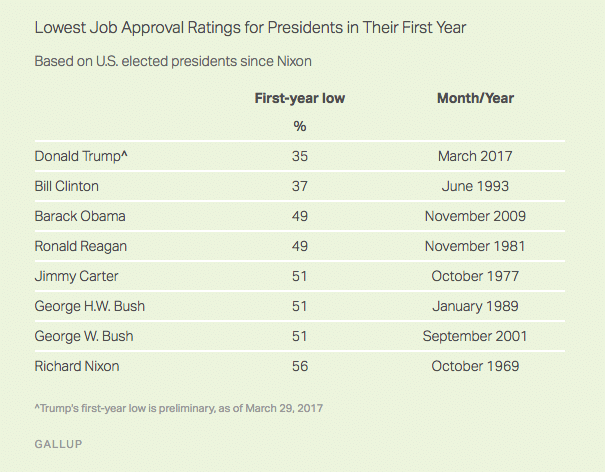

Donald Trump has a 35% approval rating among all American voters, according to the latest national poll. This is a record for how fast a US president has gotten this low – many presidents of the modern era had never gotten down here. Others only reached these levels when deep into an economic slump or a military quagmire.

And none have ever seen 35% inside of their first year, although Clinton came close.

Gallup:

Trump has unemployment below 5% thanks to the Federal Reserve’s stimulatory efforts of the last decade and the healing power of time elapsing since the Great Financial Crisis. He has no major foreign conflict currently taking place in which large numbers of casualties are covering the newspapers each day, a la Iraq, Afghanistan or Vietnam. It would be hard for him to blame the environment in which he took charge of the country.

Unlike the majority of the buildings that still bear his name, Trump wholly owns his own unpopularity.

You can point to the malevolent ugliness with which he’s carried himself in meetings with foreign leaders or on the internet. You can point to the sheer incompetence with which he’s staffed federal agencies and the White House – hiring the most unfit (DeVos), the most potentially compromised (Flynn) and the most shamelessly destructive figures (Pruitt) for almost every available slot. You can point to the Banana Republic-esque business conflicts and nepotism that pervade every aspect of his administration. You can point to his inability to sell legislative ideas even within his own party, which now controls both houses of Congress and is inexplicably incapable of passing policy. Finally, you can point to his almost wholesale betrayal of the people he convinced to take a shot on him, whether through loading his staff up with Goldman people or his effort to strip the suffering underclasses of their healthcare with nothing to replace it.

Sentiment, for any or all of these reasons, is in the gutter.

An interesting question becomes, “Is it time to buy?” Can things only improve from here?

If you were a value investor and the Trump Presidency were a thing you could invest in, betting on better “valuations” in the years to come, is this where you’d pull the trigger and buy?

The LA Times is out with an op-ed this morning in which they make the case that the damage both to Trump’s presidency and perhaps the country is already irreparable. It’s the most dire take on a subject about which no shortage of dire things have been written. It’s the kind of thing that reads so derisively that I almost want to go the other way.

Read it here and then think about whether or not they’ve gone too far in their view:

It was no secret during the campaign that Donald Trump was a narcissist and a demagogue who used fear and dishonesty to appeal to the worst in American voters. The Times called him unprepared and unsuited for the job he was seeking, and said his election would be a “catastrophe.”

Still, nothing prepared us for the magnitude of this train wreck. Like millions of other Americans, we clung to a slim hope that the new president would turn out to be all noise and bluster, or that the people around him in the White House would act as a check on his worst instincts, or that he would be sobered and transformed by the awesome responsibilities of office.

Instead, seventy-some days in — and with about 1,400 to go before his term is completed — it is increasingly clear that those hopes were misplaced.

Keep reading:

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2017/04/02/would-a-value-investor-buy-trumps-presidency-here/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2017/04/02/would-a-value-investor-buy-trumps-presidency-here/ […]

… [Trackback]

[…] Here you can find 50543 additional Info on that Topic: thereformedbroker.com/2017/04/02/would-a-value-investor-buy-trumps-presidency-here/ […]

… [Trackback]

[…] Here you will find 38860 more Information to that Topic: thereformedbroker.com/2017/04/02/would-a-value-investor-buy-trumps-presidency-here/ […]