This morning I opened up my hometown paper, Newsday, to see that the S&P’s breaking above 1500 was the story on page 2. If and when the Dow breaks its old record high above 14,000, that will not be on page 2, it will be on the cover. Not just of Newsday but of every newspaper serving every major metropolitan area in the United States. Because civilians don’t speak S&P, they speak Dow and when the Dow makes a new high it’s front page news.

And this news will be shocking to many for reasons I’ve outlined previously. Suffice it to say, most non-market participants still think we’re in a recession and automatically assume the stock market must be lousy, too.

How can this be?

Simple. Poor Richard’s Almanack (Ben Franklin in drag) says “Bad news travels faster than good news.” It has also been said that bears make headlines while bulls make money. There is truth to both of these statements and they are apt explanations for what’s taking place right now.

If you’re reading this post, you are no doubt well-versed in all of the reasons for why we should already be in depression and the market should instantly drop by 50%. The litany is long and frightening, here are the greatest hits:

1. China’s sitting on a shadow banking credit bubble powder-keg that’s about to blow.

2. Growth rates for developed nations are forever pinned below 5% thanks to unshakeable demographics and debt dynamics.

3. The Boomers are retiring daily now and pulling their money out of the stock market, downsizing their real estate needs and becoming a bloodsucking drag on the system.

4. Europe is not fixed, Mario Draghi only used words – not deeds – to forestall the collapse, all of the issues come back to haunt us this spring.

5. Debt Ceiling and Sequestration will mean negative GDP for the US and the Fed is out of bullets.

6. Profit margins for US corporations have peaked. 35% of the growth in earnings during this period have come from lower interest expense and the rest from firing people.

7. Based on Schiller 10-year CAPE, stocks are at 22x earnings vs a mean of 15. This as volatility (VIX) has nowhere to go but up and markets are short-term overbought.

8. The Fed, along with every other central bank, is embarking on a dangerous experiment of loose money/money printing, which will undoubtedly end in tears.

All of these are legitimate concerns and, when combined, they appear to be formidable. Until you realize that they are the consensus and have been consensus for-fucking-ever. Almost none of this is new information, these are very well-known and established concerns. And when the day of reckoning comes for each one of these, I would expect a great deal of market volatility and fear to take hold. Temporarily.

But it is important to understand that these problems will come to the fore and be dealt with against a backdrop that is not at all what the perma-bears would have you believe it is.

Let’s talk about the non-crisis condition we find ourselves in circa early 2013…

Initial jobless claims are dropping steadily as is private sector unemployment. The only place we continue to lose jobs is in federal, state and local government. This sets the stage for upward pressure on wages, the Holy Grail. The secret sauce we’ve been unable to slather on in this recovery has been the real confidence and behavior shift that comes from getting a raise, from feeling secure in your employment and willing to spend as though the money will keep coming in. Employment is the answer to so many of our ills it may as well be the only thing we discuss from here on out.

Another thing – Animal Spirits are back once again. The instinct to merely “protect the nest” is ceding ground to the awakening, almost primal desire for hunting and killing. The giddiness in the market these past few weeks is certainly a bit concerning – but it makes perfect sense. It is the adrenaline rush one feels coming off of a roller coaster or after a close brush with death. Skating past the debt ceiling thing felt like that for a moment, what you’re seeing now is an exhalation. And it is fueling exuberance, risk-taking and other things you’ve been conditioned to believe are somehow “bad” or reckless.

Dr. Phil Pearlman explains why this could go on for awhile once it begins:

Here’s the other thing about animal spirits.

They are normal, market native, periodic.

They are a phase as common as any other market phase. They arise regularly since there have been markets and this will always be the case.

Railing against them is a loser’s gambit.

Anyway, if you think we are in the midst of animal spirits as primary motivation of this market, then this move so far is peanuts.

I also want to talk about the potential for true economic recovery this year. It will come from two places at once if we are fortunate:

The first is the real wealth effect that comes from people’s homes growing in value (as opposed to the fake wealth effect from stocks which never works). Joe Lavorgna, Chief Economist of Deutsche Bank had this to say on the subject the other day:

we are projecting home price appreciation of 5-10% in 2013, which translates into a further increase in household assets, i.e. wealth creation, ranging between $860 billion and $1720 billion [$1.7 trillion]. To be sure, the wealth effect on consumer spending could be substantial.

