In my travels around the country, I’m fortunate to get a chance to meet some truly great investors and fellow advisors. Being located in New York City, I am equally lucky that everyone I want to meet also has to pass through my hood at some point or other. As a result, I can count some of today’s most important and well-regarded financial thinkers and writers as friends.

Tonight I’ll be pointing you toward two new blog posts on diversification written by two extraordinarily clear-thinking gentlemen, Ben Carlson and James Osborne – both of whom I’ve had the pleasure to dine and drink with in the last year. Ben and James have picked up on a theme I’ve been writing about for awhile now – the pathetic relative performance of global stock markets versus the S&P 500 in the last few years.

They come at this issue as professional investors and as Street-savvy portfolio allocators. They emphasize what’s almost guaranteed to happen once the investor class becomes convinced that they are wasting their time with anything other than Facebook, Apple and the rest of the anointed US mega-cap 100 stocks. I should mention that the USA! USA! trend of 2013 has continued throughout 2014, a year-to-date scorecard I made for the various stock markets is here.

Ben Carlson, an institutional portfolio manager with a talent for pointing out simple investing truths, reminds us that the US trouncing all other geographies is only a recent phenomenon – there are whole ten- and twenty-year periods during which this has not been the case…

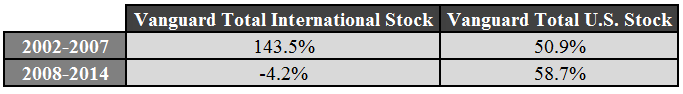

Investors have a short memory at times, so it’s easy to forget that everyone hated U.S. stocks in the middle part of the last decade as foreign stocks, led by emerging markets, were up almost three times as much on a total return basis:

Over the entire 2002 to 2014 period the total returns are fairly close, with the U.S. market up 139% against a gain of 133% for international stocks. These numbers show how mean reversion works over time.

Source:

Global Diversification: Accepting Good Enough to Avoid Terrible (A Wealth of Common Sense)

James Osborne is a financial advisor based in Colorado with strong opinions and a resolute sense of what constitutes investing discipline. He explains that diversification is terrible only because we cannot mentally get past its perceived shortcomings and focus on the ways in which it helps us:

1) You will always be worse than the best performing asset class (and you will always compare your performance to the best asset class, because your brain is terribly designed for investing). For this reason your portfolio’s performance will always seem mediocre.

2) You will always be worse than the current “darling” stock of the street. Maybe it’s Netflix or Tesla. Or rewind 15 years and it’s Amazon and Cisco. Doesn’t matter. You’ll wish you had some of that, and ignore the fact that you also avoided owning things like GT Advanced Technologies, Apple’s glass screen supply partner who just filed for bankruptcy.

3) You will always hate something in your portfolio. Really, really hate it. Emerging markets have been a drag on a diversified portfolio for years now. Who is happy that they have owned emerging markets for the last five years? Who is happy they owned REITs in 2013? Who is happy with short term bonds for the past several years? No one.

Source:

Diversification Sucks (Bason Asset Management)

Josh here – diversification is taken for granted by market participants because it can be frustrating at times and is decidedly un-sexy. While everyone understands the concept and pays it lip service, it is often tossed out the window at exactly the wrong moment, just as it’s about to become the only thing standing between you and a massive loss. Neither James nor Ben are saying anything you haven’t heard before. But being reminded of it at a time like this – where anything but 100% US stocks feels like %$#@ – may be precisely what’s necessary to head off your next major blunder.

Follow Ben and James on Twitter

Read Also:

YTD Stock Market Scorecard (TRB)

[…] Waarom spreiding soms frustrerend is Je portefeuille zal het altijd slechter doen dan de best presterende beleggingscategorie (en je zult je portefeuille altijd vergelijken met de beste beleggingscategorie). Daarom zal de prestatie van je portefeuille altijd middelmatig lijken. http://www.iexgeld.nl/Artikel/259546/Waarom-spreiding-soms-frustrerend-is.aspx http://thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/Italie […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Here you can find 67589 additional Info to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] There you can find 40120 additional Information on that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/10/06/evening-reading-when-diversification-feels-like/ […]