Welcome to week 2 of my new recurring feature, The Riskalyze Report.

My friends at Riskalyze have offered me the opportunity to see which stocks and funds advisors all over the country are adding to their clients’ accounts and which ones they’ve been selling. Each week I’ll present you with the top three buys and sells and we’ll track how this progresses while trying to figure out what it says about the professional mindset.

This data has been aggregated from across the client accounts of the thousands of advisors who use the software. Most of it comes directly through the third-party custodians where advisors’ assets are held. Thanks to Aaron Klein and Mike McDaniel for granting me this access. I hope we can uncover interesting trends for you each week…

Week of October 6th – October 10th 2014:

Winners = top investments purchased by advisors for client portfolios that week

Losers = investments that advisors sold out of in client portfolios that week

Winners (advisor flows TO these investments increased substantially):

- Short Term Bonds (SHY, CSJ)

- Berkshire Hathaway (BRKB)

- Preferred Stock (PFF)

Losers (advisor flows FROM these investments increased substantially):

- Real Estate (IYR, VNQ)

- Technology (QQQ, XLK)

- Managed Futures

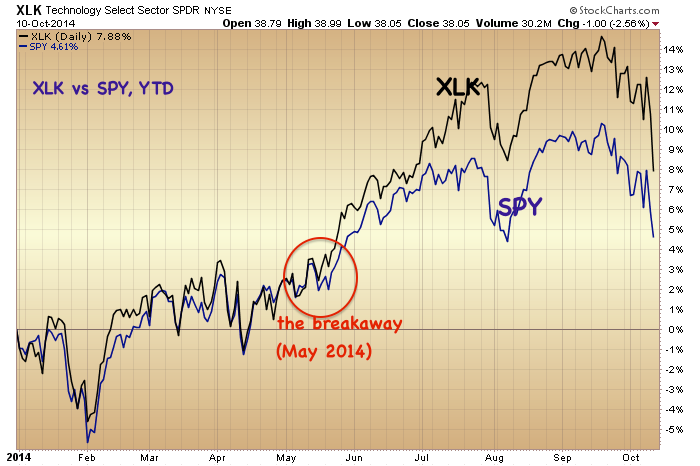

Josh here – Nasdaq 100 (QQQ) along with the large cap technology sector (XLK) in general have been one of the bright spots so far this year. As you can see in the chart below, giant tech names like Intel, Apple, Microsoft and Facebook were the world’s fair, even as the rest of the S&P was having trouble keeping up. You’ll note two things here: First, the breakaway between tech and the S&P 500 in May, second you’ll see the huge comeuppance of the past week as tech sold off harder than the broader markets:

Some stats relating to the tech-led sell-off last week:

In the last five days, the Dow lost 2.74% and the S&P 500 lost 3.14%. These drops pale in comparison with the tech-heavy Nasdaq Composite’s drop of 4.45%. The beating was especially acute in the chip sector, as the Philadelphia Semiconductor Index crashed a shocking 9.91% between Monday and Friday.

With action like this taking place, it should not come as a shock that advisors were either locking in profits from their tech sector holdings, rebalancing away from the space or just avoiding it altogether to produce one of this week’s most sold-out areas.

In the “Winners” column, it should come as no surprise to see Berkshire Hathaway as one of the most-added securities, given the company’s $55 billion cash war chest, it’s steady-eddy insurance-driven business model and its flair for owning consumer staples-like businesses, which typically hold up best when the market gets panicky about future growth. No one ever got fired for buying Buffett in an unsure tape and people have to put the money somewhere.

***

A word about Riskalyze:

In my practice, we use Riskalyze software tools to help assess clients’ true risk tolerance and to test portfolio configurations that match up accordingly. It’s changed our practice for the better, as I explain here.

RT @asibiza1: Riskalyze: Joshua Brown’s Belles of the of Stockmarket Ball! @ReformedBroker http://t.co/5XdTtAXgaA

RT @asibiza1: Riskalyze: Joshua Brown’s Belles of the of Stockmarket Ball! @ReformedBroker http://t.co/5XdTtAXgaA

RT @asibiza1: Riskalyze: Joshua Brown’s Belles of the of Stockmarket Ball! @ReformedBroker http://t.co/5XdTtAXgaA

RT @ReformedBroker: Financial advisors blew out of tech last week, loaded up on short-term bonds and Berkshire Hathaway http://t.co/4c9Wrwo…

RT @ReformedBroker Financial advisors blew out of tech last week, loaded up on short-term bonds + Berkshire Hathaway http://t.co/ewLBIh3NfP

RT @ReformedBroker: Financial advisors blew out of tech last week, loaded up on short-term bonds and Berkshire Hathaway http://t.co/4c9Wrwo…

RT @ReformedBroker: Financial advisors blew out of tech last week, loaded up on short-term bonds and Berkshire Hathaway http://t.co/4c9Wrwo…

RT @ReformedBroker: Financial advisors blew out of tech last week, loaded up on short-term bonds and Berkshire Hathaway http://t.co/4c9Wrwo…

.

tnx for info!

.

good!

.

ñïñ!

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/10/12/the-riskalyze-report-tech-gets-its-bell-rung/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/10/12/the-riskalyze-report-tech-gets-its-bell-rung/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/10/12/the-riskalyze-report-tech-gets-its-bell-rung/ […]

… [Trackback]

[…] Here you will find 8207 additional Information to that Topic: thereformedbroker.com/2014/10/12/the-riskalyze-report-tech-gets-its-bell-rung/ […]