Everyone is a closet technician. Everyone. And in a panic or a market correction, this truism is even more, um, truistic.

First, what is a technician? Here’s my own handy definition, I think you’ll like it: A technician is someone who cuts right to the chase and studies actual prices and behavior instead of puzzling over the causes of prices and behavior like everyone else.

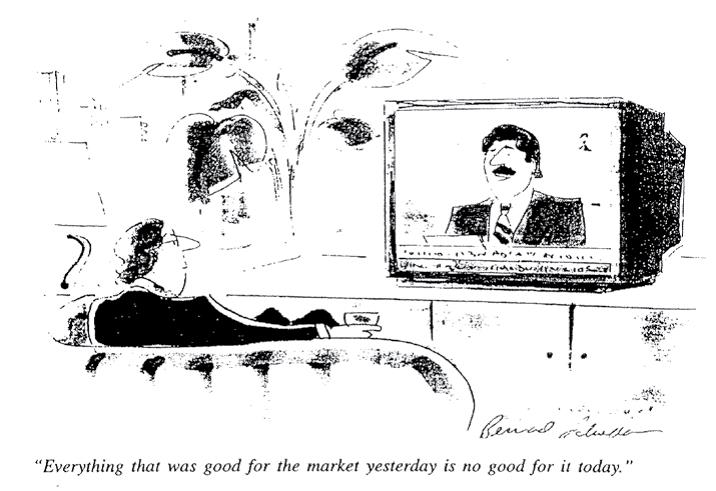

Discussing causes is a much more interesting conversation and it gets you on all the talk shows. Discussing price – the sum total of all investor fear and greed, both historical and real-time – tells you the truth about what’s actually going on, it does not offer an opinion.

Besides, price dictates what the news is, not the other way around. Consider:

When the value of Yahoo common stock was rising after Marissa Mayer first joined, she was hailed as the second coming of Lou Gerstner or Steve Jobs. Then, when it stopped, she became a punching bag whose business initiatives and party-throwing receipts were dissected in the tech press each week.

If the S&P had rallied throughout 2015 instead of flatlined, we would have thrown a parade for plunging oil prices, not freaking out over them.

When Apple shares trade higher over the course of a given quarter, it is the highest quality stock in the world with a vast opportunity ahead to take on automobiles, TV, virtual reality and the Internet Of Things. When Apple falls over the course of a quarter, Apple is a Too Big To Sail rotting old galleon, with a caretaker captain who can’t turn it and a crew who can’t innovate in time to save the ship from capsizing.

When Apple shares trade higher over the course of a given quarter, it is the highest quality stock in the world with a vast opportunity ahead to take on automobiles, TV, virtual reality and the Internet Of Things. When Apple falls over the course of a quarter, Apple is a Too Big To Sail rotting old galleon, with a caretaker captain who can’t turn it and a crew who can’t innovate in time to save the ship from capsizing.

When a social media startup prices a financing round at a higher level than the previous one, it is heralded as The Next Big Thing, a disruptor on its way to riches and glory. If that same startup does a down-round, it’s already dead; all that’s left to happen is the exodus of the talent and the selling off of the servers.

Price creates the reality for investors, because investors take their behavioral cues from price and the media fashions its headlines from it.

Technicians believe that there is wisdom in price. That price has memory. That people who were inclined to buy at a certain price are somewhat likely to buy there again. Unless something’s changed, in which case their failure to re-buy (or buy more) at that formerly significant price level can be interpreted in an entirely new way – what was once an area of support on a chart becomes an area of resistance.

Technicians believe that trends persist, in both directions, because market participants act on “news” at different speeds and act more boldly (or fearfully) the longer a particular movement in the markets goes on. This is why bull markets often end with a buying crescendo in the riskiest securities. Risk appetites grow as an uptrend persists, the desperation to participate gets stronger, it does not fade gently.

This is also why selling becomes more fierce when the market is at a 20% discount to its previous high than when it is at a 10% discount. “How could it be even more urgent to sell down 20% than it is down 10%?” someone would ask. Going by fundamentals, it isn’t. But investors only pay lip service to fundamentals. What they are more concerned with is owning less of the thing that looks stupid to own – and the lower it goes, the stupider it looks.

Unless you buy into the idea that rational behavior rules the investment markets. In which case, you’re reading the wrong writer ?

Technicians find truth in price, rather than attempting to parse the impossibly conflicted and intentionally obscured opinions of the commentariat. Technicians find meaning in the actual buying and selling activity happening today, not in the dusty old 10Q’s of 90 days ago or in the projected estimates being bandied about among the discounted cash-flow analysis crowd on the sell-side.

