I have a theory about American Exceptionalism. It can be explained by a lot of factors but among the most prominent is risk-taking DNA.

My oversimplified version goes like this: From the 1600’s through the 1900’s, the boldest, most enterprising Europeans got on boats and nearly drained the continent of energy, enthusiasm and gumption, albeit in slow motion. Beginning a bit later, the same thing happened with Latin America and Asia, but on a smaller scale. The melting pot, then, is actually a cauldron of intellectual curiosity, class-system defiance and unquenchable thirst for progress sitting atop a raging bonfire that consumes old ideas and burns them into ash.

In my view, there’s a rendition of this playing out in the wealth management industry, where all of the innovation and creative spirit is fleeing from the Old World to the new one.

Technology, as usual, is playing a central role in this trend, but so is a response to customer preference. The 20th century brands that had dominated the investment industry from the 1920’s until the turn of the millennium are being chipped away at every day. It’s beginning to become noticeable to anyone who isn’t in complete and utter denial.

If you’re reading financial advisor and industry sites these days, then you’re noticing a dramatic uptick in the stories of breakaway brokers headed to the RIA channel. It was a trickle when I first started writing about the trend four years ago. Now it’s a tsunami.

And the other thing that’s happening is that the stories are getting bigger. $1 billion teams, $2 billion teams, the other day there was a $3 billion team. It’s unprecedented. We’re no longer hearing about the adventurous big-firm brokers only. Now it’s the best and the brightest. The biggest.

Some of this is happening because a few of the major wirehouse wealth management brands are imploding.

Rome wasn’t pillaged in a day

Barclays just sold its US wealth management business to Stifel Financial, a St. Louis based brokerage. That put 180 financial advisors and $56 billion in assets potentially in play. And that’s after the exodus leading up to the actual sale that’s transpired over the last few years as the division struggled to find its raison d’etre.

Credit Suisse, which refers to its US wealth unit as its “private bank”, is hours away from announcing a major overhaul. This will undoubtedly include a huge capital raise and all manner of selling off, spinning off and laying off. According to the Wall Street Journal, “Credit Suisse’s U.S. private bank is estimated to be worth between $415 million and $623 million, with $115 billion in assets and employing roughly 370 advisers.”

Deutsche Bank is allegedly in talks to offload its entire US wealth business to Raymond James, which has a multi-tiered approach to the breakaway question; advisors can do business on the corporate RIA or simply uses RayJay for custody while acting as their own firm.

The wealth management business of UBS Americas has been rumored to be for sale for so long, its brokers probably keep an empty cardboard box in their car trunks just in case.

As the for the condition of the industry’s major stalwarts, Morgan Stanley (which is also legacy Smith Barney) and Bank of America Merrill Lynch, things seem to be a bit more stable, but that hasn’t stopped the anonymous rank-and-file griping that appears online almost daily.

What all of these companies have in common is a need to fend off the onslaught of siren songs to go independent. Whereas ten years ago, their biggest problem was intra-wirehouse poaching (colloquially known as “the prisoner exchange”), the competition now coming from outside the big-brokerage bubble is formidable.

This dissolution is being fed by three things:

- A clear preference on the part of consumers for lower-cost advice, increased transparency and declining interest in high-falutin’ sophisticated products that do not add value (just look at fund flows, the writing is on the wall)

- The emergence of high-quality platforms that help wirehouse teams transition from being merely a practice into becoming a full-fledged firm

- The zeitgeist of success stories being told by the last generation’s breakaway brokers who’ve hung a shingle and changed their own lives in the process

We’ll focus in on the second item, the platform thing.

The Enablers

Have you heard of Hightower Financial? How about Dynasty Financial Partners? If you’re not familiar with them, you will be. They’re literally sucking all the air out of the room. Not a week goes by where one of these two platform firms isn’t pulling a billion-dollar team out of one wirehouse or another. These are the enabling firms that are allowing brokers to keep everything they like about the big firms (scale! prestige!) while leaving behind everything they hate (payout and comp battles, bureaucracy, product-first culture, etc).

