“It’s easy to maintain conviction. It’s harder to maintain investors.”

– Kyle Bass, Hayman Capital

If you can’t communicate effectively with your investors, or they don’t trust you, it doesn’t matter how good your strategy is.

The data is crystal clear on this point – the vast majority of even winning funds look much worse when viewed through the prism of actual dollar-weighted returns and people tend to underperform their own investments. This is referred to as the Behavior Gap and it’s partially driven by a communication weakness on the part of asset managers.

Investors get involved with investment strategies or funds without being given the information they need to form conviction. Every strategy will eventually go through a period of time in which it is out of favor and “doesn’t work.” Having this information up front aids in the formation of client conviction. And conviction is critical if an investor is going to ride these periods out. Without conviction, the strategy will be abandoned just before the most important moment – the turn!

Do you know why some of the most well-known hedge fund managers have launched insurance subsidiaries over the past few years? Permanent capital and access to positive, nearly constant inflows.

They look at Warren Buffett’s ability to be temporarily very wrong and susceptible to big market swings, without facing redemptions, and they salivate at the prospect of a capital base like that. Besides, gating redemptions or enforcing lockups is passé and unpalatable in the post-crisis environment.

Berkshire Hathaway’s “float” – the inbound insurance and reinsurance premiums that provide the firm’s investment capital base – mean that Buffett never has to explain himself to investors who get freaked out by short-term performance. Buffett understands that there are no gains to be had if one is investing with a primary goal of limiting drawdowns. But most investors don’t. Or, they’re middle men and they don’t have the ability to weather these inevitable storms. “I have clients to answer to!”

In the summer of 1998, there was a short, sharp bear market that brought the S&P 500 down by 25% at its lowest point. Warren Buffett’s personal holdings in Berkshire Hathaway had declined by a whopping $6.2 billion between mid-July and the end of August. His own stake! But how much did he lose?

Not a penny.

No one was calling him for their money back or screaming at him for being an idiot, because he wasn’t running a fund or managing accounts. He had shareholders, who were free to come and go, but no clients per se. The markets recovered, as did Berkshire stock, and Buffett hadn’t sold a single share. Nor did he do any other foolish thing to jeopardize future returns during the course of the panic.

Now, the majority of money managers are not quite in this position. Most of us answer to consultants, allocators, pension administrators, board trustees, family officers, retail investors, etc. And the most critical thing in the world is to be prepared, in advance, for these moments. The people you are investing for can never be fully insulated from drawdowns and vol. If they are, they’ll never make anything on the upside. Every hedge costs something, someday, and fully-hedged means fully exempt from future prosperity.

If you cannot completely insulate a client from the risk of drawdowns and periodic bouts of underperformance, the next best thing is to be very clear about the potential for drawdowns and underperformance. An exposition, before a single dollar is allocated, about what kinds of market environments would typically lend themselves to “good” vs “bad” outcomes goes a long way. Ongoing education, reiterating this exposition, is not optional; it’s a must. “Look, I know you’ve heard this from us before but it bears repeating while things are going well…”

You can be lazy about client communication as the gains roll in, but both you and your clients are going to pay the price eventually when their conviction is shaken.

***

While Buffett is in Omaha contending with the collapsing global stock market in the summer of ’98, a group of young University of Chicago PhD’s and Goldman Sachs alums are launching a quant strategy that is plagued by the same problem as all other quant strategies: It may work a lot of the time but it can’t work all the time.

Cliff Asness tells the story of his firm AQR, and quite possibly the worst-timed fund launch ever – he is shorting the Nasdaq dot com darlings ahead of the biggest stock bubble in history and going long the value names that everyone is throwing away…

As fate would have it, we launched our first AQR fund in August 1998. You may remember that as an uneventful little month containing the Russian debt crisis, a huge stock market drop and the beginning of the rapid end of hedge fund firm Long-Term Capital Management. It turned out that those really weren’t problems for us (that month we did fine; we truly were fully hedged long-short, which saved our bacon), but when this scary episode was over, the tech bubble began to inflate.

We were long cheap stocks and short expensive stocks, right in front of the worst period for value strategies since the Great Depression. Imagine a brand-new business getting that kind of result right from the get-go. Not long cheap stocks alone, which simply languished, but long cheap and short expensive! We remember a lot of long-only value managers whining at the time that they weren’t making money while all the crazy stocks soared. They didn’t know how easy they had it. At the nadir of our performance, a typical comment from our clients after hearing our case was something along the lines of “I hear what you guys are saying, and I agree: These prices seem crazy. But you guys have to understand, I report to a board, and if this keeps going on, it doesn’t matter what I think, I’m going to have to fire you.”