But above all, technicians respect the power of sentiment more than their fundamentalist counterparts. And sentiment, after all, is how valuations actually come to be – the P in the PE Ratio or the PEG Ratio or the P/B calculation. In the real equation, the only one that counts, the P is what pays, not the E, not the EG and certainly not the B. Buffett would tell you the B (book value) is what pays over time (the market going from a voting machine to a weighing machine). But Buffett can afford to ride it out, having permanent capital under management and an ocean of insurance premiums sloshing in over the transom every hour of the day. Most market players do not.

What I am not saying is that price is truth.

Price lies all the time. Facebook can be valued at $40 billion and then $20 billion and then $200 billion inside of a four-year period of time. Which of these prices is the truth? None of them. But all of them were momentarily true, until they were rendered a lie, and a new truth was forged in the fires of the marketplace. Sunrise, sunset. Prices change and, with them, the truth itself.

Everyone knows this, but many have not come to terms with it yet. Or it would hurt their career to admit that buyers and sellers will pretty much lead the way and our opinions will closely follow behind.

This is how you get a chief investment strategist whose year-end price target is raised and lowered throughout the course of the year as the stock market rises and falls. The strategist starts out with a view, and then tailors her view to match the reality being generated by price. Or fails to do so and is eventually fired.

Have a look at the commentary surrounding oil. It falls from 80 to 70, and Wall Street’s seers say 65 is possible. It falls to 60 and then the downside target is lowered to 40. Over the last 30 days, we’ve seen Goldman Sachs and Morgan Stanley take their oil price targets down to 30 and 20 respectively, just as its price was slicing through the 30’s on its way to the 20’s.

If it continues to fall, you will hear calls for oil priced in the teens! If it stabilizes and trades higher, you will see targets lifted. I ask you – which is the truth, then? Price itself or the commentary around why price should be at this level or that?

When analysts and strategists adjust their views, they couch their targets in the language of fundamental developments, potential events and the news of the moment. But in truth, what they are really doing is extrapolating what’s happening today into the fog of tomorrow. Another way of saying extrapolation is to say that they are betting on a continuation or a reversal of trend. Trend is a technical concept, hence, they are dressing up technical calls in the wardrobe of fundamentals, and speaking in the language of the high priests of finance: profits, revenues, cash flows, capacity, demand, market share.

In the midst of the October 2014 correction, I said that the fundamentally inclined start looking at charts and “levels” when uncertainty strikes.

Fundamentalists will believe in technical analysis. But only temporarily. You’ll hear people who analyze balance sheets and income statements start to use the term “oversold” not understanding that they’re accidentally referring to RSI data, something you couldn’t pay them to pay attention to during a market uptrend. There are no atheists in a foxhole and there are no pure fundamentals guys in a correction. Believe me, they’re all looking at the charts. Even Bruce Berkowitz.

It happens each time and it is always hilarious. They’ll deny it: “The market is wrong” or “these are mispriced securities.”

The technician is one step ahead: “The market is not wrong, it has a current set of collective beliefs that are subject to change. Price will tell us when there is a likelihood that this change is at hand.”

Let’s get back to the “Why?” question and the fact that technicians don’t waste their time with it.

There’s a cognitive foible common to human beings known as the Hindsight Bias. As investors, there’s nothing we like to do more than looking back at an event that’s just taken place and reciting the reasons for what caused it as though they were obvious to us in advance. “I knew it all along! It wasChina, Greece, the Fed, that magazine cover, Obama, the rate hike.”

The hindsight bias is a strong tendency in humans because it helped our ancestors survive on the Savannah – telling stories of cause and effect to the next generation so no one gets themselves killed trying to harvest a wasps’ nest full of honey or having intercourse with a saber-toothed tiger. Early humans who did not carry the trait to tell these stories did not pass their genes on, they were stung to death or had their genitals ripped off.

We, on the other hand, did have ancestors who concerned themselves with explaining recent events. They survived and passed these tendencies down to us. And after a million years of bee stings and foiled tiger rape, we carry on the same tradition.

But it’s all made up.

No one knows why a million market participants thought one thing on a Monday and something completely different on the following Thursday. The fundamentalists will share their explanations and guesses with anyone willing to listen. The technicians will take these reasons in stride and focus on what is happening, not why. The why will always be much more apparent after the fact, after it no longer matters. We still don’t have the agreed-upon why nailed down for the Crash of ’29, the Crash of ’87 or even the Great Financial Crisis of a decade ago. We have theories and arguments and half-truths and politically-charged polemics.

But price did its thing regardless.

It always will.

Your favorite fundamentalist is adjusting his insights accordingly.

***

This post originally appeared here on January 18th, 2016.

[…] ‘Everyone Is A Closet Technician’ – Josh Brown – The Reformed Broker […]

[…] Josh Brown: Everyone Is A Closet Technician […]

[…] Josh Brown: Everyone Is A Closet Technician […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]

… [Trackback]

[…] Here you can find 24550 additional Info to that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]

… [Trackback]

[…] There you can find 91768 more Info to that Topic: thereformedbroker.com/2016/08/30/everyone-is-a-closet-technician-2/ […]