Yes, I’m excited about Michael Lewis’s new book Flash Boys coming out this week but no, I don’t get worked up about high frequency trading anymore.

I’m going to tell you a quick story and then you won’t either.

Once upon a time in the late 1700’s, there were two types of sonofabitches trading the earliest version of securities in Lower Manhattan: There were the auctioneer sonofabitches and there were the merchant sonofabitches.

The auctioneers were all-powerful and totally destructive at times. They presided over trade, which took place outside under a Buttonwood Tree on Wall Street. What the auctioneers did that was most maddening to the rest of the participants in these protozoic markets was charge exorbitant commissions and allow for securities to trade in a lawless fashion, without regard for fairness of any kind.

Meanwhile, the cutthroat speculators were growing to be quite fed up with this arrangement so they did what all would-be conspirators do – they met in secret to plot an overthrow. In March of 1792, twenty four of these merchant sonofabitches snuck into the Corre’s Hotel, which occupied what is now 68 Wall Street (which has since been absorbed into 40 Wall Street, aka the Trump Building), for their clandestine sitdown.

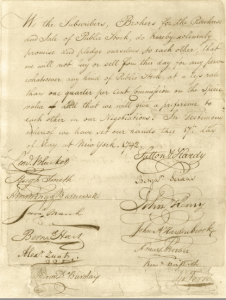

Two months later, they hatched their scheme, signing a document called the Buttonwood Agreement (at left), named for the tree they’d been wheeling and dealing under each day. The accord meant that all twenty four signers were bound to trade securities only amongst each other, to deny entry into their clique to outsiders who’d not been accepted by the membership and to fix commissions on trades at a set amount (.25% of face value for all shares of stock or similar instrument). This banding together made these twenty four large-scale merchant sonofabitches into the de facto monopoly that controlled all trade and it sent the other sonofabitches, the auctioneers, out of business.

Two months later, they hatched their scheme, signing a document called the Buttonwood Agreement (at left), named for the tree they’d been wheeling and dealing under each day. The accord meant that all twenty four signers were bound to trade securities only amongst each other, to deny entry into their clique to outsiders who’d not been accepted by the membership and to fix commissions on trades at a set amount (.25% of face value for all shares of stock or similar instrument). This banding together made these twenty four large-scale merchant sonofabitches into the de facto monopoly that controlled all trade and it sent the other sonofabitches, the auctioneers, out of business.

And then a constitution for the exchange was written. And then 73 years later in 1865 the buttonwood tree came crashing down during a thunderstorm – the first Flash Crash, incidentally 😉

Anyway…

The two-dozen sonofabitch signers of the Buttonwood Agreement had the whole game on smash, they formed the nucleus around which the New York Stock Exchange would eventually coalesce.

And once they’d seized control of all securities trading on The Street, chasing out anyone who didn’t want to play by their rules, they ran that shit like a powdered-wig mafia. If you were on the other side of their trades, even unknowingly, you were done.

The bottom line is this – there have always been insiders, unscrupulous dealers and some participants with unfair advantages over others. HFT is just the latest in a long line of shenanigans and the moment you outlaw it or modify it or babysit it out of existence, there’ll be a new broad-daylight robbery format waiting right behind it.

As we see from the events of 222 years ago this spring, the stock market hasn’t become rigged, IT STARTED OUT RIGGED.

Get over it.

***

Sorry Michael, didn’t mean to steal your thunder. The book is here:

[…] So stop hating the players and learn to play the game. I love this historical look at why ‘the market is rigged’ by Josh […]

[…] The stock market has been “rigged” since day one (The Reformed Broker) […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/03/30/the-stock-market-is-rigged/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/03/30/the-stock-market-is-rigged/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/03/30/the-stock-market-is-rigged/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/03/30/the-stock-market-is-rigged/ […]