In the case of Hightower, which is run by founder Elliot Weissbluth, advisors are being coaxed with the promise of equity ownership in the overall venture and the chance to be entrepreneurial while not losing the safety net of support entirely. It’s a great pitch – bring your clients, bring your abilities and skills, leave behind the conflicts of interest and we’ll take care of the back office functions you’re currently paying too much for. Hightower is offering freedom, their tagline is “What happens when you remove the walls from Wall Street?”

Dynasty is a minor miracle as financial startup concepts go. Its founder Shirl Penney, whom I’ve recently become friendly with, wrote the business plan in his Saratoga, New York garage in September 2008, at the apex of Wall Street’s Waterloo. Within two years, its first breakaway broker signed on to the platform. Two months later, a second team. Fast-forward to today and there are 27 teams and counting who have formed firms partnering with Shirl & Co, with new announcements coming at a torrid pace.

Last month, a seven-member Merrill Lynch team signed on with Dynasty as “Corient Capital Partners”, bringing some $3.3 billion in assets under management with them – a nearly unheard of number for a breakaway. A group of Barclays advisors formed the firm “Summit Trail” in partnership with Dynasty in July, shortly after the sale to Stifel; they have since recruited former Barclays veterans managing over $5 billion in client assets. It’s a prison break where the escapees return to the scene to bust their colleagues out later.

Shirl Penney and Elliot Weissbluth, and their respective firms, represent the biggest, most concrete existential threat to the Wall Street wirehouse since the dawn of the investment industry circa World War I. Other threats, like continued regulation of informationally-asymmetric principal transactions, the widespread dissemination of product and service information on the web and the technological encroachment into previously untouchable “walled gardens” are every bit as important. But these partnership platforms are a crystalized manifestation of all of these things. They are the monster beneath the bed.

“Going indie” no longer means setting up shop in the wilderness and having to figure out all of the details of running a firm through trial and error. Amateur Hour is over and the next generation of breakaways have an opportunity that their 1990’s predecessors could not have imagined.

Time for the re-up

The timing of this transitional flurry is not an accident.

In the wake of the financial crisis, Wall Street firms fell in love with wealth management again, once the honeymoon with banking and trading ended in tears (and losses and lawsuits). These firms realized that wealth management was steady, reliable, recurring and, even better, it didn’t fall down on the job when its clients needed it. This is a testament to the hardworking advisors around the country, who stood their ground and answered the phone – even when there was nothing but bloody murder to report.

The retention and recruiting deals written from 2008 to 2010 made sure to reward advisors for this fact. Wealth management became sexy again and the seven-year contracts of this era were insanely lucrative for large advisor teams. The good news is that advisory business has been the crown jewel for firms like Merrill and Morgan ever since. The bad news is that these seven-year post-crisis deals are rolling off right about now. And while many wirehouse advisors will either re-up or take a similar deal at the wirehouse down the street, many will not.

