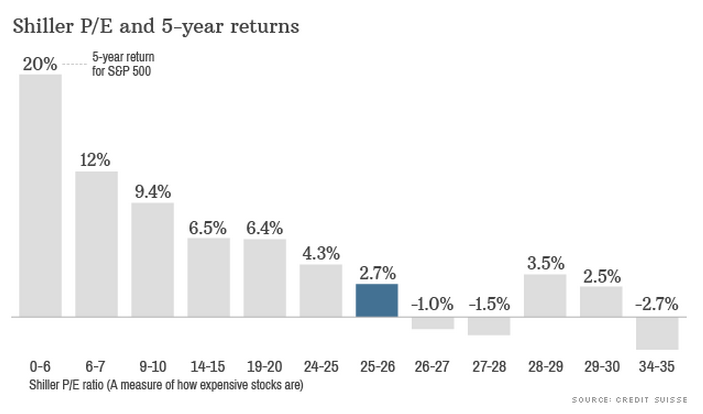

Chart below from Credit Suisse via CNNMoney:

The S&P 500 currently sells at a cyclically adjusted PE (a smoothed out multiple of ten years’ worth of earnings) of 25 right now. History suggests that the next five years are likely produce subpar returns for US stocks, on a go-forward basis, of just 2.7% annualized between now and 2019. Over the last 130 years, according to the Credit Suisse analysis, stocks sold for an average CAPE ratio of 16 – so by this measure we are fairly expensive.

Here’s the problem with buying into this CAPE argument hook, line and sinker…

First of all, interest rates have almost never been this low for this long – people need a return on their capital, as do insurance companies, pensions, sovereign wealth funds and corporations. It makes perfect sense for us to be selling at an elevated CAPE and there’s no reason this couldn’t continue.

Second of all, CAPE ratios have been elevated above that 16X average for most of the last 25 years. So if you were waiting to buy in at a level below it, you’ve been on the sidelines for the greatest value-creating era of all time. CAPE may have some predictive value but not always and it is certainly not omniscient.

Third, of course we know that the numbers above are average rates of return – by definition averages are produced by much more wide-ranging highs and lows.

Fourth, we also know that the modern investors’ opportunity set is far from limited to just large cap US equities. It’s never been cheaper and simpler to diversify beyond the S&P 500 – where CAPE ratios leave stocks at much less expensive valuations. So even if we’re to see subpar returns for the US, that’s only 50% of the world’s total equity market capitalization.

Fifth, and as we’ve argued here for years (see Leaving CAPE Town), the financial losses of 2008-2009 have drastically skewed the previous decade’s earnings to the downside thereby making a CAPE including those years higher than it would normally be. Purists would argue that this is the exact reason why CAPE works to begin with. Pragmatists argue that the accounting laws around earnings losses have changed, rendering comparisons to previous periods unfair or silly.

Sixth, and as Credit Suisse points out, the forward multiple we’re currently selling at is a very average 15 times the coming year’s earnings. There’s nothing egregious about that.

Seventh, CAPE is a valuable tool for assessing the long-run valuation of this market era relative to history but a tool is all it is – not an answer. Like all other measures and metrics, it should not be used in the absence of other tools, common sense included.

Eighth, most of us investing are looking at time horizons that far exceed the next five years being discussed here by Credit Suisse. Accepting the good times with the bad is part of what it means to be an investor. As Morgan Housel explained last week, the only reason we can make money with stocks long-term is because of the ever-present risk of drawdown short-term. Anyone claiming an ability to have their cake and eat it too is a liar or a fool.

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2014/05/22/cape-forward-returns-and-you/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/05/22/cape-forward-returns-and-you/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/05/22/cape-forward-returns-and-you/ […]