361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

July 15, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

The Great Rotation continues forward as Zoo Master Ben tames the Taper…

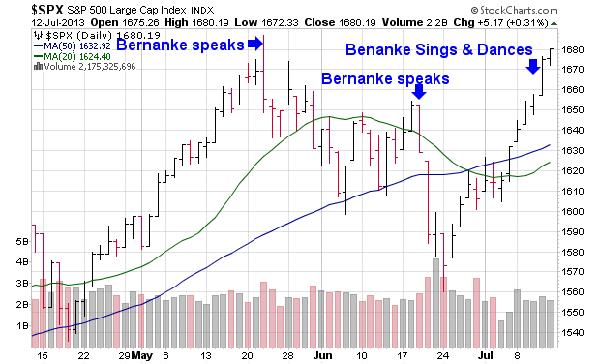

Fed Chairman Ben Bernanke grabbed the mic on Wednesday and gave a performance that garnered a standing ovation from Stock, Bond, and Commodity investors. Only U.S. Dollar longs went home dragging their programs and spilling their popcorn. As a result, U.S. equity markets ended the week at all-time highs as stocks remained the darlings of the asset classes.

Bernanke signals no early end to QE…

Ben Bernanke yesterday indicated that the Fed will keep the money printing presses ramped up for a while to come, saying “that highly accommodative monetary policy for the foreseeable future is what’s needed for the U.S. economy.” The chairman’s comments came after minutes from the last FOMC meeting showed policy makers divided between those who believe that tapering is warranted soon and those who want to see further improvement in the labor market first. (SeekingAlpha)

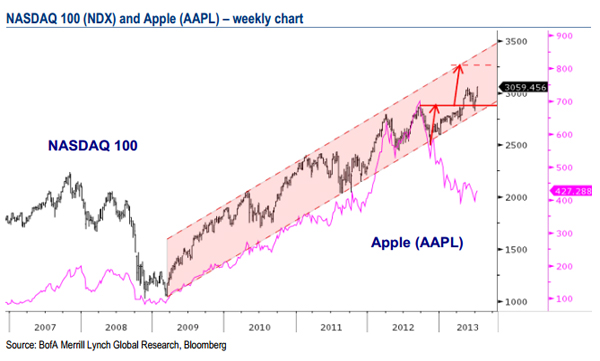

Within the U.S. equity markets, the Nasdaq100 put up its 13th day in a row of gains…

