In my opinion, the very worst place you can be in the financial services industry right now is on the product side. Investors (and their intermediaries) show absolutely no sign that they are willing to pay up for these products again, as they did before the financial crisis.

Andrew Bary’s column in Barron’s this weekend is must-read for the industry, even though I completely disagree with his conclusions.

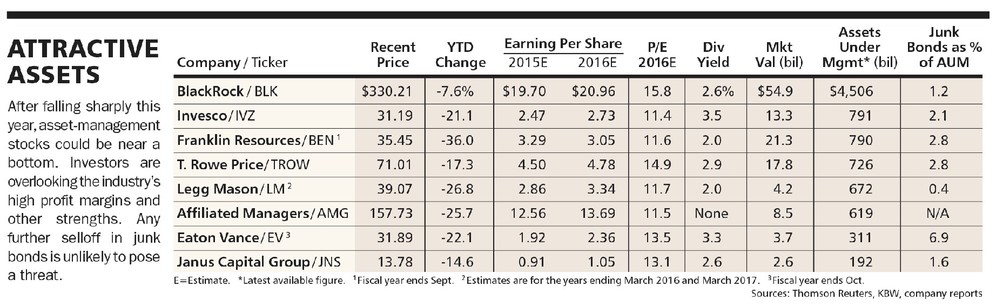

Bary looks at what has been a horrible year for the publicly traded companies within the asset management space – the mutual fund and ETF stocks that have dropped precipitously, even as investment account balances and 401(k) assets have grown.

Bary’s take is that these stocks have dropped into value territory and have created an opportunity for investors. I would say that the pressure on fees and the transparency around what you pay vs what you get makes most of the sector uninvestable. Multi-million dollar ad budgets and the typical PR campaigns are failing to counter the power of the internet. The jig is up; investors have gotten too savvy (or skeptical, either way) for these businesses to bounce back as they used to.

The big story is here is that actively managed mutual funds have seen a mass exodus of billions of dollars once again this year while ETFs (mostly Vanguard and iShares) have been the beneficiaries. This is not the same as saying that money is leaving one pocket and going into another – there is a significantly smaller group of players on the ETF side accounting for the majority of assets than there is on the mutual fund side. And, importantly, there is a lot less profit to go around too.

And while there are still hot categories on the product side, this cycle will not look like others for the fund companies that bring products to market to capitalize. Smart Beta now represents 25% of the US ETF industry’s assets under management (roughly $500 billion), but the profitability of the genre is about to be flattened.

Last week I sat with someone from Goldman Sachs who showed me what they’re doing within Smart Beta ETFs and it looks just like what everyone else is doing – multi-factor passive portfolios emphasizing value, small, quality and momentum. The difference is, Goldman is charging 9 basis points (9!). I had to be picked up off the floor.

Goldman is going slash-and-burn for factor investing market share with a pricing structure that rivals what State Street, Schwab, Vanguard and BlackRock are charging for plain vanilla index exposure. Legg Mason and Fidelity are both on the verge of doing something similar. I’m not sure how Smart Beta ETFs (or active managers mimicking these styles) will be able to hold the line on charging more than 50 basis points in a world where Goldman gives it away for free.

Bary cites below-market multiples for the asset management sector created by this fall’s market turmoil. I’d say, given the competitive landscape and the new proclivities of the customer base, these below-market multiples are justified. It’s time for some merger activity to take out the rampant excess capacity of the space. Until then, cutthroat pricing and me-too product rollouts will continue to keep the group under pressure.

Source:

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/12/20/the-woes-of-the-asset-managers/ […]