I’m ridiculously fortunate because I get to work with my friends. I’m even more fortunate in that I get to work with really smart people – there are now two CFAs and two CFPs at my shop. The best part is that I get to learn something from them nearly every day.

Ben Carlson and Mike Batnick have each written really great posts at their sites this week that I want to share.

At A Wealth of Common Sense, Ben looks at a really important concept that doesn’t get enough attention among professional investors. Historical relationships between asset classes are the only facts we have to go on, but sometimes things diverge significantly from history in ways that no one can imagine.

Consider:

…there are certain times when we see a regime shift in the markets that makes historical numbers irrelevant to a certain extent.

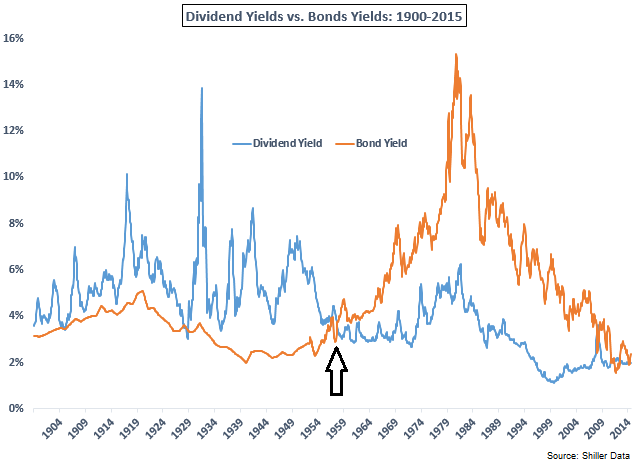

In the early 1900s, stocks used to pay much higher dividend yields than they do today. Part of the reason for this is because they didn’t really buyback their own shares back then. But stocks were not as widely owned as they are today, so to entice equity investors, corporations generally paid out a high dividend yield. In fact, stocks almost always yielded more than bonds. This was such a widely held belief that it turned into something of a market timing signal whenever the two yields would converge.

When dividend yields dropped below bond yields it was time to get out of stocks, after they had risen enough to lower their payout. This worked…until it stopped working. You can see where bond yields crossed stock yields in the late-1950s and never looked back (until recently). Had you continued to use that historical signal and waited to get back into stocks you would have been sitting out for decades and decades.

Read the whole thing:

When Evidence Fails (A Wealth Of Common Sense)

Over at The Irrelevant Investor, Michael is talking about the benefit of having bonds in a portfolio as dry powder:

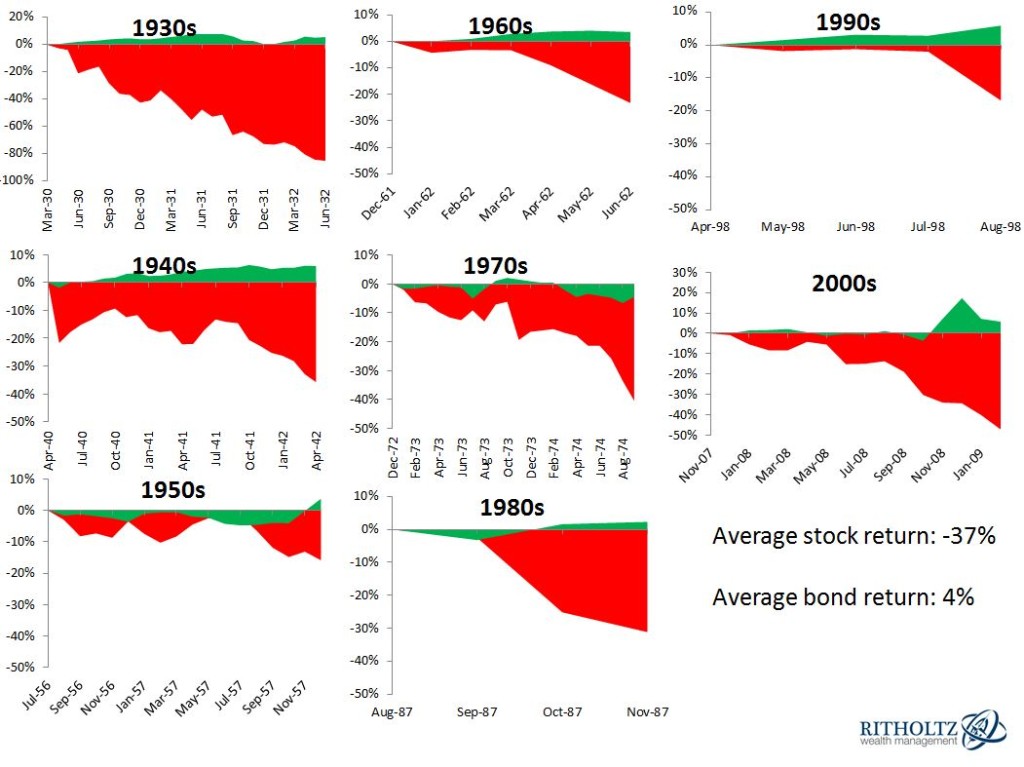

I want to incorporate how *bonds performed during these selloffs. Below in red are the drawdowns stocks experienced and green represents the returns for bonds during that time. The average stock drawdown was -37%. Over that same period, the average return for bonds was 4%. The 1970s were the only decade where bonds did not deliver a positive return (real bond returns were significantly worse).

Not only did bonds provide some stability while stocks fell, but more importantly, they provided investors with dry powder to rebalance into stocks as they went on sale.

Read the whole thing:

Dry Powder (Irrelevant Investor)

Josh here – if you’re not following Ben and Michael’s blogs, you’re missing out on some really interesting stuff each day. I know I never miss them – but I’m a little bit biased 🙂

TWO AMAZING READS

http://t.co/3AeXNBOCwg http://t.co/RHJpskCO3F

Two Amazing Reads http://t.co/PKx644yaeU #Uncategorized @ReformedBroker

RT @ReformedBroker: TWO AMAZING READS

http://t.co/3AeXNBOCwg http://t.co/RHJpskCO3F

RT @ReformedBroker: TWO AMAZING READS

http://t.co/3AeXNBOCwg http://t.co/RHJpskCO3F

RT @ReformedBroker: TWO AMAZING READS

http://t.co/3AeXNBOCwg http://t.co/RHJpskCO3F

Two Amazing Reads http://t.co/N4O8UPPpVl

Two Amazing Reads by @ReformedBroker http://t.co/r8eCpytQku

RT @ritholtz: Two Amazing Reads by @ReformedBroker http://t.co/r8eCpytQku

Two Amazing Reads by ReformedBroker http://t.co/SOFgHBeFQx

RT @ReformedBroker: TWO AMAZING READS

http://t.co/3AeXNBOCwg http://t.co/RHJpskCO3F

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2015/10/16/two-amazing-reads/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2015/10/16/two-amazing-reads/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2015/10/16/two-amazing-reads/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/10/16/two-amazing-reads/ […]