If you managed to own the relatively few major winners among large cap stocks and didn’t bother with anything else, you’re pretty happy with your portfolio’s concentration this year. Most people do not invest this way because the dangers of picking the wrong stocks to concentrate on far outweighs the slim chance you’ll nail it.

If you were an indexer and owned the cap-weighted indices, you’re just okay this year. Within a few percentage points of record highs, enduring lots of volatility, and without much to show for international or smaller cap diversification. Oh well, we’ve all seen worse (much worse).

For everyone else, it will be a pleasure to kiss 2015 goodbye. There are far more individual stock losers this year compared to previous years of the current bull.

The Financial Times wrote about the “narrowness” of 2015 that everyone’s been carrying on about (emphasis mine):

Some talk about the Fang stocks — Facebook, Amazon, Netflix and Google — while Ned Davis Research refers to the Nifty Nine, which adds Priceline, Ebay, Starbucks, Microsoft and Salesforce. (Note that Apple appears on neither list.) If made into indices, research by the FT statistics group shows that either of these groupings would have gained about 60 per cent for this year, while the S&P 500 is up about 1 per cent.

Meanwhile, the equal-weighted version of the S&P, where each stock is given a weighting of 0.2 per cent, has fallen slightly for the year, even as the main cap-weighted index has risen. So, unusually, the average stock has failed to beat the index. Most US stocks are down for the year, even if the Fangs’ exploits have kept the main benchmark in the black.

Now, if you owned only the FANG stocks or only the Nifty Nine and that was your entire portfolio, it is undeniable that you crushed it this year. Unfortunately, you also took a major risk – one that would not likely benefit you should you attempt to repeat this exploit in future years.

Lucking into the nine best holdings in a universe of thousands of stocks only seems possible with the benefit of a rearview mirror. “Of course those were the best stocks to be in, anyone could have foreseen that in January!” Nope. We have a pet name for this kind of thinking on Twitter – an imaginary hedge fund we like to refer to as “Hindsight Capital Partners LP”. Don’t try to send them any of your money to manage, there’s a waiting list ten miles long.

And as for avoiding the many, many losing stocks…every bit as impossible an endeavor as only owning the champions.

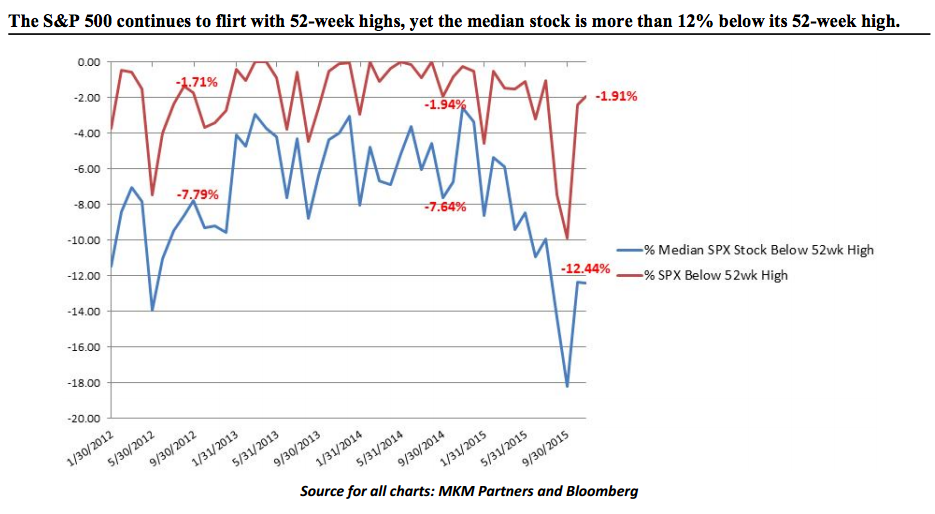

My friend Jon Krinsky’s new technical analysis note at MKM Partners paints the picture of this year’s bumper crop of losing stocks perfectly in a single chart:

Says Jon:

The S&P 500 is less than 2% away from its recent all-time highs, yet the median stock is down over 12% from its 52-week high, and nearly a third of stocks are down 20% or more. Further, just 53% of components are above their 200 DMA. In other words, the turkey looks good on the surface, but where’s the stuffing? In the last 20 years, the only other times we have seen less than 55% of components above their 200 DMA while the SPX was within 2% of a 52-week high have been ’98-’00, October 2007, and July/August of this year.

Josh here – This week marks the first week of the last month of this year. Lots of investors are saying “good riddance” despite our proximity to new all time highs in the S&P 500 and Nasdaq. It’s easy to see why.

Sources:

Fangs and Nifty Nine power US equities (FT)

The Turkey Looks Good, But Where’s The Stuffing?

MKM Partners – November 29th 2015

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/11/29/another-banner-year-for-hindsight-capital/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2015/11/29/another-banner-year-for-hindsight-capital/ […]

… [Trackback]

[…] Here you will find 9089 additional Info on that Topic: thereformedbroker.com/2015/11/29/another-banner-year-for-hindsight-capital/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2015/11/29/another-banner-year-for-hindsight-capital/ […]