It is hard to fathom the mental toughness required of a money manager in the face of such a bald-faced repudiation of his strategy by the market gods. Now imagine how difficult it would be for a client of AQR’s to stick it out! Imagine the level of conviction necessary to not only lose so quickly but to do so at a time when every idiot around you is seemingly getting richer by the hour. It’s enough to drive a sane person crazy.

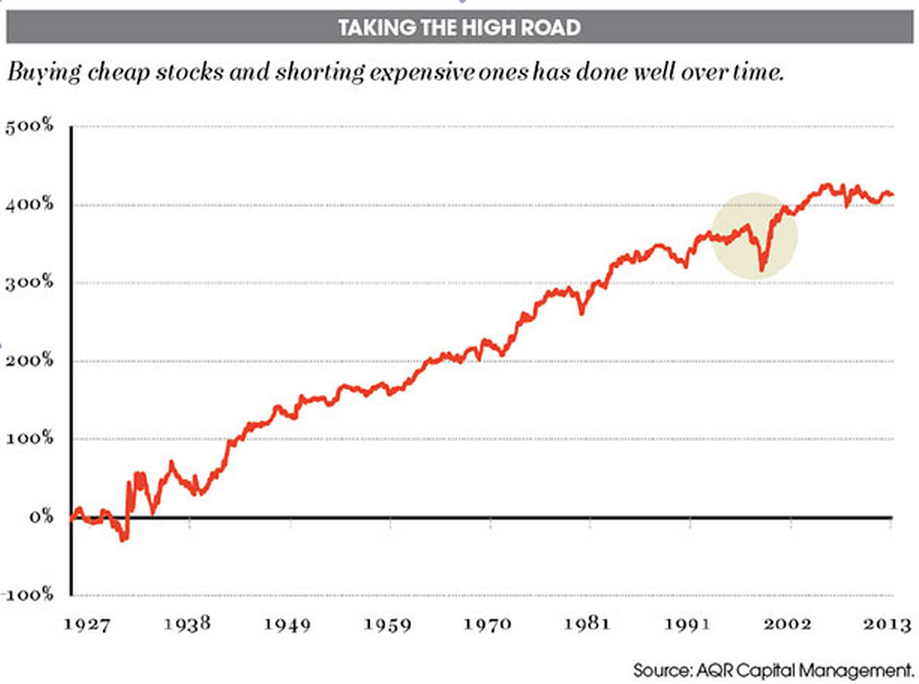

The Nasdaq would explode from around 1500 that summer to its peak of over 5000 in the spring of 2000. Cliff’s “high minus low” or HML strategy of betting on cheap stocks and against egregiously valued stocks would eventually pay off nicely for those with the conviction to hold on. It would go on to continue to perform, much as it had throughout history, regardless of this two year blip during which it looked like it would never work again:

I don’t know how much money fled these sorts of relative value strategies at the time, but I’m fairly certain it was quite a bit. This cycle plays out in every market era.

Dimensional Fund Advisors bases its mutual fund strategies on some of the same academic work that Cliff Asness mined for his hedge fund.

DFA founder David Booth was just given a Manager Lifetime Achievement award from II this month. His entire business – $400 billion in assets across dozens of funds – is built on client conviction. Two layers of it, in fact. Advisors have exclusive access to DFA products and must have the conviction to keep their end-clients resolute in order for the benefits of the strategies to show up.

David tells the magazine that this fostering of client conviction what he is most proud of:

Booth is most proud of his firm’s ability to keep clients invested during hard times. When investors withdrew $500 billion from U.S. equity funds during the crisis of 2009-’09, Dimensional had positive flows. “It wasn’t because returns were better; we actually lost more than the market,” Booth says. “But clients trusted us.”

Trust forges conviction. It comes from communication. Understanding the underlying drivers of one’s investment portfolio and why it’s ultimately going to work, regardless of what happens in the short-term, is the key. If you’re not working your ass off on client communication, the conviction is not going to be there – just when it’s needed most.

[…] Josh Brown: Client Conviction is Everything […]

[…] Client conviction is everything (Reformed Broker) […]

[…] colleague Josh Brown notes that accountants tell taxpayers what they can or can’t deduct; lawyers make decisions on […]

[…] The difference between a player’s stats and the ones a fantasy team actually benefits from remind me of what many in the investment world call the “behavior gap“. This refers to total returns on investments compared to returns investors actually realize from those investments. Put another way, investment returns vs. investor returns. Josh Brown summed it up pretty well: […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] There you will find 87459 more Info to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]

… [Trackback]

[…] Here you can find 55291 additional Information to that Topic: thereformedbroker.com/2016/05/24/client-conviction-is-everything/ […]