The other place where previously unexpected economic strength could come from is in US manufacturing, which could very well be on the verge of its biggest renaissance in decades – maybe half a century. It is no longer a given that Americans are uncompetitive with Asia thanks to drastic increases in the cost of doing business in China. To say nothing of the incredible untold energy boom that is only now beginning to be appreciated. Barron’s new cover story this morning is all about the Next Boom – a massive wave of new industry thanks to $3 natural gas, plentiful domestic oil and water supplies, low square footage costs for new factories and an eager and capacious labor force that’s bursting to be put to good use. Toyota is now planning to ship minivans to Asia that they’ll build in Indiana. Airbus is building a plant in Alabama while Samsung is building in Texas. Quoted in the article is researcher Nancy Lazar, who declares:

“The U.S. is the Saudi Arabia of natural gas…and Middle America is my favorite emerging market.”

I highly recommend you read this cover story by Kopin Tan, the insights and new information within will probably pay for the whole year’s subscription.

Have a look at the start to the year enjoyed by stocks in the industrial and energy sectors – there is an accumulation underway that is about more than just rotation from bonds to stocks. There is a multiple expansion happening there presaging the cyclical upturn that virtually no one dares to speak of out loud. Energy stocks in particular are interesting in that they’ve been underperforming the rest of the market for years; analyst expectations for the sector are somewhat muted in 2013 yet again.

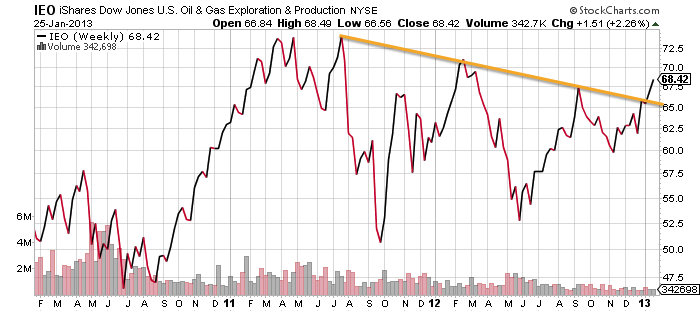

But the market is telling you otherwise, have a look at this breakout in the iShares DJ Oil & Gas Exploration & Production ETF, ticker $IEO (disclosure: long), that’s gotten underway this week:

That’s a breakout on a weekly timeframe. Within this ETF are your Devons and your Anadarkos, your Occidentals and your EOGs – the companies who will be at the heart of this boom as the United States becomes a net exporter of fossil fuel energy by 2025.

Industrials are telling a similar story with their share price advances. The idea that we can’t make things here anymore is being discredited everyday. And should global demand actually return, these stocks are too cheap, despite what they’ve done since the summer.

The way to think about 2013 is that we’ve gotten off to way too fast a start in January for most people’s comfort. And while it’s hard to say that stocks are expensive, it’s also heard to say that they’re cheap – they aren’t based on $108 in S&P earnings. But what the “peak profit margins” guys aren’t saying is that should growth and revenue begin to accelerate on the backside of the debt ceiling lurch this year, preserving abnormally high margins will become less important as top lines begin expanding. Also, declining margins aren’t a bad thing, per se – especially if they are declining because American employees are being paid more or because cash is being funneled into R&D budgets.

And so while the risks are real and will certainly provide opportunity throughout the course of the year, they are also well known and represent the core of consensus thinking right now. Even most of traditionally perma-bullish Wall Street has been fixated on them for ages.

Against such an awful and seemingly inevitable backdrop of tears and fears, the risk is to the upside. Pray for pullbacks; anticipate them like the cooling, restorative rainstorms they are.

Sources and Further Reading:

The Word is Out, Just So You Know (TRB)

Here’s the Thing About Animal Spirits (Phil Pearlman)

On the Dangers of Fighting the Last Investment War (Abnormal Returns)

Hamptons Average Home Price Hits Record on Luxury Surge (BusinessWeek)

Housing Wealth Effect (Deutsche Bank)

[…] Risks by Josh Brown. No doubt currency wars and printing are a driver […]

… [Trackback]

[…] There you can find 98050 more Information on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] There you can find 2857 more Info to that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/01/26/upside-risks/ […]