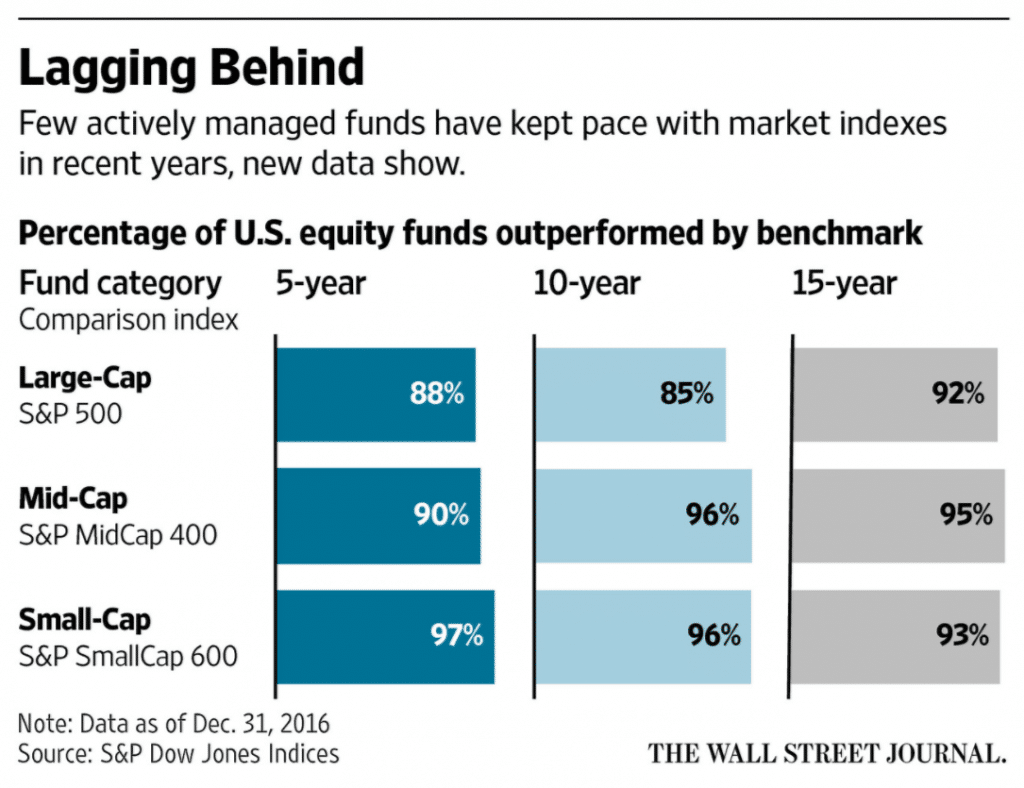

Over the 15 years ended in December 2016, 82% of all U.S. funds trailed their respective benchmarks, according to the latest S&P Indices Versus Active funds scorecard. This was the first year that the analysis included 15 years of data, helping smooth out periods of volatility that can affect the performance of active managers.

Among more than a dozen categories tracked, 95.4% of U.S. mid-cap funds, 93.2% of U.S. small-cap funds and 92.2% of U.S. large-cap funds trailed their respective benchmarks, according to the data. The performance analysis, known as Spiva, is published semiannually by S&P Global using a methodology that includes funds that have been liquidated or merged out of existence.

And here’s my chart o’ the day:

Now let’s talk about the 8% of active managers who did, in fact, beat their benchmark over the full 15 year term. The SPIVA Scorecard looks at something called “persistence” – basically, whether or not a winning fund keeps winning. The probability of a top quartile fund in a given period remaining on top of the next given period is not high. And the probability of finding the fund that can do it – in advance – is also not high.

This is the type of data and information that has not been as widespread and available to previous generations of investors. I’ve remarked that the internet is disrupting mediocre asset management and making it extinct. This is yet another example.

See Mediocre Asset Management is No Longer an Actual Business or Bad Active Management Can’t Survive the Internet for more on the topic.

Now imagine you’re a financial advisor. How can you possibly, without any evidence, represent to a client that you have the ability to pick the flesh and blood human active manager who will be in the 8% over the next 15 years? I mean, you could try. You could do a whole song and dance about how you vet managers and do your due diligence and “focus on quality” and make sure that your managers are “sticking to their knitting” and blah blah blah. But can anyone actually do this?

The other thing you could do, if you were so inclined, would be to say “We have no idea if this collection of actively managed funds we’ve assembled for you will be able to, in the aggregate, beat a blended benchmark, but we’re comfortable with their investment approach regardless and think they’ve got a good chance of doing well for you after fees and taxes.”

It’s a nice statement, but it is definitely asking the client to take a leap of faith in your ability to not only predict asset class returns, but also predict the behavior of the people you’re hiring as they predict asset classes. Can you rely on good managers to stay good? Can you rely on fund companies to continue to support them in their attempts? Can you rely on them to stay put and not leave for other opportunities at other fund companies? Can you know if they will suddenly develop a drinking problem or go through a horrific divorce or wake up one day without the magic touch that got them there?

Too many if’s.

Which is why you see more and more advisors opting for the benchmarks themselves – jockey-less horses. It’s not just an issue of cost, it is also an issue of our ability to set reasonable expectations for our end-clients. Rules-based strategies are not guaranteed to work any better than faith-based strategies, like active stock-picking by a committee of Wharton MBAs. But when they don’t do well, there is, at least, a ready explanation for why – “Sorry, value and quality factors were out of favor this year.”

Lastly, one point I’ve been making in the talks I give around the industry – a major difference between the Boomers and their millennial adult sons and daughters is that the former generation was always willing to accept the judgment and wisdom of experts and hand over their money based on having confidence in a person or a brand; “It’s Merrill Lynch, they must know what they’re doing.” or “It’s Peter Lynch, do you know how many f***ing books he’s written?” The new generation wants proof. “Show us how this approach is going to work for us. What is the data. Show us the receipts.”

This generation doesn’t accept the first answer that sounds good, they actually Google things they want the answer to. Saying “Don’t worry, I got this.” is not a great way to propose asset management solutions to them. “Look at my suit. It has many pinstripes, each as thick and white as a line of the purest cocaine.”

The SPIVA Scorecard continues to represent one of the most insurmountable hurdles for the active management community to overcome. The numbers are the numbers, as much as we all might wish they weren’t.

Source:

Indexes Beat Stock Pickers Even Over 15 Years (Wall Street Journal)

[…] No, active managers don’t beat the market ‘over the cycle’ – Reformed Broker […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/04/13/you-need-to-judge-us-over-a-full-cycle/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2017/04/13/you-need-to-judge-us-over-a-full-cycle/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2017/04/13/you-need-to-judge-us-over-a-full-cycle/ […]

… [Trackback]

[…] There you can find 16768 more Info to that Topic: thereformedbroker.com/2017/04/13/you-need-to-judge-us-over-a-full-cycle/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2017/04/13/you-need-to-judge-us-over-a-full-cycle/ […]