It had been a frustrating year for those overweight US financials (guilty!) up until a couple of weeks ago as they’d managed to underperform most of the marketplace with rates falling and economic momentum sputtering. With the recent pickup in data (and short rates) however, this bet is starting to pay off for those who had made it on the heels of 2013. 70% of all bank lending is priced off of short-term interest rates – LIBOR, Fed Funds etc. So whatever’s happening with the long bond is not nearly as important to financial sector earnings as what’s happening at the short end of the curve – and the short end is creeping up.

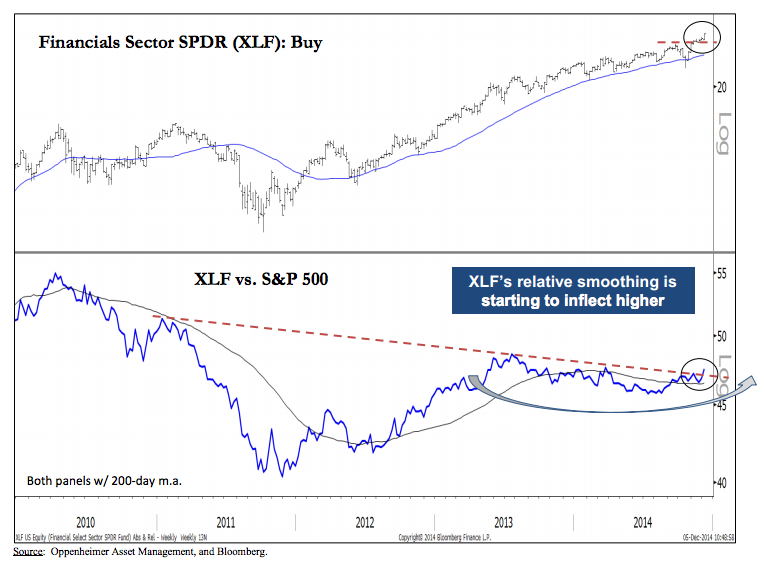

My friend Ari Wald, technical analyst at Oppenheimer Asset Management, spotlights the S&P 500 financials this week and shows them breaking out on both an absolute and relative basis…

In terms of sectors, Financials is our favorite rotation idea due to considerable signs of relative trend improvement vs. the S&P 500. Specifically, the sector is resuming a multi-year bearish-to-bullish reversal following a year of healthy sideways consolidation.

We see XLF’s new price high as the market telling us that strong hands want to own financials in a market where many stocks have not been able to make new highs. We recommend listening to the market and buying financials given their improving relative profile.

Relative to Financials, our ranking of the four financial sub groups are: 1) Diversified Financials; 2) REITs; 3)

Banks; and 4) Insurance

Ari’s top two picks in the space are Citi and Morgan Stanley on fresh 52-week highs. Bon chance.

Source:

Technical Analysis: Inflection Points

Oppenheimer Asset Management – December 8th 2014

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/12/08/and-now-the-bank-breakout/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2014/12/08/and-now-the-bank-breakout/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/12/08/and-now-the-bank-breakout/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/12/08/and-now-the-bank-breakout/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/12/08/and-now-the-bank-breakout/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/12/08/and-now-the-bank-breakout/ […]