2015 will be The Year of the Stock Picker, the year that professional active management makes its long-awaited comeback.

I feel pretty confident in making this forecast. Mostly because if it doesn’t happen, I can just roll it over into 2016, with a whole new set of reasons.

In 2013, something like 98 cents of every dollar of inflows to US stock funds went to Vanguard or a passive index product. In December, we were told that with almost no one attempting to pick winning stocks anymore, this would bring about an excellent climate for active managers in 2014. Furthermore, the drop in correlations meant more dispersion of returns between stocks – another boon for the stock selecting managers, who would surely be able to identify and benefit from owning the best names.

Bob Doll told my writing partner Jeff Macke back in January that this was going to be it! After a five year stretch during which 77 percent of active managers trailed their benchmarks, 2014 would mark the turning point!

Doll says this is finally the year when active managers start making up for lost ground. In the attached clip, Doll makes his case that 51% of active managers beating the market in the 3rd quarter was the start of something big. His argument starts with the high correlation between stocks over the course of the rally of the last 5 years. More than 400 of the 500 members of the benchmark S&P rose last year. Active management is based on the idea of discriminating between companies and industries. When everything moves in the same direction any fees and friction lead to underperformance.

Only it hasn’t worked out that way.

2014, when all is said and done, may in fact turn out to have been one of the worst years for active management of all time.

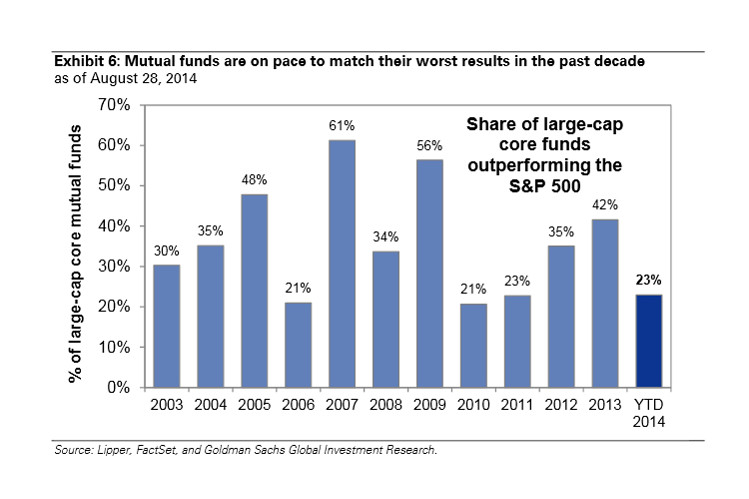

We’ve been talking about this abysmal showing all year here on the site. In August we mentioned that only 25 percent of US stock fund managers were ahead of the respective benchmarks. But it’s somehow gotten even worse.

Here’s Goldman Sachs vis Steven Russolillo’s MoneyBeat column today:

Only 23% of large-cap mutual fund managers have outperformed the S&P 500 this year, rivaling the worst performance in the past decade, according to David Kostin, chief U.S. equity strategist at Goldman. By comparison, about 37% of fund managers have outperformed the benchmark since 2003. Only performances in 2006, 2010 and 2011 have been as bad or worse than the current year’s pace.

Why is this happening?

The explainers are out in force. Here’s Suzanne McGee at the Fiscal Times with a fair description:

We’re caught in the kind of market that only the most agile of traders can love. It is one characterized by rapid shifts in direction, a lack of clear leadership, inconsistent economic data and general confusion about what’s going to happen next. In other words, it favors those who are willing and able to take short-term positions and switch them at a moment’s notice.

For obvious reasons, this is not what the majority of active managers are able (or willing) to do in the mutual fund complex. That kind of activity is better left for traders who want to chop their own money to pieces, not for pros who have a responsibility to others.

I have some trader friends who are doing really well this year in the stock picking arena so far this year – they’ve focused on areas like tech and biotech that have been chock full of winners. It can be done. Just not by the majority of people – even among the best and the brightest. While the majority of stock picking mutual fund managers struggle, their more highly compensated brethren in hedge fund land aren’t doing much better, with the average fund up just 2 percent year-to-date – but that’s just par for the course.

In the meantime, the S&P 500 is up close to 9 percent including dividends, US small caps are up just under 2 percent and the bond indices are all higher as well (especially the long-bond). Developed International stocks (Europe and Japan) are flat and Emerging Markets are crushing it, up mid-teens on the broad average and much more for some specific countries. With performance like this, for the basic and broad asset classes, it’s a total non-sequitur that anyone should feel as though they need (or are entitled to) more.

They’re not getting it, in most cases, in 2014.

Maybe 2015 will be the year it all turns around!

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]

… [Trackback]

[…] Here you will find 37045 more Info to that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]

… [Trackback]

[…] Here you will find 68204 more Information to that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/09/05/2015-will-be-the-year-of-the-stockpicker/ […]