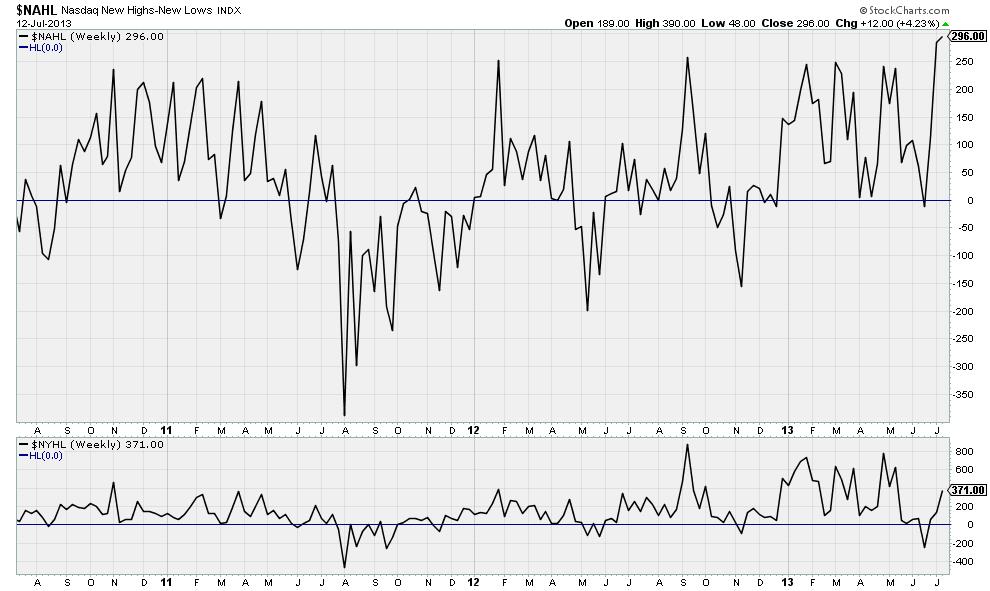

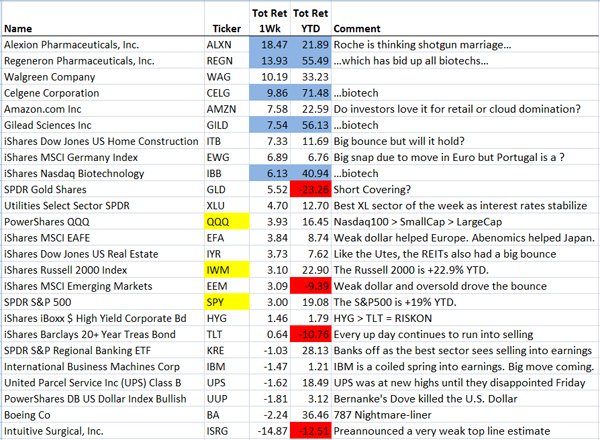

Helping the Nasdaq has been the breadth of the advance, which surged to new highs behind the strength in Smaller Caps, Technology and Biotech…

If only Apple still had a $700 stock price, the Nasdaq would be the year to date leader among the major indexes…

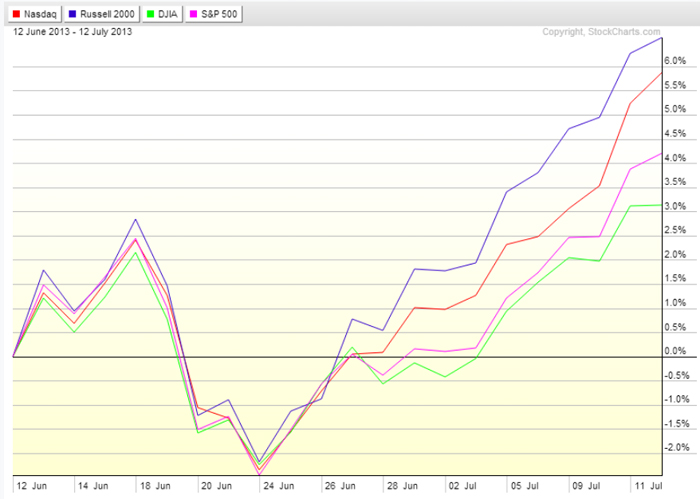

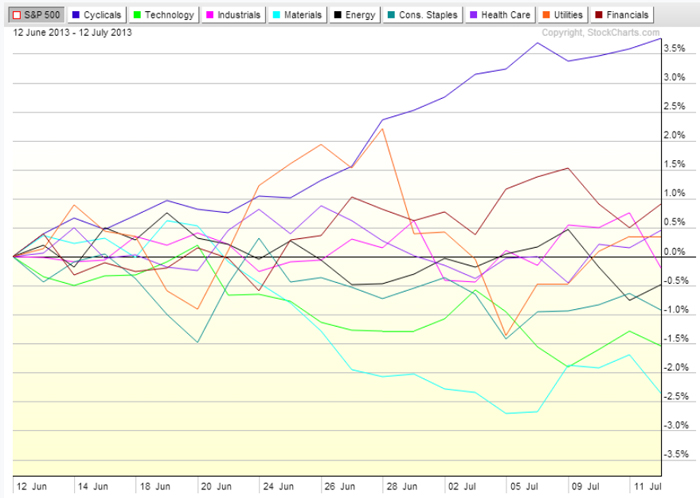

Looking more closely at the bounce off the lows 3 weeks ago also shows continue leadership from Small Caps…

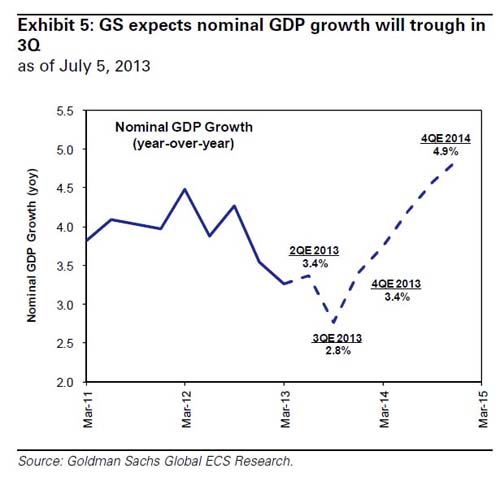

One primary reason for Small Cap outperformance is that it has the most direct exposure to U.S. GDP…

Roughly 80% of Russell 2000 sales are derived domestically, compared with 66% for the S&P 500, which is more exposed to foreign economic growth and FX. Our economists expect that U.S. GDP growth will accelerate from about 1.5% now to over 3% in 2014-2016. The high exposure to domestic growth also insulates small caps from recent investor concerns about the impact of a strong dollar and uncertain EM growth on U.S. corporate earnings.

