Research Affiliates runs several funds and portfolios modeled on the premise that only with the “full toolkit” of all 16 major asset classes can investors meet their objectives in what could be a prolonged low-return environment.

Given their view that stocks and bonds offer less upside on a go-forward basis than what we’ve seen in the prior few decades, the last thing we should do is add components to our portfolios that virtually guarantee underperformance over a cycle.

Unfortunately, investors have plowed over $2 trillion dollars into the hedge fund complex under the misguided assumption that they’d be able to deliver alpha and absolute returns to juice performance. In actual fact, so-called “alternatives” have done the opposite for the vast majority of their investors. And before you say “But what about what’s his name?”, bear in mind that the rare few hedge funds that have consistently posted great returns would never in a million years take money from you. And the odds of you identifying an emerging manager from the ground floor who becomes Paul Tudor Jones are about the same as you making out with Kate Upton in an outdoor shower on a Tahitian beach. There are amazing and talented fund managers out there – but even the fund of funds industry has been proven ineffective in terms of being able to sort them out from the rest.

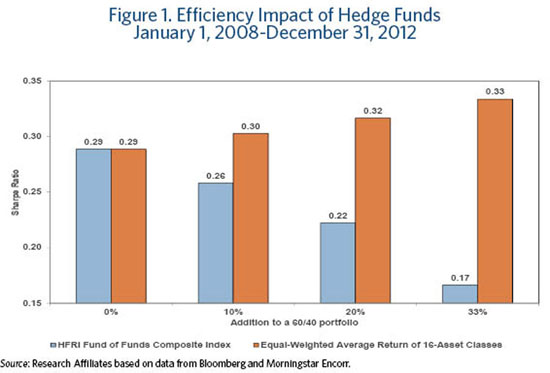

One argument you hear made a lot to justify the underperformance of hedge funds in the aggregate is that they are reducing portfolio risk. Below, RA’s John West shows us the results of “diversifying into hedge funds” over the last five years vs simply equal-weighting a basket of the aforementioned “full toolkit” in terms of Sharpe Ratio:

Hedge funds’ popularity and increasing adoption can’t be disputed. But on average, do they hedge (reduce risk) and do they fund (i.e., deliver returns to serve our retirements and other liabilities)? To test this notion, we add various levels of the HFRI Hedge Fund of Funds Composite to a simple 60/40 blend of the S&P 500 and BarCap Aggregate Bond Index over the past five years as seen in Figure 1. Why the last five years? Because it represents what many newer investors, those rushing to follow the endowment model in the middle part of the last decade, have actually achieved. Between 2002 and mid-2007, total hedge fund assets went from $626 billion to $1.7 billion, a nearly three-fold increase. Today the hedge fund industry manages $2.25 trillion of capital according to HFRI. Plus, the last five years have seen a variety of environments to qualify as a market cycle.

As shown in Figure 1, a pure 60/40 portfolio exhibited a Sharpe ratio of 0.29 over the five years ended December 31, 2012. Adding hedge fund of funds to a 60/40 portfolio reduces the overall return, resulting in a lower Sharpe ratio—a measure of portfolio efficiency. Upon adding a 33% exposure of hedge funds to this portfolio, the return falls from 3.8% annualized with plain 60/40 to 2.0%. This substantial decline more than offsets the favorable risk impact (standard deviation falls from 11.7% to 9.4%, a 19% decline) and the resultant Sharpe ratio falls to 0.17. Over the past five years, this category of investments, on average, has resulted in substantially lower portfolio efficiency!

Now of course, there are several benefits to being invested with hedge funds that Mr. West leaves out of his analysis. Namely, those awesome quarterly letters they pay someone to write for them. Also, you get to tell your friends about how you once had lunch with the rock star manager. Not to mention the thrill of possibly seeing your manager taken out of an office building in handcuffs someday.

So it’s kind of a trade-off if you want the glitz and glamor associated with the hedge fund limited partner lifestyle.

Source:

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] There you can find 16679 more Info to that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/04/22/use-hedge-funds-for-proven-return-reduction/ […]