The term “Must-Read” gets thrown around a lot on the financial web (mostly by me and my friends, lol) but today’s chart comes from a truly must-read profile of Leon Cooperman by CNBC’s Lawrence Delavingne. Lee Cooperman is one of the greatest investors of all time, having established and led the asset management division at Goldman Sachs in the 1960’s before launching his own market-dominating hedge fund in 1991.

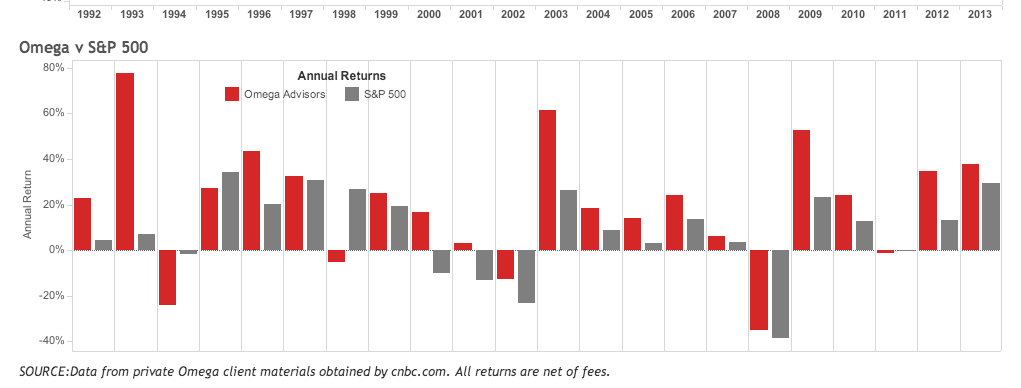

Cooperman’s hedge fund, Omega Advisors, has posted average annual returns of 14.6 percent net of fees versus the S&P 500’s 9.3 percent between January 1992 through June 2014. Almost no one else has been that good for that long. In the below chart, you’ll see that this outperformance certainly didn’t come for free – there were major drawdowns and setbacks almost every step along the way:

A few things should jump out at you upon glancing at this graphic…

1. Omega’s secret seems to be betting big on recoveries after sell-offs. Cooperman clearly has a bullish bias and during the opening stages of market recoveries he tends to crush the indices and his fellow hedge fund peers who are typically more encumbered by short bets and hedges that drag. Take a look at that burst from the gates during the 1993, 2003 and 2009 recovery years. Markets made a comeback after recession in all three cases, but Lee’s portfolio absolutely smoked them to the upside.

2. Drawdowns have been unavoidable. This outperformance has come with a cost – Omega has not been immune to market downturns. The interest rate spike in 1994 caused major problems for some macro bets the firm had on, as did the Asian Contagion episode in 1998. In 2008, Omega’s drawdown during the Credit Crash was every bit as severe as the overall market’s – although Lee made it up to patient investors just a year later. I’m sure some doubters were quick to hit the escape hatch during each of those years. I’m even more sure they’re kicking themselves now for doing so.

3. There are only two up-years for the S&P 500 during this 20-year span in which the market had beaten Omega to the upside, as Cooperman’s bottoms-up analysis and stockpicking have been remarkable overall. That said, you just know that during each of those two “underperforming” years, there were investors grumbling about their fees not being justified. This is what I call the dumb smart money – otherwise intelligent people who ought to know better than to obsess over a year or a quarter of relative performance. But everyone is guilty of this kind of ridiculousness from time to time, myself included.

Anyway, the entire article should be in your queue, Lee is a living legend and Lawrence’s profile of him is loaded with interesting process and career nuggets for investors and pros alike.

Source:

.

ñïñ!!

[…] work ethic and dedication to being a top investor are the stuff of Wall Street legend. Last summer I looked at the long-term track record of his fund, Omega Advisors, and I was truly astounded at what the man has been able to accomplish […]

[…] A big part of Leon Cooperman’s success is being greedy when others are fearful (The Reformed Broker) […]

[…] A big part of Leon Cooperman’s success is being greedy when others are fearful (The Reformed Broker) […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] There you can find 88342 more Info on that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] Here you can find 90692 more Info on that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/07/21/chart-o-the-day-omega-advisors-vs-the-sp-500/ […]

much does cialis cost without insurance

USA delivery

safe buy cialis

Health