(Goldman Sachs)

Another RISKON signal is seen in the outperformance in Cyclical stocks over the last month…

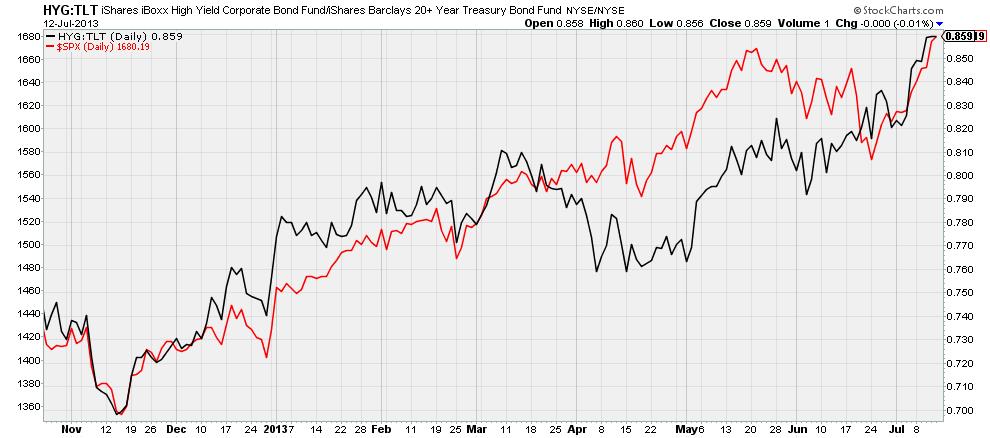

And of course, we must note the bounce in Junk Bond performance last week…

…which even shows continued outperformance versus Treasuries…

Note the VERY high correlation with the S&P500 which is why we keep a close eye on the Junk to Treasury spread.

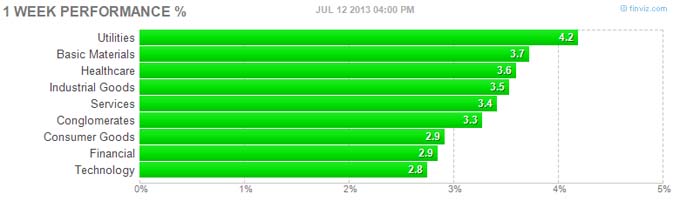

Looking closer at the week, it was UP across the board for the markets with all sectors gaining strongly…

The best subsector was the Biotechs, given the ongoing M&A interest by Big Pharma and Big Biotech. Utilities and REITs also bounced due to their interest rate sensitivity. Europe did well with the weakness in the U.S. Dollar…

As the earnings period gets under way, one giant elected to pre-release a disappointment on Friday to put a damper on the Transports…

UPS said Friday that overcapacity, increasing customer preference for lower-yielding shipping services, and a slowing U.S. industrial economy drove revenue and operating profit below its expectations. The shipping company now expects to post adjusted earnings of $4.65 to $4.85 a share, versus its previous view of $4.80 to $5.06, which was below market expectations when issued in January. Street consensus for the year was $4.95, according to FactSet. Second-quarter earnings are expected to be $1.13 a share, below estimates of $1.20, according to FactSet. A part of the lowered outlook is being driven by changes within the industry, but even those changes are being driven by the weak economy. ”We believe the industry is going through a secular change as customers continue to opt for lower cost alternatives to priority air,” Cowen analyst Helane Becker wrote. “We do not expect to see a significant uptick in next-day priority services until we see a global recovery and not just a U.S. recovery.”

