The hottest topic this year so far is whether or not Emerging Markets stocks and bonds are a buy. After more than three years of massive underperformance versus developed markets and a huge disparity in valuation, is now the time to get excited about the foreign investments that no one else will touch?

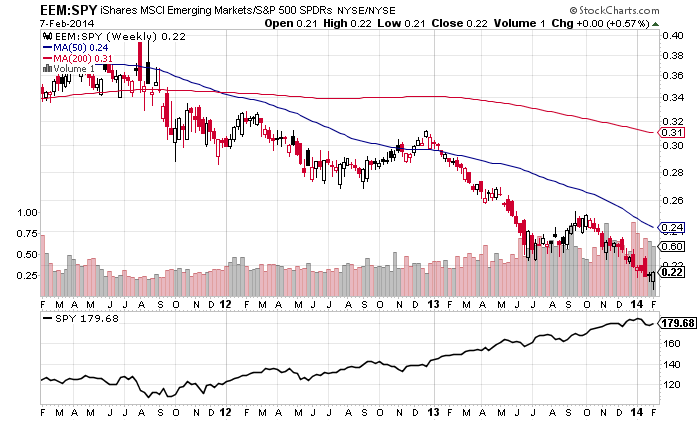

To give you some context as to the magnitude of underperformance, let’s take a look at this simple ratio chart of EEM priced in SPY along with some moving averages. The suffering is endless going back to 2011 and the trend on this weekly chart says there’s no end in sight. The pane below is the plain ol’ SPY, which would make the casual observer ask “Why buy anything else?”

So now what? Another three years of underperformance and outright losses? Or worse?

I’ve got some interesting reading for you on the topic, all from the last week or so…

Is it 1997 all over again? EM bulls scoff at the idea: this time, they say, is different, and for solid reasons.

Two things especially have changed, according to this view. Emerging markets no longer have such high levels of debt relative to GDP. And whereas in the 90s many EMs had a lot of dollar-denominated debt backed by local-currency revenues (the so-called “original sin”), much of this has been replaced by local-currency debt.

Original sin in emerging markets: it’s back (beyondbrics)

When a repeated set of minor chords builds slowly but steadily during a scary movie, it’s usually clear what’s coming next. The notes are about to flash suddenly higher, and whatever it is that is threatening the hero will be revealed to have been lurking right behind him the whole time.

Similarly, the forces driving the second major emerging market selloff of the past year are not exactly a surprise…But do we have a full-blown crisis on our hands? Credit Suisse analysts and economists say no.

Emerging Markets: It’s Still Not a Crisis (The Financialist)

Enter reality. Yes, in reality, the emerging markets — taken as a whole — aren’t any more dangerous than the generally profligate developed world. “That notion is an illusion,” says Rob Arnott, CEO of Research Affiliates. “Do I buy what’s expensive, where the reality is really worse than advertised — meaning U.S. stocks and bonds?” Arnott frames the question. “Or do I buy a market that is cheap and perceived as troubled, where the reality isn’t nearly as bad?”

Fear be damned: This is the time to invest in emerging markets (Fortune)

The Sunday Telegraph has constructed a special league table of 55 different nations, ranked by the potential for company shares to soar, which we publish today.

It was calculated by how “cheap” share prices are in that market, relative to the true strength of the businesses behind them. Put simply: the cheaper the shares today, the more potential for investors to make future gains as share prices play catch up…Our research, which combined three key measures of “value” used by professional investors, revealed Russia, Hungary, Turkey, Austria and Italy as the cheapest markets.

Where in the world are shares cheap? (Telegraph)

Since the inception of the MSCI Emerging Markets Index in 1988 through the end of 2013, EM stocks have returned nearly 1,900% or roughly 12.1% per year. Compare that with the nearly 1,200% gain or 10.4% a year in the S&P 500. Ten thousand bucks invested in the EM index grew to almost $196,000 while you got around $130,000 in the S&P 500.

Sounds great, but you have to be an extremely aggressive and patient investor to be able to stomach the ups and downs in emerging market stocks.

Putting Emerging Market Stock Losses Into Perspective (A Wealth of Common Sense)

I suggest reading them all if you can and then see if you agree or not. Then check out my piece from yesterday about the massive EM outflows this year:

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2014/02/09/emerging-markets-here-come-the-bulls/ […]

… [Trackback]

[…] There you can find 3525 more Info to that Topic: thereformedbroker.com/2014/02/09/emerging-markets-here-come-the-bulls/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/02/09/emerging-markets-here-come-the-bulls/ […]

… [Trackback]

[…] Here you can find 42247 additional Information to that Topic: thereformedbroker.com/2014/02/09/emerging-markets-here-come-the-bulls/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/02/09/emerging-markets-here-come-the-bulls/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/02/09/emerging-markets-here-come-the-bulls/ […]