In some ways, Wall Street will be forever chastened and changed by the events of the credit crisis and its aftermath. But in other ways, business as usual will surely continue for the nation’s Systemic Six banks, even if it’s a largely scaled back affair as Ben White demonstrated at Politico the other day (see How Washington Beat Wall Street).

Ben White tells us that the prevailing narrative, that the banks are methodically spaying and neutering the new regulations before they can even be implemented, is not exactly accurate “on the ground”:

Goldman Sachs, the biggest money machine in Wall Street history, is a shell of its former self. Morgan Stanley, Goldman’s one-time bitter rival in the swashbuckling world of high-risk trading, is transforming into a staid money management firm with a side business underwriting stocks and offering merger advice.

Citigroup and Bank of America sold off many of their classic “Wall Street” businesses, including proprietary trading desks and private equity and hedge fund stakes, to comply with the Dodd-Frank financial reform bill.

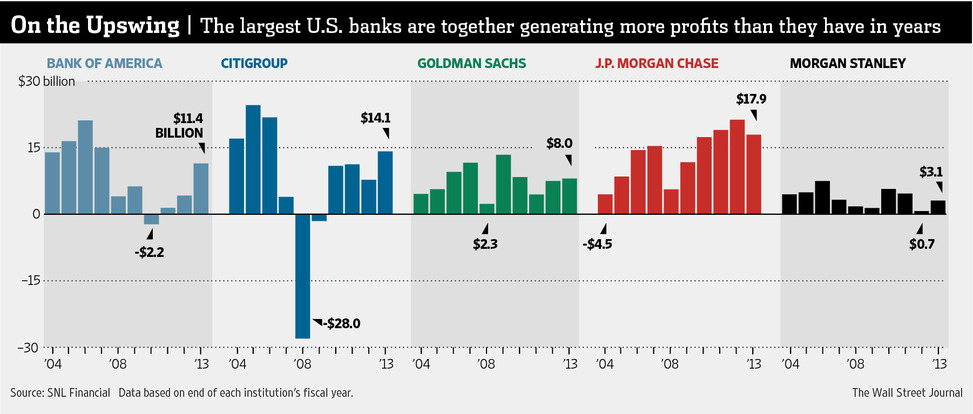

Contra to Ben’s take, the Wall Street Journal tells us that profits for major financial institutions are right back to where they were, give or take, prior to 2008….

After a five-year stretch in which J.P. Morgan Chase & Co., Bank of America Corp., Citigroup Inc., Wells Fargo & Co., Goldman Sachs Group Inc. and Morgan Stanley have been buffeted by sluggish growth, a European debt crisis and a spate of new regulations, executives and analysts say the worst is behind them.

As a group, the six earned $76 billion in 2013. That is $6 billion shy of the collective all-time high achieved in 2006, a year U.S. housing prices peaked amid a torrid economic expansion…

Despite the many challenges, big banks are beginning to find ways to boost revenue. The six largest banks posted a 4% revenue gain during 2013.

Smaller banks are recovering, as well. Earnings reports are still being released, but, together, all 6,900 commercial banks in the U.S. are on pace to match or exceed the industry’s all-time earnings peak of $145.2 billion in 2006, according to an analysis by The Wall Street Journal of Federal Deposit Insurance Corp. data.

Josh here. I’m okay with this. I’ve already made my peace with the fact that nothing was really and truly going to be different and that systemic risk / Too Big To Fail was here to stay. It’s fine.

The reality is that banks have armies of lobbyists and paid-off congresspeople and there is quite literally no one with the money or incentive to relentlessly fight back from the other side. We’ll just have to watch helplessly as these motherf*ckers blow themselves up again and take a big chunk of the economy down with them. Can’t be avoided, it’s like extreme weather.

Not that anyone seems particularly worried right now. Not anymore.

What’s for dinner, anyway? And which Super Bowl party should I attend? Does the dog need to go for a walk?

American apathy.

Sources:

Profits Show Biggest Banks Are Back From the Brink (WSJ)

How Washington beat Wall Street (Politico)

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/01/20/the-empire-strikes-back/ […]