Investors (and their squires in the financial media) have been repeating the same old fears to each other for decades. It’s incredible how long these concerns have been with us, in an almost unchanged format.

To wit, investors have been talking about the following issues and worries since before I was born:

- This generation will be the first to not see an improvement in their standards of living

- Buybacks are just juicing the returns of wealthy people while denying capital to the economy

- Earnings are being manipulated and obfuscating the true profitability of public companies

- The Fed is trapped / boxed in / out of ammo

- The economic recovery is too sluggish

- Margin debt is exploding

- China is on the verge of collapse

Yes, these are all legitimate issues. But they have always been legitimate issues, through thousands and thousands of Dow Jones points to the upside.

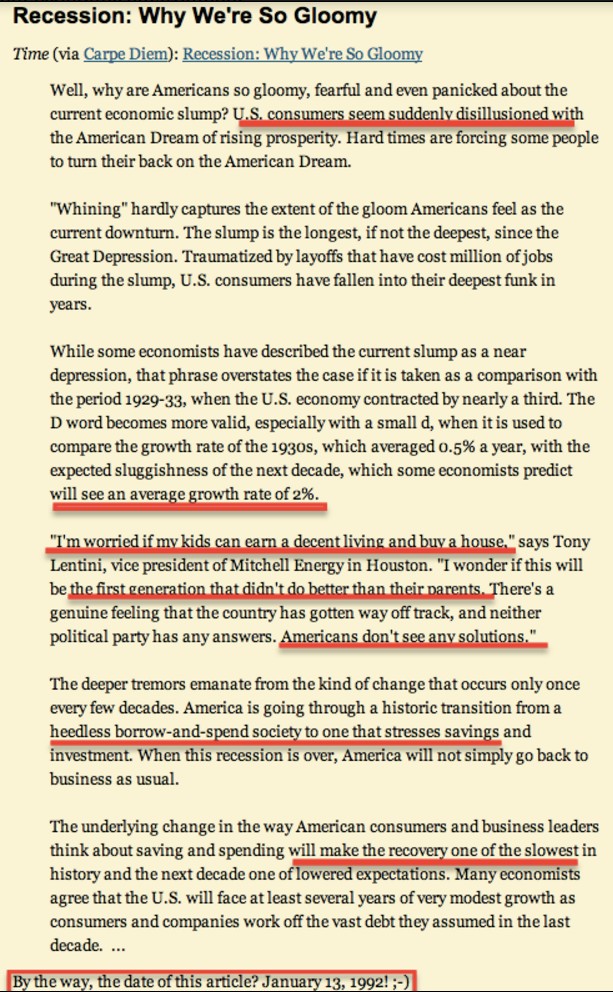

Urban Carmel at the Fat Pitch blog has collected the proof that these same stories have made the rounds on Wall Street since at least the early 1980’s. For instance, the below was written in 1992! You could reprint it today almost unchanged and no one would know the difference:

You should head over to see the rest of the clips he’s assembled. It’s really an incredible reminder that there will always be grounds for concern, no matter when you’re investing – and that the same old fears never really go away.

Source:

Current Investor Concerns (The Fat Pitch)

Okay fine, here it is:

… [Trackback]

[…] There you can find 17580 additional Info to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]

… [Trackback]

[…] There you can find 41386 more Info on that Topic: thereformedbroker.com/2016/03/22/same-old-fears/ […]