Just wanted to revisit something I did on January 5th for a moment, from my year-opening post “You Are Here“. In it, I tried to come up with the most likely scenario for 2014 and I hit upon the 1994 analogy as my top guess:

1. The 1994 – A flattish, low volatility market in 2014 as the two opposing forces of reduced stimulus and slightly better-than-expected economic growth fight each other to a draw. Stocks go nowhere in the end with little gyration to speak of. Incidentally, this would be the outcome that frustrates the most players – all the passive index johnny-come-lately’s who require a rising tide don’t get it, all the long/short hedge funds and vol-starved traders don’t get their desert oasis in this scenario either. Bear in mind that many of us are beginning to use 1994 as our analog here and for good reason – it’s a mid-bull market year shortly after recession with a pickup in earnings but with interest rates beginning to rise as well. In ’94, you got 20% growth in S&P earnings but a flat market because rising rates led to a 25% compression in PE multiples. That particular rate hike cycle involved the Fed Funds Rate rising 300 basis points and it took place over 14 months. Once it was completed, in early 1995, the S&P 500 was off to the races for the next five years. I wouldn’t fall out of my chair if we went through something similar now as rates normalize and stocks digest huge gains. Consolidation is terrific and I certainly would much prefer to correct through time rather than through price any day of the week.

So far, this is pretty much what’s transpired as we come to the close of Q1. Rates haven’t exactly risen but expectations for rate hikes certainly have. Volatility has been minimal and stocks have largely done nothing – frustrating all but the most nimble.

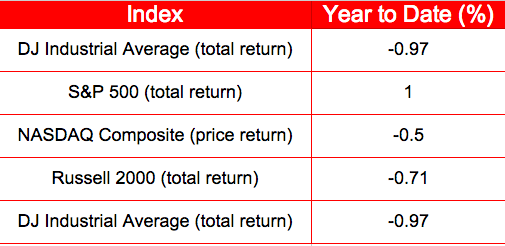

As it stands, the US stock market looks to finish the first quarter of 2014 flat. See indices below, data via Morningstar through the close on Friday 3/28:

On a price basis, the S&P 500’s gain is cut in half to just 50 basis points this year – and the composition of sectors that got it there ought to be quite troubling for the “new secular bull market” crowd. See chart below, via State Street SPDRs:

Now let’s keep it real – sector leadership, in and of itself, is not at all predictive of what’s to come most of the time. The beginning of 2013 started off with a bang and the big leadership groups were also consumer staples, telecoms and utilities. If that caused you to sell, you missed one of the greatest years for stocks of all time – by mid-year consumer discretionaries, techs and industrials were more than happy to take the baton and power us higher. Anytime someone’s spinning a narrative around which sector is leading that particular day, change the channel – it’s a loser of a thesis.

Let’s talk about what’s happening right now…

Sometimes markets are fairly simple and intuitive: This year the economic data has been mixed and inconclusive, those betting on acceleration have so far been unrequited. The tapering of Fed stimulus has kept stock price multiple growth in check after a 20% + jump in PE ratios last year. Buyback activity has maintained its pace from the end of last year but the growth rate of new repurchase announcements has leveled off. Earnings have been good, not great, but margins are maxed out (9.5%!). Revenue growth will be the new buzzword as the Q2 season gets underway (institutional investors have begun to display and vocalize a clear preference for return ON capital versus financial engineering after five years of management caution). A lack of major catalysts ahead favors the “sell the rips” camp but, absent some major dislocation, it’s hard to see what could drive the unbiased observer to get crazy-bearish here – Ukraine? Mid-terms? Please.

A month-by-month look at how we’ve arrived at a flat-on-year outcome will be be instructive as well:

The January selloff (roughly 6% peak to trough) was largely driven by profit-taking and the massive rebalancing being executed by millions of investors and their advisors with tens of trillions under management – trimming gains on stocks and adding to bonds was a no-brainer at the year’s beginning. There was no news other than the weather, which sucked, to have precipitated the selling. This is a good reminder that compiling lists of major risks is entirely unnecessary because dips happen on no news also.

The February bounce was incredible. Participation ramped up, internals were fantastic and virtually everything began to climb back to the December 31st closing highs. We gained back 7% from the bottom for a total gain of 4.3% on the month, basically a rally in a straight line as the early, over-eager shorts who jumped on the January slide were barbecued once again. For old times’ sake 🙂

March was a motherf***er for just about everyone. On the one hand, you have the “popular” momentum stocks down enormously from their peaks – Twitter, Amazon, Netflix, Facebook, Tesla, Chipotle all smashed. On the other hand, JNJ and Microsoft were still breaking out to all-time or decade highs by month’s end, as though the carnage in the Cool Kids sectors was a distant ship’s smoke on the horizon (see what I did there?). In the meanwhile, the most popular sector for speculators in recent years – biotechnology – has just been absolutely pummeled. The Nasdaq Biotech Index was down 7% over the past week and 13% for the month. It’s worth noting that biotech stocks have doubled from 10% to almost 20% of the once-defensive healthcare sector in the last two years and they now represent 15% of the Nasdaq Composite’s market cap weighting. In other words, what was once a relatively obscure and idiosyncratically volatile corner of the market is now more influential on the bigger picture.

These cross-currents and contretemps are all quite jarring for even veteran market-watchers who need to come up with an explanation for this action. What does it all mean?

Probably nothing. The easiest explanation is the simplest: Uninspiring economic progress, possibly driven by weather, collides with a slightly expensive stock market as investors digest massive gains from the year before. End of story.

Now what?

[…] 2014 has been pretty meh so far (Reformed Broker) […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2014/03/30/so-far-so-meh/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2014/03/30/so-far-so-meh/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/03/30/so-far-so-meh/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/03/30/so-far-so-meh/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/03/30/so-far-so-meh/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/03/30/so-far-so-meh/ […]