Today we’re going to talk about the boom in hedge fund-like mutual funds and the difference between brokers and advisors.

I once looked at a “liquid alternative fund” from Natixis – liquid alts are products that purport to offer hedge fund strategies in a ’40 Act mutual fund wrapper – and I couldn’t understand a word of what the wholesaler was talking about.

It was early 2011 and they were pushing this Dr. Andrew Lo vehicle called ASG Diversifying Strategies Fund. The idea what that Dr. Lo, perhaps one of the most brilliant quantitative scientists and academicians in finance (MIT, Harvard, all kinds of awards, PhDs out the ass, etc), would be incorporating a variety of approaches to manage the fund using all asset classes, derivatives and trading methodologies that he and his team saw fit to apply. As the strategies were explained to me, I nodded as though I understood – but it was Greek, locked in a black box, dumped into a river, in the middle of the night, as far as I was concerned.

Regretfully, I declined to get myself involved. But I promised the nice man from the mutual fund company to watch it and perhaps feel foolish in hindsight.

But that’s not what ended up happening.

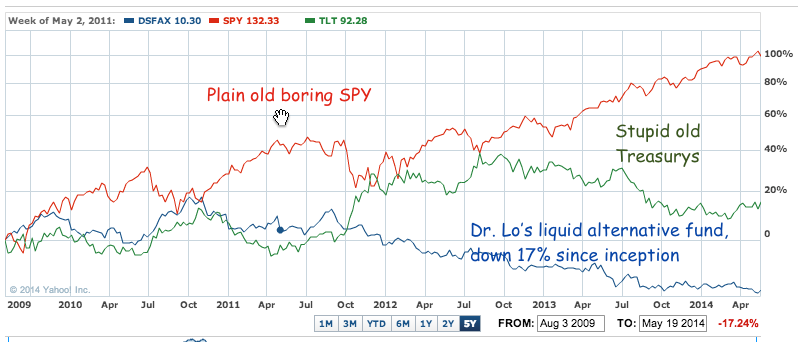

What actually did happen was this: Andy Lo, maybe one of the smartest men in the history of finance, managed to invent a product that literally cannot make money in any environment. It’s an extraordinarily rare accomplishment; I don’t think you could go out and invent something that always loses money if you were actually attempting to.

Since its inception in August of 2009 – weeks after the generational bottom – the ASG Div Strat Fund lost money during almost every quarter. It’s compounding at something like negative 7% a year since 2010. It managed to lose money in a bad market (2011, negative 2.75%), a good market (2012, return was negative 7.69%) and a raging bull market (2013, in which it lost another 8%, inexplicably). It’s hard to say that it’s meant as a bear market vehicle or a short fund, because it actually earned 8% in 2010 with the S&P up 15. So if you ask “What is the ideal environment for this strategy?” the answer is that there isn’t one.

By the way, it’s actually somehow down another .73% year-to-date – with stocks, commodities and bonds all higher so far in 2014. I have no idea what the hell is in this thing. I don’t think I’ve ever seen anything like it.

In the meantime, this fund – and other alternative funds like it – takes a net internal expense ratio of close to 2% of assets while the brokers who sold their clients the A shares have been paid 5.75% upon purchase.

In other words, if this is the “alternative”, the real thing probably ain’t all that bad in comparison. Actually, just for the hell of it, let’s look at the alternatives to the alternative since this fund’s start date:

We won’t even get into the turnover and tax consequences here…

And yes, this is an extreme example – but again, coming from an extremely well-pedigreed management team, perhaps the best you could find. You would write Dr. Lo a check ten seconds after seeing him speak somewhere, trust me.

So this is why you rarely see fiduciary advisors getting excited about black boxes and unorthodox strategies – even when wrapped inside a friendly mutual fund casing.

But brokers on the other hand…

Wall Street Journal:

In 2013, liquid-alternative funds made up half of the net sales at firms like Bank of America Corp.’s Merrill Lynch and Morgan Stanley that sell mutual funds to investors, up from 38% in 2011, according to a report from Dover Financial Research, a Boston-based consulting firm, on behalf of the Money Management Institute, a trade association.

But despite that growth, investor portfolios have less than 5% of assets in liquid-alternatives funds, compared with as much as 20% recommended by banks.

One of the reasons money managers like the funds is the same reason financial advisers don’t: high fees. Because they use more complicated trades, the average expense ratio for a liquid-alternative fund is 1.9%, compared with 1.3% for a typical mutual fund and 0.8% for an index fund, according to Morningstar. An investor would pay $190 for every $10,000 invested in a liquid-alternative fund, versus $80 for every $10,000 in an index fund.

We see here a stark contrast between the brokerage model and the advisory model, through the lens of a predilection for complex, expensive products.

The broker who sells liquid alt funds gets paid on those fees while the true financial advisor gets paid the same amount whether he recommends these funds or not – and he only gets paid by the client, never receives compensation from the fund family.

Night and day.

There’s nothing wrong with liquid alternative funds – some of them do things for a portfolio that other solutions and strategies simply can’t. But how much is the salesman’s compensation driving these recommendations? If all things were equal, we’d be able to find out. But they’re not.

The bottom line is that brokerage sales forces, in the aggregate, will usually push the higher-margin, more complex product – even while referring to themselves as “financial advisors.” Their whole-hearted embrace of really expensive, often inscrutable liquid alts is just one more example of this.

Source:

Financial Advisers, Firms Spar Over Alternative Funds (WSJ)

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/05/28/brokers-liquid-alts-and-the-fund-that-never-goes-up/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/05/28/brokers-liquid-alts-and-the-fund-that-never-goes-up/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/05/28/brokers-liquid-alts-and-the-fund-that-never-goes-up/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2014/05/28/brokers-liquid-alts-and-the-fund-that-never-goes-up/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/05/28/brokers-liquid-alts-and-the-fund-that-never-goes-up/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2014/05/28/brokers-liquid-alts-and-the-fund-that-never-goes-up/ […]