First, let me apologize on behalf of the markets for the fact that the fundamentals began mattering again and no one sent you so much as a text alert or an email. The market tends to do that sometimes. Just when everyone had settled on “the Fed is all that matters” and “Chase for Performance will lead us higher” – the market said, yeah f*ck you, and went down faster than a Petraeus biographer behind closed tent-flaps.

The world turned one revolution and all that had been working began to work against. Stocks dropped beneath all the short-term moving averages in concert with a symphony of off-key earnings reports – almost as in a willful attempt to show you just what they thought of the mo-mo clowns that had become your new messiahs.

But what must go down, musn’t necessarily go down in perpetuity or in a straight line. And so I wanted to show you the the three positive signs I saw in the market on Friday that lend credence to the potential for a bounce here.

These three signs were as follows:

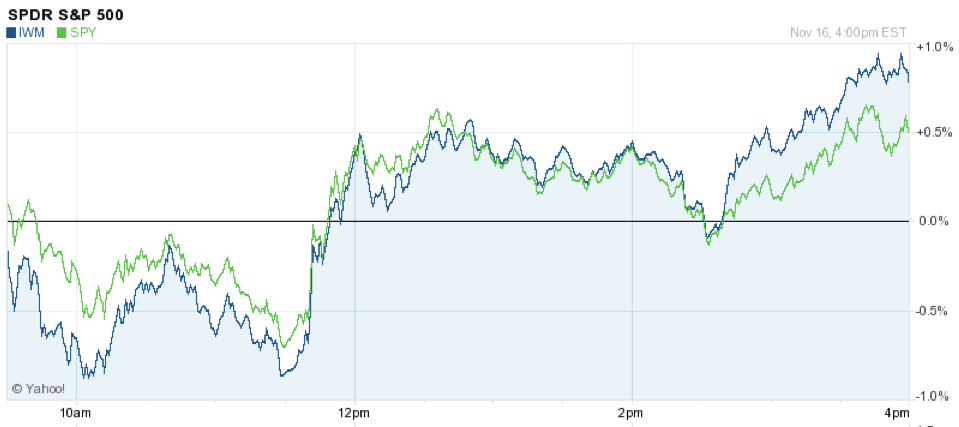

1. Small caps led: After a few weeks now of relentless selling, which always disproportionately nails the little stocks, it was very interesting to see the Russell 2000 (let’s use the IWM index ETF) leading the charge into the close. On the day, it outperformed the S&P 500 by almost double. Granted, we’re only talking about one day’s action, but still – an outperforming Russell is indicative of growing risk appetite. Pay close attention to the last hour of trading (3 to 4pm) in the chart below, it shows you guys getting ready for a bounce this week by loading up on smaller stocks that “move faster.”

Here’s what it looked like:

2. Explosive volume in Apple: Yesterday, on a Friday, Apple traded 45 million shares and managed to eke out a gain of about a half a percent on the session. This is versus its ten-day average volume of 25 million and its 90-day average volume of 19 million. 45 million shares is enormous in both absolute share volume and in terms of actual dollars changing hands. This is not to say that Apple has bottomed necessarily. Rather, it is to say that a very large numbers of buyers and sellers fought it out and, at least in the short-term, the price they’ve discovered where the B’s outnumber the S’s is 525.

This is important insofar as 530 was the support level Apple was “supposed to” have found. This is good, not great, as real support for AAPL lies at the four year trend line in the mid-400’s. See the chart below from SMTD:

3. The relative outperformance of Emerging Markets vs Developed Markets became more pronounced. It’s not so much that emerging market stocks are rallying, it’s more that developed nations (SPY as proxy) have seen falling markets while China has simply ceased dropping. For the first time since 2010. China’s stocks, specifically listings on the Shanghai Composite, may have reached the point where there is no one left to sell.

I rigged up the EEM priced in SPY ratio chart below…

Please note that this price action in China’s stocks is occurring at around the same time that China’s economy is showing signs of stabilization. Please see Cam Hui’s excellent work at Humble Student for more on this. Once again, no one’s talking about a raging bull market in BRICs. But the asset class’s relative strength versus the US large cap universe speaks to the possibility of risk appetites improving. It also allows us to dream of the potential for a game-changing new inter-market dynamic: In a world where China’s businesses and consumers are back to buying stuff again, we can stop sweating the small stuff so much, no?

I’ve been detailing the negatives for this market for quite sometime. Technically, we are broken and rolling over; economically-speaking we are as well.

But in the short-term, depending on how nimble you are, there could be some fantastic trading set-ups given the positive signs we’re seeing like those above. Bon chance.

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2012/11/18/market-goods-and-bads/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/11/18/market-goods-and-bads/ […]