(WSJ)

Q2 reports will pick up next week…

As is typical in earnings, financials will dominate the early part of the season with C, BAC, BLK, STT, STI, USB, PNC, and BX among the notable names. Tech names will also be well represented with IBM, GOOG, YHOO, EBAY, INTC, SNDK, XLNX and NOK. Some other companies of note include: CSX, UNH, UNP, KO, JNJ, and MOS. (Briefing.com)

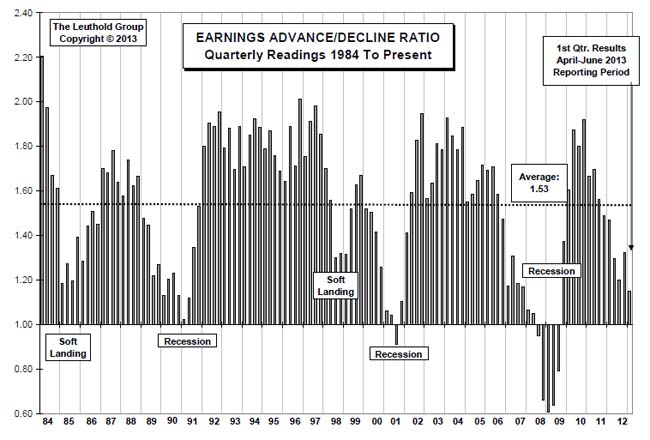

Although stocks are up into the earnings period, one thing the market does have going for it is that expectations are low as a result of the slow growing economy…

(@LeutholdGroup)

But the stock market is a discounting machine and it is not placing value on the Q2 or Q3, but instead looking out to the 2014 earnings potential…

And Goldman, like many others, thinks that GDP growth will ramp through 2014.

One shining area of the U.S. economy remains consumer spending and June retail sales did not disappoint…

Retail sales got a summer shape-up in June as cheerier job prospects, toastier temperatures, and more affordable fuel prices gave the gauge its biggest boost since the beginning of the year. Same-store sales at shops open at least a year — a measure that strips out the volatility of openings and closings — rose 4.1% last month from the same period a year earlier, according to Retail Metrics Inc. The surge is the largest of the year behind a 5.1% swell in January. June results beat forecasts of a 3.7% boost and also outperformed the 3.8% increase recorded in May, as well as a 0.3% upswing in June 2012.

(LATimes)

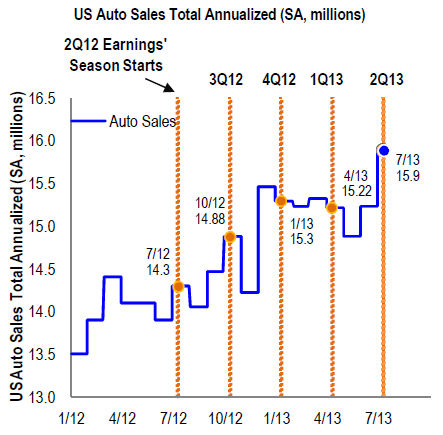

…neither have U.S. auto sales…

(JPMorgan)

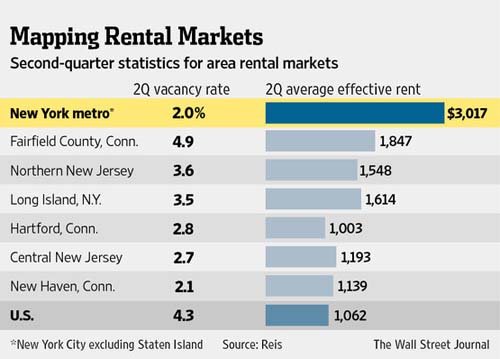

And if you are a landlord in New York City, can the sentiment get any better than today’s environment?

New York City’s average rental rate crossed $3,000 for the first time in the second quarter, rising 1% to $3,017 a month, according to new market data… New York landlords are able to raise rent because there is little inventory available, in part because it is the season when recent college graduates flock to the city. New York’s vacancy rate was 2% in the second quarter, well below the national 4.3% rate, according to Reis. With few apartments up for grabs, brokers are urging prospective tenants to carry financial paperwork with them to showings and to make a decision quickly.

If you are looking for fuel for the Great Rotation discussion, how about the very low direct exposure of American’s owning equities…

According to Gallup’s annual Economy and Finance survey, only 52% of Americans are either personally or along with a spouse invested in the stock market as of April 2013. This is the lowest number since Gallup began the survey in 1998 and 13% lower than the pre-recession high in 2007. It is possible that this has to do with the impacts of emotional investing or peoples’ decreasing appetites for risk since the recession.

