Car dealership. You are being persuaded to buy a Ford from a Ford dealer. You ask him if he drives a Ford. “Hell no. I drive a Chevy,” he tells you.

Restaurant. You go back into the kitchen and ask the chef if he eats his own dishes. “Never,” he replies, slamming shut the top of a trash can filled with fast food wrappers from the burger joint down the street.

These little vignettes are inconceivable. Imagine a homebuilder who wouldn’t raise his family under a roof that he himself had raised. A fitness instructor who doesn’t do his own workouts. A nutritionist who swears by someone else’s diet plan rather than the one she recommends to her clientele.

Outrageous.

But in the asset management industry, it’s becoming de rigeur. The fund complex knows it’s full of shit and that the product fails more often than it works, after taxes and fees. The employees of these firms are fighting back when they are forced to use the very products they make and sell for the investor community. They’re furious for having been forced to eat their own cooking.

Take a moment and think about how astonishing this is.

Here’s Investment News on the latest example of the fund business rejecting its own offspring:

Employees of American Century Companies, Inc., parent of asset management firm American Century Investments, have sued over the firm’s 401(k) plan…

Since 2010, fiduciaries of the $600 million American Century Retirement Plan populated the plan’s investment menu solely with American Century funds, using a selection process “tainted by self-interest” rather than a prudent one that would have led fiduciaries to use less-expensive funds with similar or better performance, the complaint said.

“Defendants have used the Plan as an opportunity to promote American Century’s mutual fund business and maximize profits at the expense of the Plan and its participants,” the plaintiffs said in the complaint, claiming the firm earned millions of dollars in fees by retaining proprietary investments.

In other words, it’s fine for brokers across the country to sell these underperforming, overly expensive A-share vehicles to regular people – strangers – but not for us to own in our own retirement accounts.

Got it.

If it were the case that the American Century portfolio of products were too narrow to meet the employees’ needs, I could see the merit here. But it’s simply not the case. I count over 100 funds in virtually every category here on this list. There’s no conceivable way you could make the case that between strategies, sectors and life cycles, every employee couldn’t diversify and invest appropriately.

What’s really going on is that the industry knows basic math. They know that what you don’t spend on an active stock or bond manager is more money that stays in your account, compounding. They wake up every morning and shadowbox with this reality for a living. The job is a farce, at times, especially for the marketers and wholesalers who have to pretend the sky is yellow and the sun is blue.

