If you believe that history is any guide at all when it comes to monetary policy, the dollar and gold, then this may be of interest to you…

Gold has been in a death spiral of late based on the twin fears of rising rates and a dollar at decade highs. According to HSBC’s FX strategist, David Bloom, gold has already priced in the first hike and it may be discounting a continuing dollar rally thesis that is unsupported by history. According to the bank, after the first hike of a cycle the dollar declines in the first 100 days, on average, and gold bounces from where everyone sold in anticipation.

In other words, buy the rumor of rate hikes and sell the event for USD – the reverse order for gold.

re the dollar:

while the USD tends to appreciate going into a Fed hike, history also suggests the USD tends to weaken after the Fed raises rates. Looking at the previous four Fed tightening cycles that have happened over the past 30 years, the USD has fallen for the next 100 days immediately after the first rate rise. On each occasion, the USD fell even though there were additional rate increases made during the period…Fed tightening is already in the price by the time the Fed finally delivers the first hike.

and re gold:

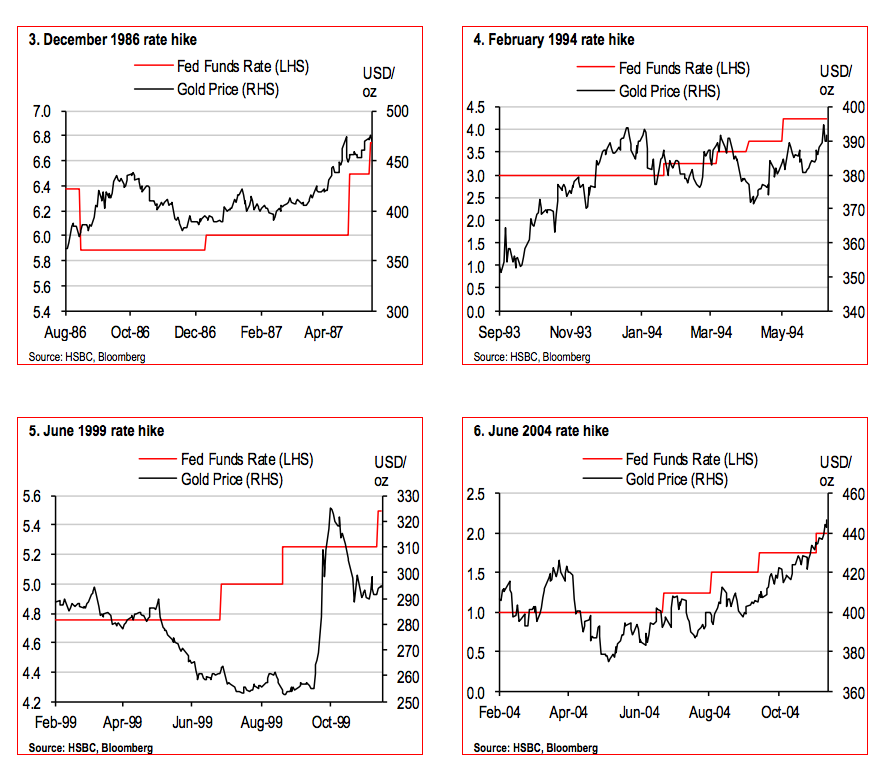

History shows that gold prices also fall leading into a rate hike and generally rise, though sometimes with a lag, after the first rate hike. This is shown in charts 3-6, for the last four Fed tightening cycles. Investors are apt to unload gold in anticipation of tightening monetary policies. This negative pressure is sustained until the Fed announces a rate hike which then eases the negative sentiment towards the yellow-metal. This explains the subsequent rallies in gold that occurred shortly after the Fed announced the first rate hike in the last four tightening cycles.

Here are the charts:

The takeaway is that no one knows anything.

Most people read a few things here or there and just run their mouths, without worrying so much about the actual data. Not that historical data is necessarily predictive, but it’s probably a better guide than someone’s feelings.

The other takeaway is that anything can happen, even the most unexpected thing – like rate hikes being positive for gold and negative for the dollar. “Should” that happen? I don’t know, let me answer that question with another question – should deflation be the predominant problem in the economy seven years into zero-percent interest rates and the Federal Reserve’s balance sheet ballooning from $1 to $4 trillion? Probably not.

But that’s the point. As Jeff Gundlach says, “Whenever you hear people in the investment business say the word ‘Never’, that’s when you know it’s about to happen.”

Source:

Currency Weekly

HSBC Global Research – July 27th 2015

[…] “History shows that gold prices also fall leading into a rate hike and generally rise, though sometimes with a lag, after the first rate hike… Investors are apt to unload gold in anticipation of tightening monetary policies. This negative pressure is sustained until the Fed announces a rate hike, which then eases the negative sentiment towards the yellow-metal. This explains the subsequent rallies in gold that occurred shortly after the Fed announced the first rate hike in the last four tightening cycles.” Source. […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Here you can find 11133 more Information on that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2015/07/28/actually-gold-rises-after-rate-hikes-begin/ […]