I had lunch today down in the vault at the New York Yankees Steakhouse in midtown Manhattan with some colleagues from the asset management business and our hosts, EG Shares and State Street Global Advisors. The walls in the dining room (which was once the vault of an old bank) are covered with some pretty epic memorabilia – including the actual signed contracts of some of the most legendary ballplayers of all time.

I took a few shots…

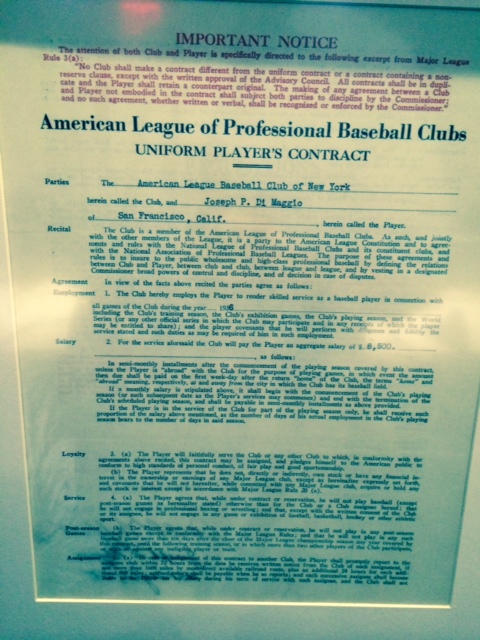

This first one is kind of awesome – it’s Joe DiMaggio’s 1936 contract to play for the Yankees at a salary of $8500. In pre-WWII dollars for a ballplayer – before luxury boxes and TV rights – that was a pretty good income. In today’s dollars, it only works out to about $141,045.17, or what the typical back office professional at JPMorgan or Citigroup makes – for one of the greatest athletes of all time. They also had Mickey Mantle’s contract on the wall, it was similarly hilarious. The Yankees used to get away with murder.

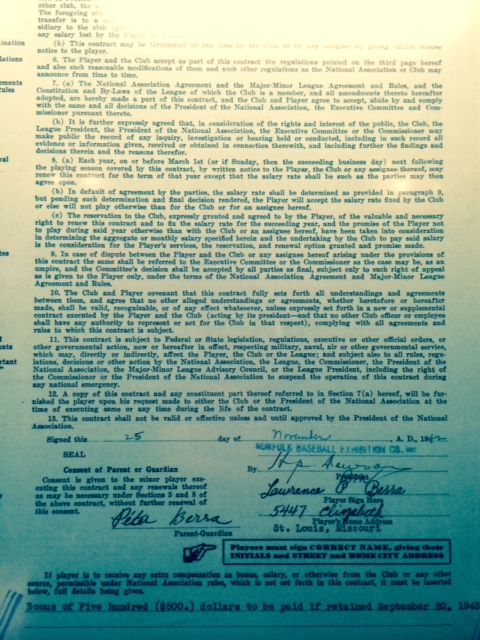

Below, you’re looking at the signature page of Yogi Berra’s contract from November of 1942. You’ll notice that it’s signed by “parent or guardian” Peter Berra. This is because Yogi was 17 years old when the Yankees signed him that fall! His dad had to sign for him.

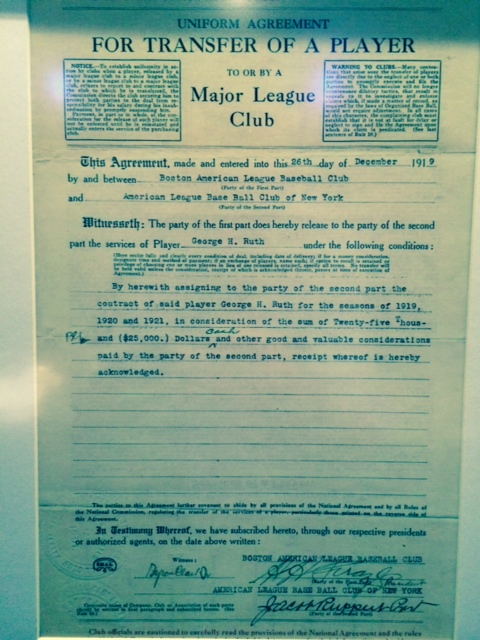

Now here’s where things start to get really interesting. Below is a “Uniform Agreement for Transfer of a Player” signed the day after Christmas in 1919. The agreement represents the deal by which the Boston Red Sox sold George Herman Ruth (the Babe!) for just $25,000! Long-suffering Sox fans believed that this was the deal that had doomed them for the next 86 championship-less seasons, the Curse of the Bambino.