(BlackRock)

Meanwhile, adding to the ‘sell bonds on every bounce’ argument last week was Goldman Sachs & Merrill Lynch:

- Goldman Sachs Group Inc. GS revised its forecasts for the 10-year Treasury note yield upward Sunday in the wake of announcements from the European Central Bank and a strong U.S. unemployment report last week. The investment bank now expects the benchmark yield to hit 4% by 2016 and begin 2014 in a range of 2.75% to 3%, according a report by analyst Francesco Garzarelli. Goldman cites an improving economic outlook in the U.S., a scale-back in the pace of the Federal Reserve’s bond-purchase program, and waning systemic risks in the euro zone. (MarketWatch)

- Fundamentally, we have shifted from the camp of buying dips to selling rallies. While we are not super bearish, we have to acknowledge that many of the forces that had kept rates compressed for so long are subsiding (a Fed purchase program for nearly three years, downside risks, central bank demand, safe haven flows from Europe, and bond fund inflows). Therefore we believe that 10s should settle down around 2.6-3% for the rest of the year… Apart from better data and a different Fed reaction function, we are concerned about a continued slowdown in demand from traditional buyers. We look to sell if the current rally continues and we reach 2.4-2.5% on 10s. (BofAML via Barron’s)

Merrill Lynch even noted what their customer activity has been since the birth of “The Taper”…

Since the “taper tantrum” began in May, BofAML private clients have bought $7bn of stocks, sold $7bn bonds and raised cash by $2bn. (BofAML)

As did Vanguard which saw its first firm wide redemption in 19 years as a result of the exodus in fixed income…

Investors redeemed $432 million from Vanguard in June, including mutual funds, exchange-traded funds, and money market funds. The outflows at Vanguard were driven by a $7.4 billion outflow from the firm’s taxable bond funds and a $2.5 billion outflow from municipal bond funds. Industry wide, those two category groups had outflows of $68 billion. Despite the outflows, the firm still managed to gain market share on the month as industry assets declined at a faster rate. While Vanguard’s flows were not unusual given the acute reaction to the Fed’s talk of tapering its asset purchase program, the outflow was the first firm wide outflow since December 1994. Excluding money market funds, Vanguard’s outflow was $5.5 billion, while PIMCO led all firms with a $14.3 billion outflow. (Morningstar)

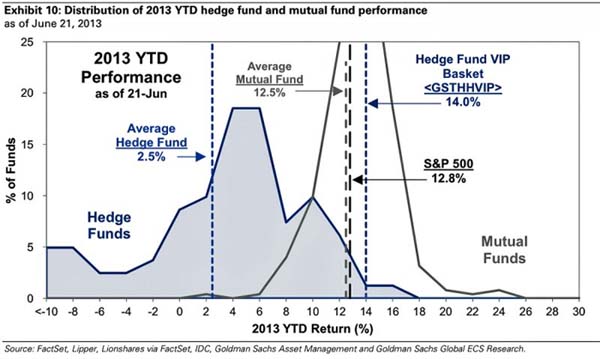

Bloomberg Businessweek, The Atlantic and others threw dirt clods at Hedge Funds this week…

But according to this graph, their top 50 stock picks are outperforming both the indexes and the long only managers in 2013. Their total return stream might be less than the others, but the vast majority of hedge funds are not running 100% long portfolios like an ETF or a Mutual Fund.

One more time, if you know any recent graduate looking for a job, tell them to move to Dallas, Austin, San Antonio, or Houston. There is a reason why this State is creating 300,000 new jobs per year…

@ianbremmer: 1/3 of all net job creation in the US over the past decade comes from #Texas.

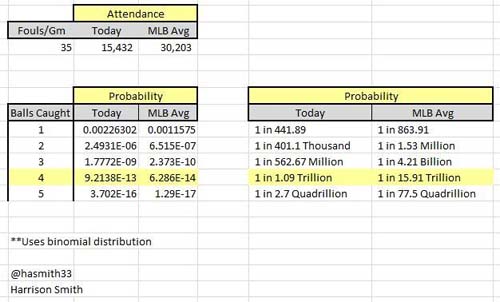

Geek Stat of the Day: Odds of catching 4 foul balls at a baseball game > 1 in 1.1 Trillion*…

* This number should be higher to exclude all outfield tickets (which would be a homerun), as well as other random seats which would never have access to a foul ball (behind a netted, glassed, or blocked area).

This guy did it on Sunday…

@Indians: Found him: Tribe Season Ticket Holder Greg Niel has caught four foul balls today. Nice work Greg!

Finally, the funniest thing that I came across last week…

(@upsidetrader)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Here you can find 74949 additional Info on that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/07/16/361-capital-weekly-research-briefing-49/ […]