The Fed met just now, they said (I’m paraphrasing) that your grandchildren better get accustomed to low rates. The Hunt for Yield is probably going to continue so let’s talk…

When we think dividends, we typically think large, value-skewing, old line companies, what we used to refer to as widow-and-orphan stocks before the PC Police kicked in the door. As a result, most investors looking for yield are primarily doing so in the Dow 30, the Utility sector and in other blue chip areas.

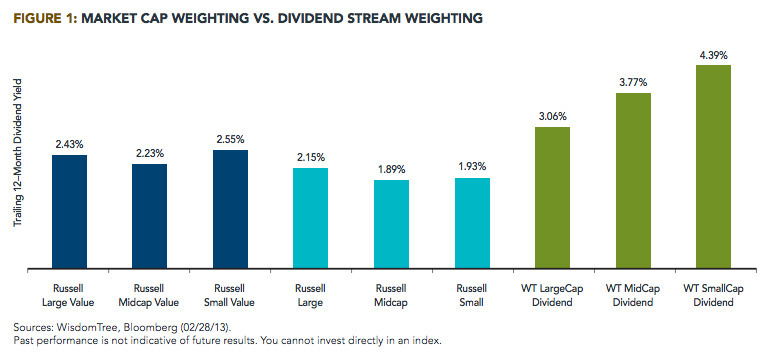

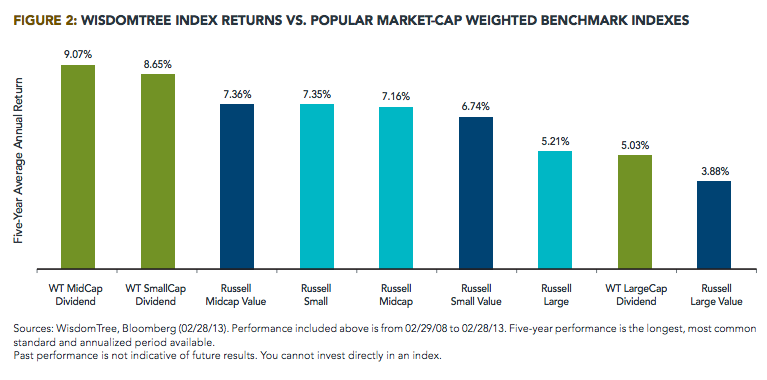

But there is another way, as Jeremy Schwartz and Tripp Zimmerman of WisdomTree demonstrate in a new research piece this month. It turns out that in both 12-months trailing dividend yield and in five-year historic returns, a small- or mid-cap dividend-focused strategy has noticeably outperformed a simple large cap value or traditional “dinosaur dividend fund” weighted by market cap size.

Two graphs from Jeremy and Tripp’s research break this down. Before I show them to you, please know that this is an informational blog post and not an advertisement or an inducement for you to place any trades. I don’t know you, man, I’m not your advisor. Past performance is only a guarantee that the minute you invest in something, it’s about to mean revert and go the other way 🙂 Anyway, that’s my official disclaimer.

Okay, check this out, first the trailing yields of the different cap-weighted and dividend-weighted funds:

Going down the size spectrum from the Russell 1000 (large) to the Russell Midcap (mid-cap) and the Russell 2000 (small) within the Russell index family of market cap-weighted indexes illustrated in figure 1, the indexes that focus on the larger market capitalization companies tend to have higher trailing 12-month dividend yields. The “value” slides of each size-based index present a mixed story: the Russell 1000 Value (large value) has a higher trailing 12-month dividend yield than the Russell Midcap Value (mid-cap value) but a slightly lower one than the Russell 2000 Value (small value).

And now, performance going back to 2008:

It’s not a secret that mid and small cap stocks outperform over time, but what is very much a mystery to most investors is how much oomph a small-mid value piece can add to a portfolio.

Full report here:

The Forgotten Dividend Payers: Mid- & Small-Cap Equities (WisdomTree)

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Here you will find 1094 additional Info on that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] There you will find 63139 additional Information to that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/05/01/dividends-dont-be-such-a-size-queen/ […]