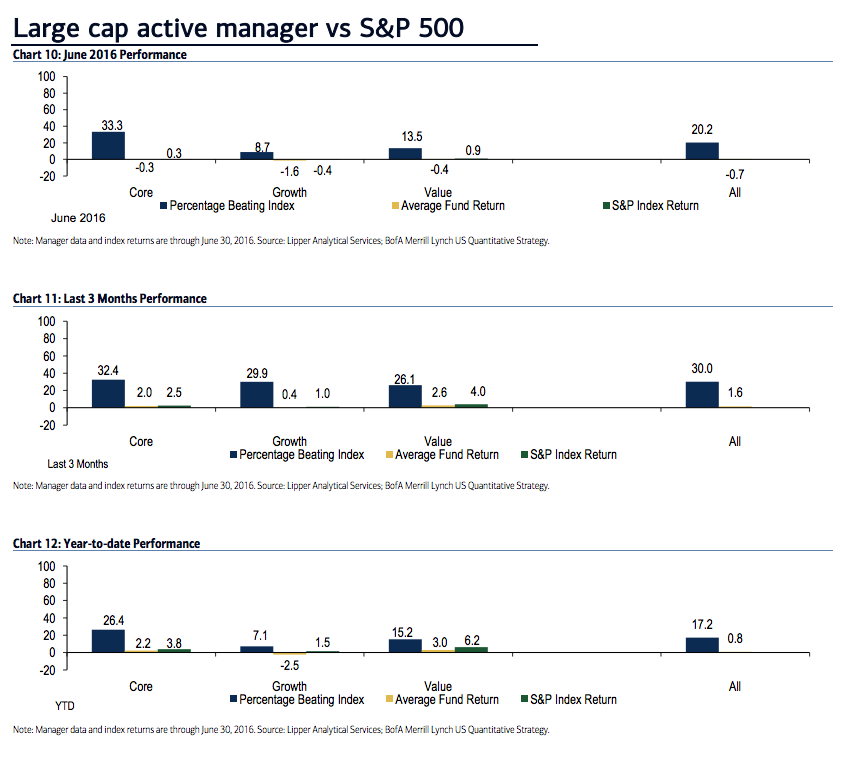

The latest data from Bank of America Merrill Lynch on fund performance offers a glimpse into why there is this aversion coming from inside the firms themselves. The products tend not to work in large numbers, or with any consistency, despite the industry’s best intentions and most valiant efforts. Here’s what large cap funds are doing against the S&P 500 over 1-month, 3-month and 12-month time frames (click to embiggen!):

Just 15% of large cap value and 7% of large cap growth funds are beating the index over the last year. Might as well be zero. And this doesn’t even get into the tax ramifications, ongoing trailing costs and the non-persistence / unpredictability of returns. No wonder the workers are revolting.

I can relate. As a retail broker, I spent over a decade providing an unnecessary service to clients. It took the 2008 crisis to figure it out, and then another two years to extricate myself from the job. I sympathize. I know what it’s like to be in this position. Upton Sinclair said “It is difficult to get a man to understand something, when his salary depends upon his not understanding it!” Charlie Munger says that incentives explain just about everything, and the older he gets, the more he realizes how absolute this truth is.

So I get it. It’s the gig.

But then to take it another step and actually sue your company for making you invest in the product you make and sell? That’s chutzpah.

It’s not limited to this one fund company, by the way. It’s happened with Ameriprise, Putnam, Fidelity and Pimco. The settlements from these suits have ranged from $3 million to almost $30 million in the prior cases. Which begs the question, “How can you recommend that others use your funds to save for retirement when you yourself have sued to get out of having to use them?”

You can’t answer it without contorting your soul into a pretzel. Without acknowledging the existential threat to your firm’s business implicit in the dispute. “How dare you make us eat our own cooking when there are better options available?” Maybe it’s time to change your recipe then, or stop cooking altogether.

At my wealth management firm, all employees’ 401(k) accounts are invested in the same portfolios we recommend to clients. Our family members own the same portfolios as new clients who’ve come to us in just the last week. We believe our portfolios work, and our own defined contribution money goes directly into them. It’s a point of pride for us that we mean what we say and we practice what we preach. There is no Plan B. There’s no VIP room. If you’re investing with us, you get what we believe in and what we ourselves do with our own money.

I know some people aren’t as fortunate – to have such seamless accord between the service they sell and the belief system they personally hold. Believe me, I don’t take it for granted. Stories like this are a helpful affirmation, even though I feel sorry for those at the center of them. Not everyone can walk the walk and still earn a paycheck.

[…] Josh Brown: How Dare You Make Us Eat Our Own Cooking! […]

[…] How dare you make us eat our own cooking (Reformed Broker) […]

[…] of this blog – incentives explain everything. For gods sake I wrote about it yesterday! And a month ago! If you tie people’s pay or employment to a given outcome, you’re going to get more of […]

[…] In other words, How Dare You Make Us Eat Our Own Cooking? […]

[…] stories from the past week illustrate the fee pressure on the industry. First Josh Brown covers the story of a mutual fund company being sued by its own employees because their funds used […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]

… [Trackback]

[…] There you will find 77851 additional Information on that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]

… [Trackback]

[…] Here you will find 9321 more Info to that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]

… [Trackback]

[…] Here you will find 8751 additional Info to that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/07/06/how-dare-you-make-us-eat-our-own-cooking/ […]