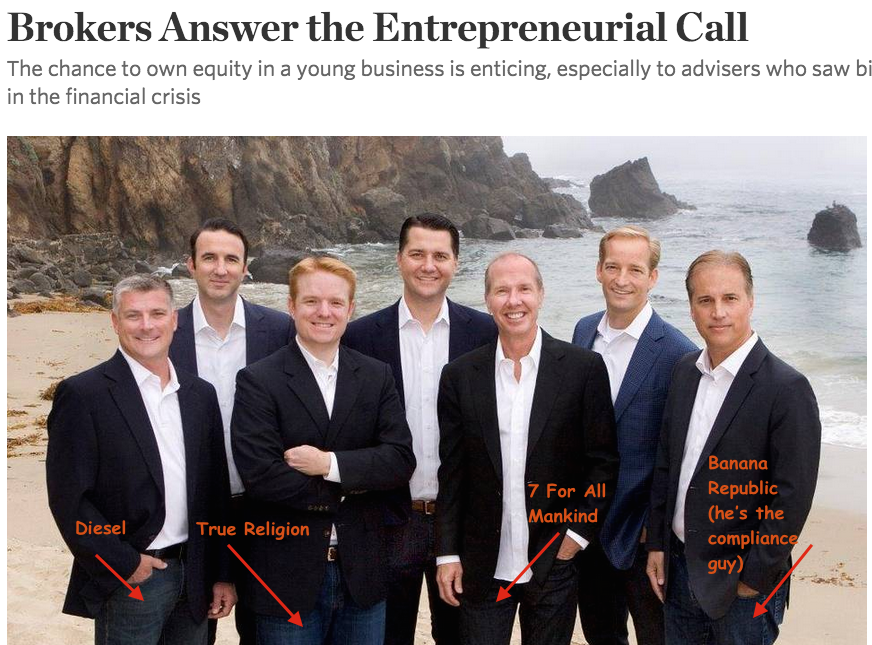

This time, unlike last time, there are serious options to consider elsewhere. Options that include freedom. Options that include meaningful equity in newly formed partnerships (rather than the moribund, go-nowhere shares of BAC). Options that include the chance to wear jeans and a blazer five days a week*, the unofficial uniform of the RIA. The jeans say “I’m edgy”, the crisp white button-down shirt says “but don’t worry, I’m not really edgy.”

A word on culture

Not every breakaway advisor wants to or has the ability to launch their own firm. But plenty want the chance to be part of something they believe in. The large firms have been able to thrive on signing bonus free-agency for a long time, but there are many advisors who don’t want the next check. They want something else. They want a culture.

You don’t build a culture on free-agency. You don’t build an army of believers out of mercenaries. A culture forms when a group of people start out with a set of core beliefs that they are willing to be absolutely unreasonable about, that they are willing to stake their futures on. That’s what my firm is attempting to do. It’s going well so far. We’re trying and working at it every day.

We’re hearing from other RIAs and from wirehouse advisors all over America who agree with our message to investors and want to be a part of spreading it.

We don’t work with headhunters, we don’t cut signing bonus checks and we’re not a platform company. We’re a firm and we’re a movement**. And we’re culture snobs, too. This means not everyone we talk to is a fit. In order to preserve the culture, we have to say “no” more than we say “yes.” We can only bring advisors into the fold that have the same “unreasonable” ideas and priorities that we do: Client-centric business model, evidence-based portfolios, radical customer education.

They’re out there. We’re talking to them. Not every breakaway is a candidate for us, but we’re hearing from some incredible professionals every week.

The test

I would also point out that not every broker should be thinking breakaway. A quick breakdown of who should and who should not below:

Should breakaway:

- I believe that my clients work with me because of my own expertise

- I want open-architecture in terms of product and service offerings

- I want access to cutting-edge technology that evolves quickly

- I believe the ability to express myself publicly will be important to the next generation of investors

- I want to wear jeans to work and maybe even those Cole-Haan shoes with fluorescent yellow soles

Should not breakaway:

- I believe that the products and services of my firm are the most fitting for my clients

- I want to represent the brand of the firm I’m at

- I have paid enough dues here and I am destined for a more important role

- I am nearing retirement and very comfortable, the firm is good to me

- My clients are immobile because they like the firm or have banking relationships tying them here

Every broker and advisor needs to be able to answer these questions to determine whether or not they should be considering a breakaway. For many advisors, it would not be a smart move. For those who do choose to jump, success will not come automatically. A lot will have to go right, starting with whom one chooses to be affiliated with, be it platform or firm. Plenty of RIAs are dead-ends. Not every startup RIA makes the jump into established-firm status. And in some cases, an advisor’s clients are truly best-served at the largest, most integrated wirehouse firms – especially if things like syndicate business, hedge fund access, lending options and one-stop banking are important to them.

The ballad of the breakaway broker is a happy tune these days, but even the sweetest songs contain the occasional minor key downshift.

***

*No denim was harmed in the making of this article.

**Advisors, talk to us about your career and what you want out of life here: Ritholtz Wealth Management

I’ll be discussing this and other industry topics at the IMN Global Indexing and ETF Conference in the desert this winter, free registration for advisors here.

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Here you can find 4582 additional Information to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]

… [Trackback]

[…] There you will find 20089 more Information to that Topic: thereformedbroker.com/2015/10/18/the-ballad-of-the-breakaway-broker/ […]