Two years ago, I stayed at the historic Hotel Adlon in Berlin. I was told, upon check-in, that the hotel was known internationally as the place where Michael Jackson had dangled his baby over the front balcony, to the horror of spectators below. But something even more notable once took place at Adlon, one hundred years ago – the door was finally opened for a central bank in America.

I just finished Roger Lowenstein’s latest book, America’s Bank: The Epic Struggle to Create the Federal Reserve. It’s really good and should be read by anyone with an interest in American history and the state of the modern markets.

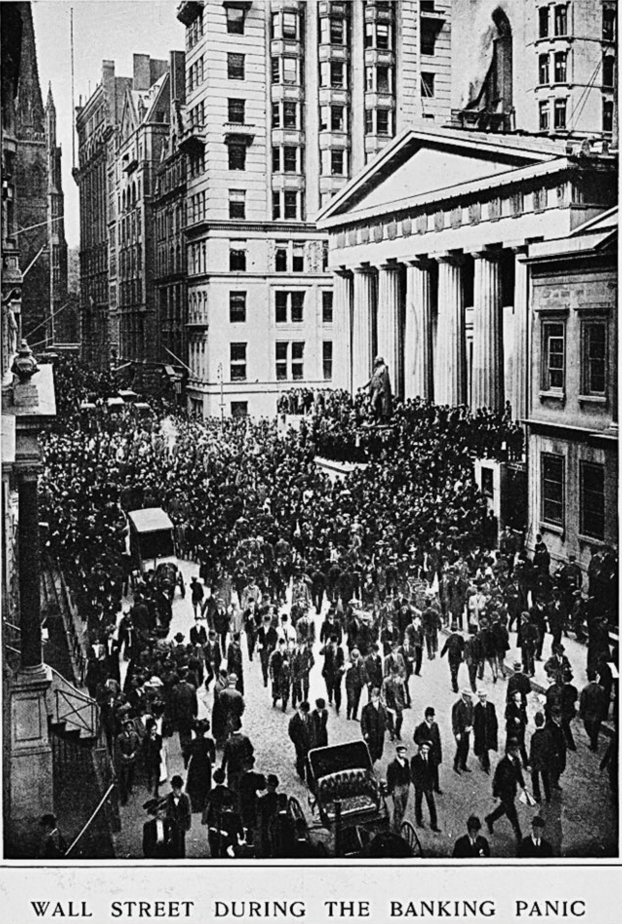

The Panic of 1907 was a game-changer for the way bankers and politicians thought about the role of money in America. J. Pierpont Morgan stepped in to head off a crisis that could very well have led to a massive depression – mostly because he was the only person alive who could have done so. In the time of Morgan, the national banking system was an absolute trainwreck – primitive, unwieldy and useless in a crisis. Some would even say it was the cause of most crises given its decentralized nature, susceptibility to agricultural issues and the vicissitudes of gold mining.

The way banking worked at the turn of the last century was like this:

* Small town banks would hold gold reserves in order to fund the agrarian activity that constituted the bulk of America’s economy. In winter, the banks would ship their gold reserves to New York so that investment banks could speculate with it and earn a return for them.

* In planting and harvest season, the regional banks would recall their reserves from New York in order to make loans to farmers or bring in the crop.

* This sucking back and forth of reserves meant volatility for stock and bond markets, as well as constant uncertainty that credit would be available when it was needed.

* It set off constant bank runs and market panics that were entirely unnecessary.

Now keep in mind, this is happening in an age before there was a government currency in circulation – money was actually just credit issued in the form of bank notes by private banks. This is also during a time before there was a such thing as national mortgage lending and before there was even an income tax or the IRS. We were really just a step above a third-world barter economy. Even the bank note system itself was rife with fraud and scandal – you really couldn’t trust anything except reserves backed by gold, and gold was cumbersome to move back and forth.

Back to the Hotel Adlon – US Republican Senator Nelson Aldrich, once a staunch critic of anything that threatened the banking status quo, sat beneath the stairs in the hotel’s lobby being educated on the way Europeans stabilized their economies. Having toured the continent in search of knowledge, Aldrich went from bitter foe to staunch advocate for banking reform. This set into motion a chain of events that would culminate in the Federal Reserve Act a few difficult years later.

Aldrich’s conversion, instigated by German emigré Paul Warburg and a small cadre of scholars and bankers, would lead to a clandestine week spent at the Jekyll Island hunting lodge where the framework for the Fed was first laid out. This in turn would spark a whirlwind of warring proposals from Democrats, Progressives, Republicans, Bankers, Professors, Farmers, Senators and Congressmen as all of the interested parties clamored for influence in the overhaul of American finance.

Woodrow Wilson and his Treasury Secretary (turned son-in-law) Benjamin McAdoo would eventually win out with a bill that resolved thousands of conflicts, but it certainly wasn’t easy.

Lowenstein’s book tells the story of how it came to be that a Democratic president – representing the party of Jacksonian anti-bank rhetoric and the anti-Wall Street populism of William Jennings Bryan – would ram the bill through against incredible odds. The creation of the Fed in 1914 could not have happened at a more opportune moment. Within months of its launch, America’s new banking and government bond system would face its first real test – the financing of our entrance into World War I. Without the Fed in place to create and direct capital efficiently and swiftly, the outcome of the war may have been quite different.

America’s Bank is a great read, rich with historical detail along with a wealth of fascinating characters who propel the narrative forward.

Follow the link below to get your copy now:

America’s Bank: The Epic Struggle to Create the Federal Reserve (Amazon)

… [Trackback]

[…] Here you will find 58762 additional Info to that Topic: thereformedbroker.com/2016/01/29/book-review-americas-bank/ […]

cialis sale 20mg

Health