In the aftermath of the Fed’s first hint at tapering this past spring, mortgage rates shot up a bit along with the entire complex and the narrative was that the Fed just opened its stupid mouth too soon and staked the housing recovery right through the heart. “That’s the end of the cycle,” we were told. The new home sales data softened concurrent with the rise in mortgage rates and the pundits drew a line between A and B to explain it.

But just-released data from the month of October tells us we may have been premature – it could be that the housing market is digesting these (minimally) heightened rates and plowing on ahead. If this is the case, there are positive implications for the rest of the economy as QE begins to unwind – an affirmation that we can, in fact, tolerate rising rates without stumbling.

Here’s Bank of America Merrill Lynch’s US Economics team this morning:

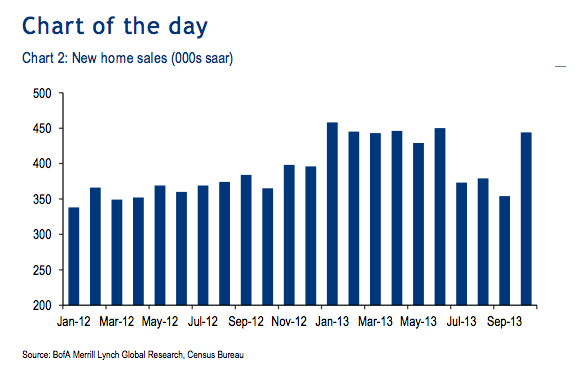

New home sales: Sales of new single-family homes climbed 25% in October, reversing the weakness in summer and early fall. This mini-downturn in sales was seemingly in response to the spike in mortgage rates this spring and the gain in October suggests it was transitory.

Wishful thinking or a true sign of resiliency?

Source:

Talk it out

Bank of America Merrill Lynch Economics | United States

17 December 2013

… [Trackback]

[…] Here you can find 58736 more Info on that Topic: thereformedbroker.com/2013/12/17/did-the-housing-market-already-digest-higher-mortgage-rates/ […]