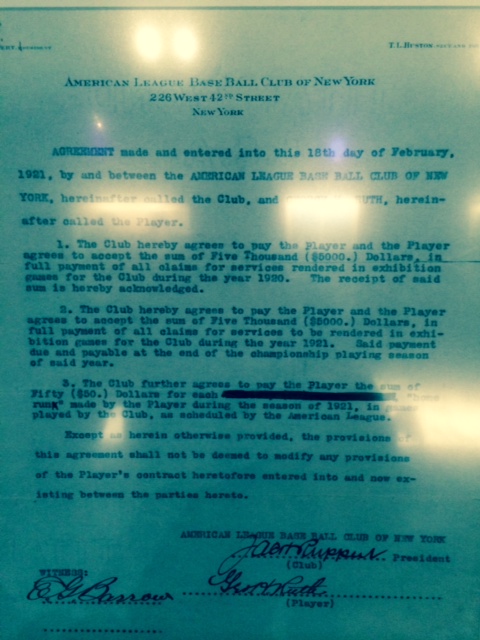

And then my favorite part – Babe Ruth’s agreement with then-owner Jacob Ruppert (of the Ruppert beer brewing company). In it, we see that Ruth’s salary will total $5000 for the 1920 season.

But!

There is the added kicker that “The club further agrees to pay the Player and the Player agrees to accept the sum of Fifty ($50.) Dollars for each home run made by the player during the season.”

Well guess what happened next…

Babe Ruth, who hit 29 home runs during the 1919 season would almost double that total in 1920 to 54 out of the park blasts. In 1921, he’d smack another 59 home runs, his second best year ever.

Gee, I wonder what helped that process along? Fifty bucks doesn’t seem like much now, but in 1920 those payments added $2700 onto his $5000 salary, or more than 50% of Babe Ruth’s total compensation!

This got me thinking about incentives, good and bad, and how they affect both performance and behavior in the markets.

I’ve told this story before but it bears repeating…

A few years back, my partner Barry got a call from a potential investor who’d mentioned he had come into $5 million in cash and was “auditioning” potential managers. His plan was to select five managers, stake them with a million dollars each, and whichever one did the best over the first year would get the rest of the money.

Barry’s response at being offered a berth in this bake-off was basically, “First of all, no thank you. Second of all, have you thought about the perversity of the incentives you’re setting up for the five managers? You’re basically telling them swing for the fences – heads they win, tails you’re taking the money away anyway so they don’t lose. You’re encouraging your stable of talent to take giant risks with your money while they themselves have only potential upside and none of the consequences.”

The flustered investor was a bit taken aback at being turned down, apparently everyone else he’d spoken to jumped at the prospect of this asymmetric opportunity. Barry’s ended the conversation by saying, “Best of luck, feel free to call us down the road with whatever you have left, if it still meets our minimums.”

Now of course, you’d love to see your investment manager hit home runs for you like the Bambino, but you most definitely don’t want to tie his compensation to ability to do so. Because while Ruth’s home run total jumped from 29 to 54 between 1919 and 1920, so did his strike out total – 58 to 80. And you probably can’t sustain a 25% jump in strike outs when it comes to your financial assets, can you?

Incentives matter. Often they dictate the probability of potential outcomes in very foreseeable ways.

[…] This post originally appeared here on June 3rd, 2014 […]

.

áëàãîäàðåí!!

.

ñïñ çà èíôó!!

.

thanks!!

.

good!

.

ñïñ!

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]

… [Trackback]

[…] Here you will find 20904 more Info on that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]

… [Trackback]

[…] Here you can find 48852 more Info on that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/06/03/incentives-matter/ […]