“There’s no science behind that, people look at that kind of thing and they point out what they want to see.”

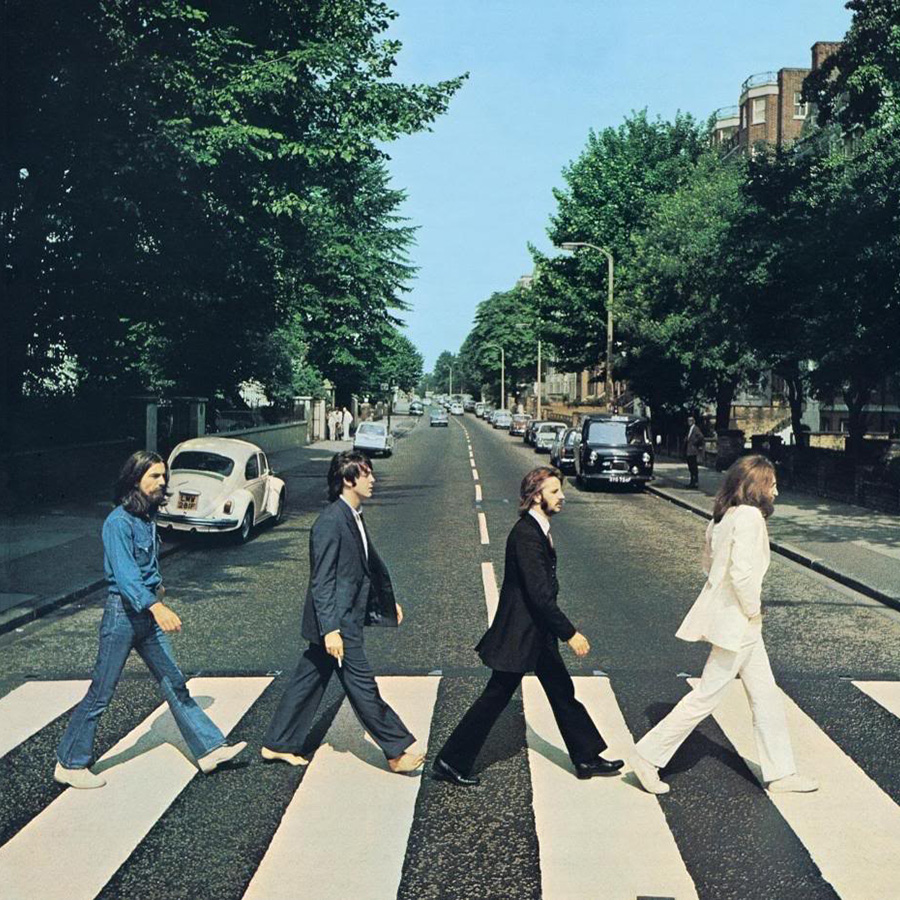

In the above image, you’ll see the photograph that became the cover shot for the Beatle’s final album, Abbey Road. The photo contains one of the most talked about divergences of all time – Paul McCartney being both shoeless and out of step with the rest of the band. This divergence sparked all manner of conspiracy theories as people took observations from the image and ascribed a deeper meaning to them that simply wasn’t there. In one example, fans took the “clue” of Paul’s bare feet and concocted a story whereby he had actually died and the Beatles were telling us that he had, in fact, been replaced with a body double sometime during the 1960’s.

The reality, however, is that this “divergence” carried absolutely zero significance at all.

What actually happened was fairly straightforward: It was August 8th, 1969, and a very hot day. Paul McCartney had been wearing sandals for the shoot, which had taken all of ten minutes with very little planning at all. John Lennon’s friend, freelance photographer Iain Macmillan, got up on a step ladder in the middle of the intersection outside the Abbey Road recording studio. The Beatles had made a handful of passes across the road. Of the six shots Macmillan had taken, the Beatles chose the fifth one because they appeared to be the most in-step as well as the fact that they were walking away from their studio and – not toward it – after seven long years of being “trapped” there. The fifth shot just happened to feature Paul without his sandals on, he’d taken them off because all the back and forth had been bothering his feet.

Yes, a divergence. But no, there was any meaning behind it.

Technical analysts tend to talk a lot about divergences because they often can present an opportunity to make money. They can also presage a change in trend for a given index or stock or asset class – for example:

A stock’s price keep going lower but its relative strength stops dropping – this can be a sign that the momentum to the downside is slowing and a bottom is nigh.

An index breaks out to new all-time highs – but it does so with very few stocks that make up the index participating.

An index making new lows while a growing number of its constituent stocks stop falling (as was the case with the S&P 500 in March 2009).

The relationship between two commodities that typically move in the same or an opposing direction begins to come apart.

A sector is rallying but with each successive thrust, the gains become more concentrated between just a handful of the sector’s leading names.

etc, etc.

The thing is, there is always a divergence. Sometimes they matter, sometimes they don’t. Sometimes one key divergence that was extremely important ends up meaning exactly zero the next time around. A single divergence, in and of itself, has all of the reliable predictive power of a bowl of chicken bones spilled out across the table.

And since no one has ever been able to prove otherwise – isolating a single divergence and showing a consistent win rate based on following it – you’re going to have to take my word for it.

I did a new interview with Jeff Macke, my co-author from Clash of the Financial Pundits, about the current divergences in the stock market and why they’re good to be aware of, even if they don’t make sense to react to. Watch it at the link below (and no, I don’t get to write the headlines of these things):

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/07/30/theres-always-a-divergence/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/07/30/theres-always-a-divergence/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2014/07/30/theres-always-a-divergence/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/07/30/theres-always-a-divergence/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/07/30/theres-always-a-divergence/ […]